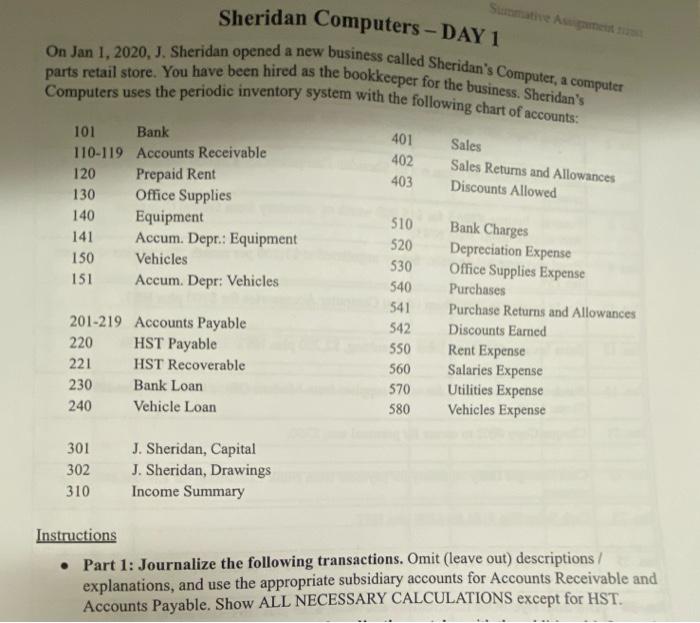

Summative Assignment Sheridan Computers - DAY 1 On Jan 1, 2020, J. Sheridan opened a new business called Sheridan's Computer, a computer parts retail store. You have been hired as the bookkeeper for the business. Sheridan's Computers uses the periodic inventory system with the following chart of accounts: Bank 401 Sales 101 110-119 Accounts Receivable 402 Sales Returns and Allowances 120 Prepaid Rent 403 Discounts Allowed 130 Office Supplies 140 Equipment 510 Bank Charges 141 Accum. Depr.: Equipment 520 Depreciation Expense 150 Vehicles. 530 Office Supplies Expense 151 Accum. Depr: Vehicles 540 Purchases 541 Purchase Returns and Allowances 201-219 Accounts Payable 542 Discounts Earned 220 HST Payable 550 Rent Expense 221 HST Recoverable 560 Salaries Expense 230 Bank Loan 570 Utilities Expense 240 Vehicle Loan 580 Vehicles Expense 301 J. Sheridan, Capital 302 J. Sheridan, Drawings 310 Income Summary Instructions Part 1: Journalize the following transactions. Omit (leave out) descriptions / explanations, and use the appropriate subsidiary accounts for Accounts Receivable and Accounts Payable. Show ALL NECESSARY CALCULATIONS except for HST. Summative Assignment Sheridan Computers - DAY 1 On Jan 1, 2020, J. Sheridan opened a new business called Sheridan's Computer, a computer parts retail store. You have been hired as the bookkeeper for the business. Sheridan's Computers uses the periodic inventory system with the following chart of accounts: Bank 401 Sales 101 110-119 Accounts Receivable 402 Sales Returns and Allowances 120 Prepaid Rent 403 Discounts Allowed 130 Office Supplies 140 Equipment 510 Bank Charges 141 Accum. Depr.: Equipment 520 Depreciation Expense 150 Vehicles. 530 Office Supplies Expense 151 Accum. Depr: Vehicles 540 Purchases 541 Purchase Returns and Allowances 201-219 Accounts Payable 542 Discounts Earned 220 HST Payable 550 Rent Expense 221 HST Recoverable 560 Salaries Expense 230 Bank Loan 570 Utilities Expense 240 Vehicle Loan 580 Vehicles Expense 301 J. Sheridan, Capital 302 J. Sheridan, Drawings 310 Income Summary Instructions Part 1: Journalize the following transactions. Omit (leave out) descriptions / explanations, and use the appropriate subsidiary accounts for Accounts Receivable and Accounts Payable. Show ALL NECESSARY CALCULATIONS except for HST