Question

Summative Project BAF3M Financial Accounting Fundamentals... Summative Project BAF3M Financial Accounting Fundamentals Introduction This is a simulation of the accounting cycle of a merchandising business.

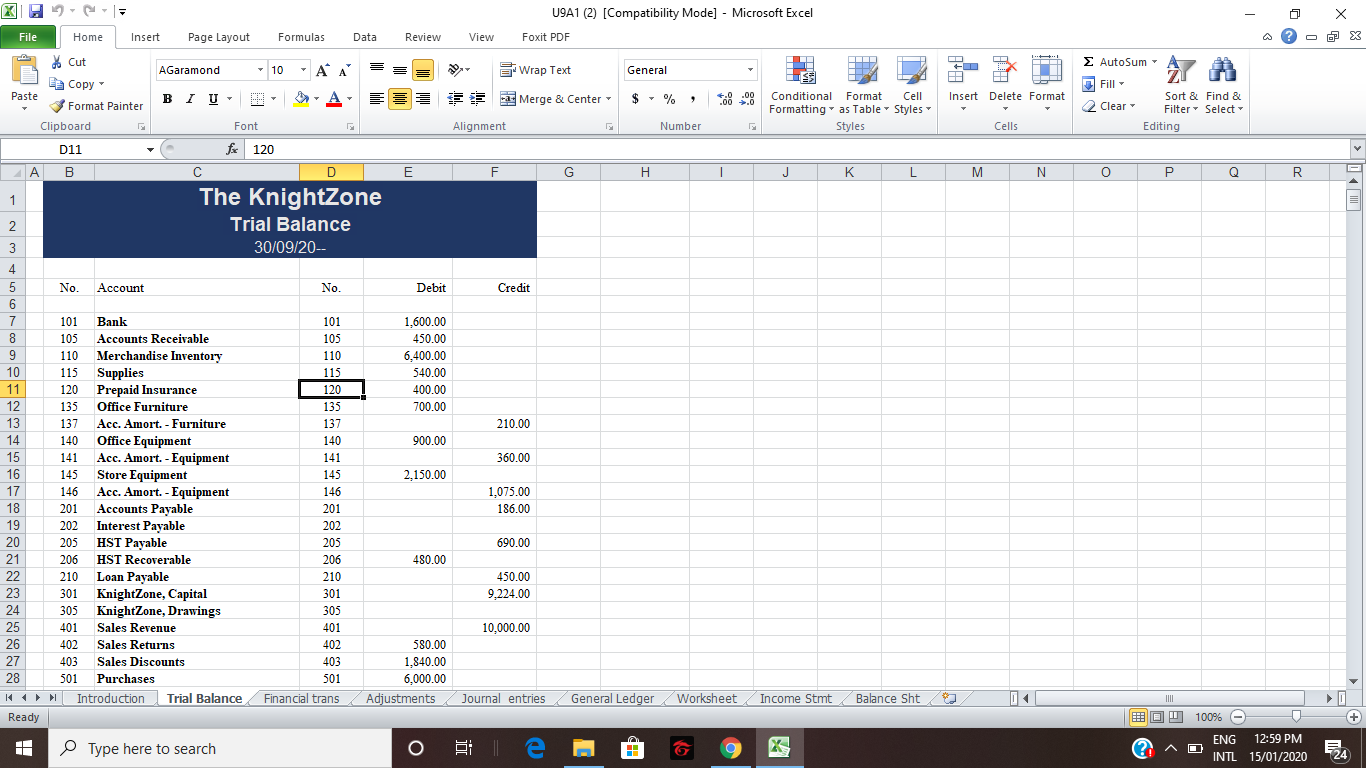

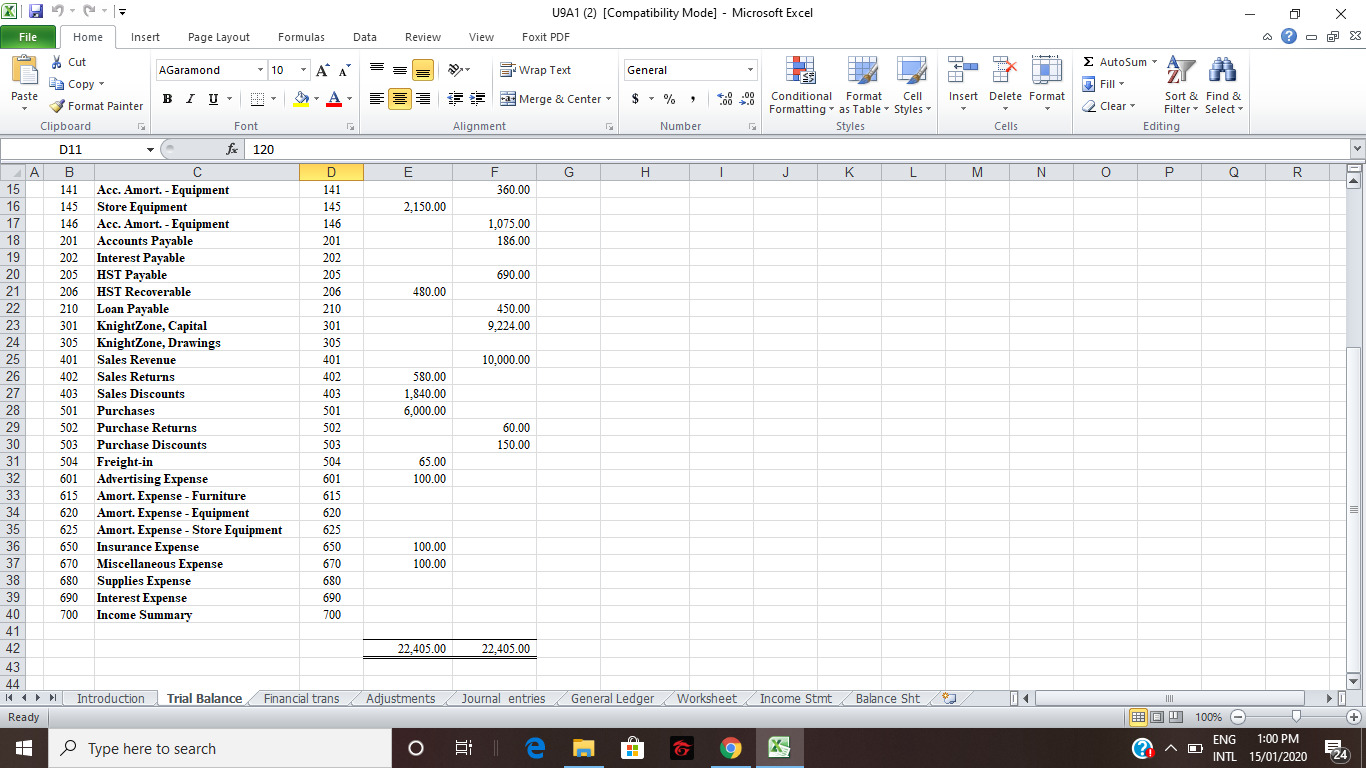

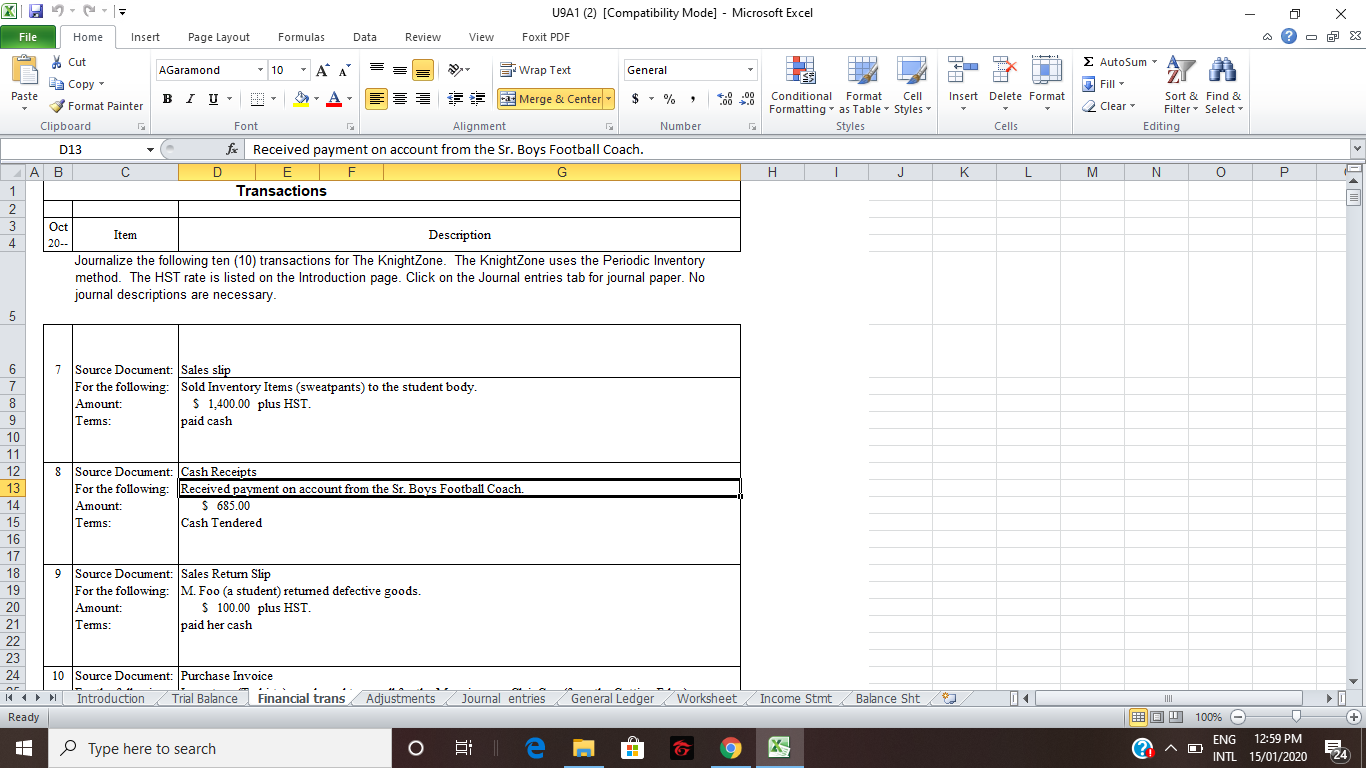

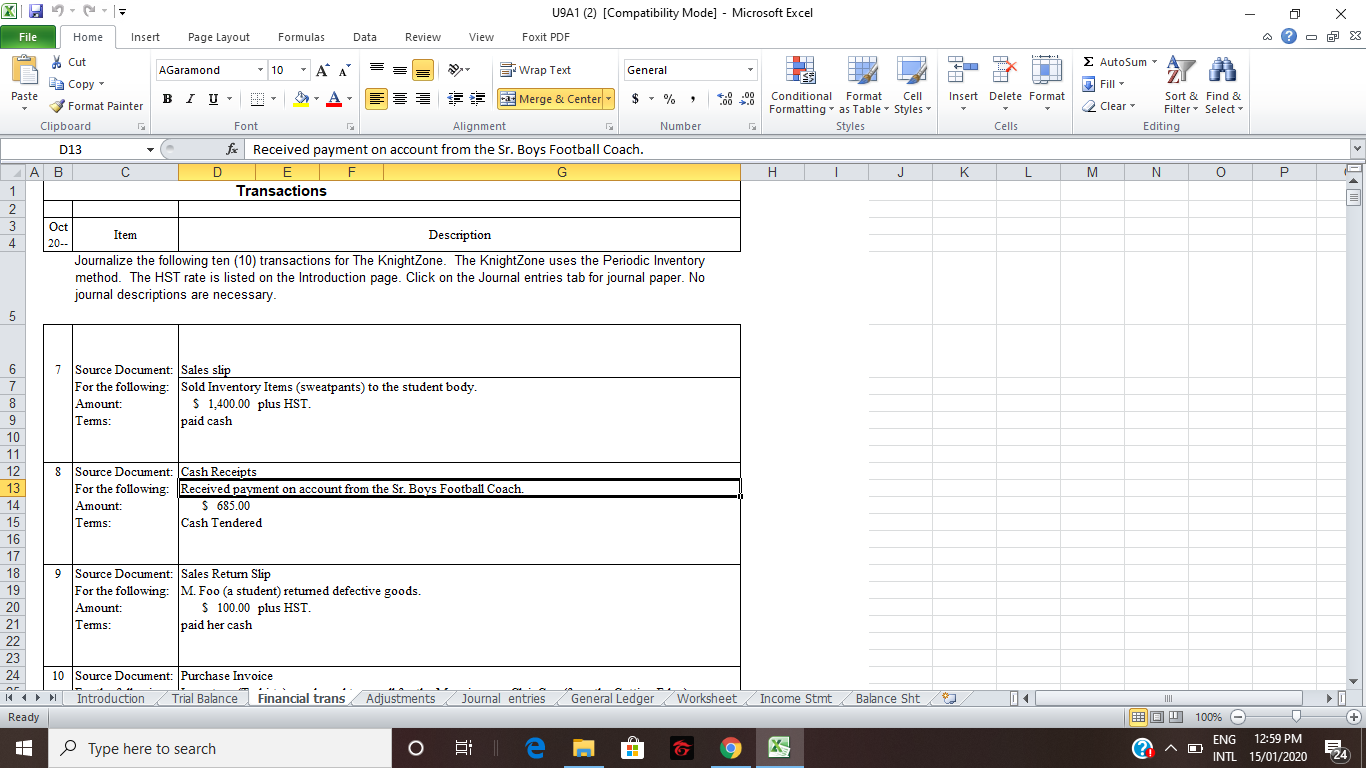

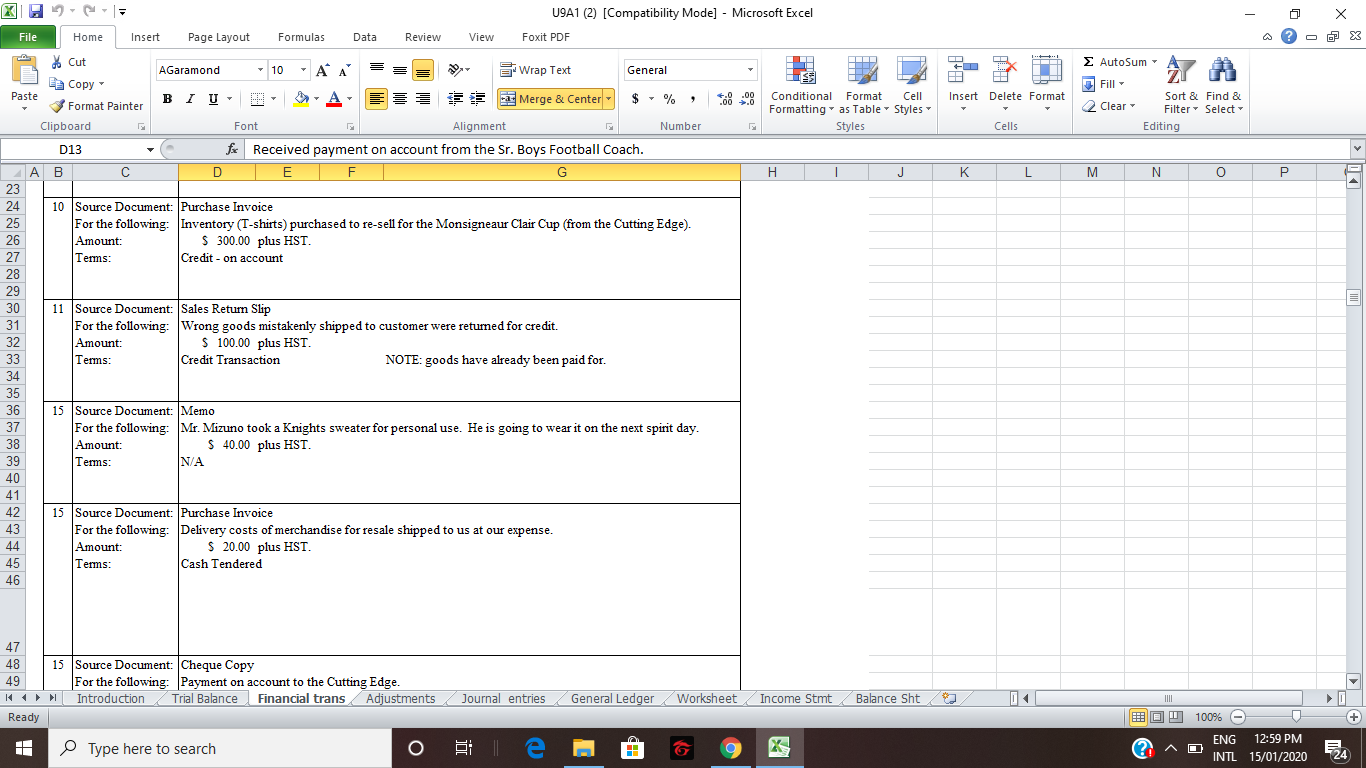

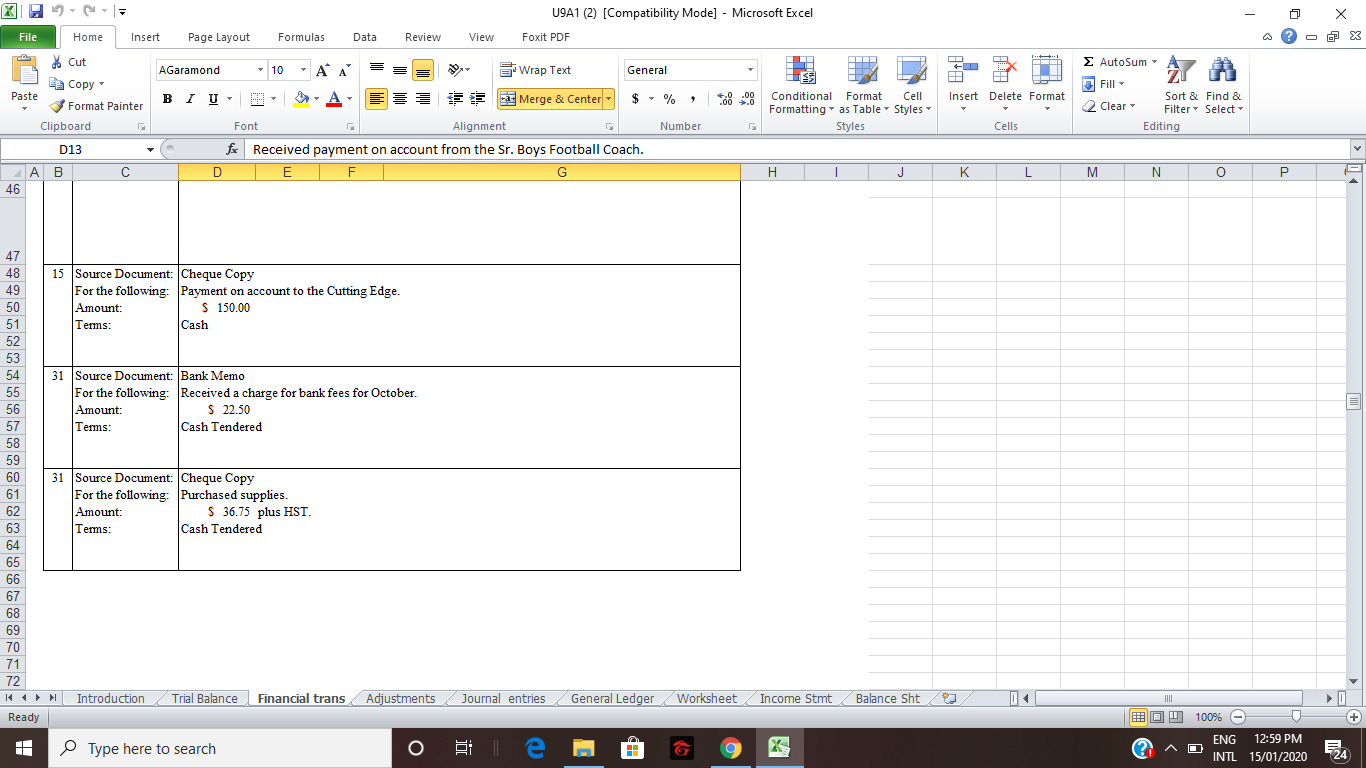

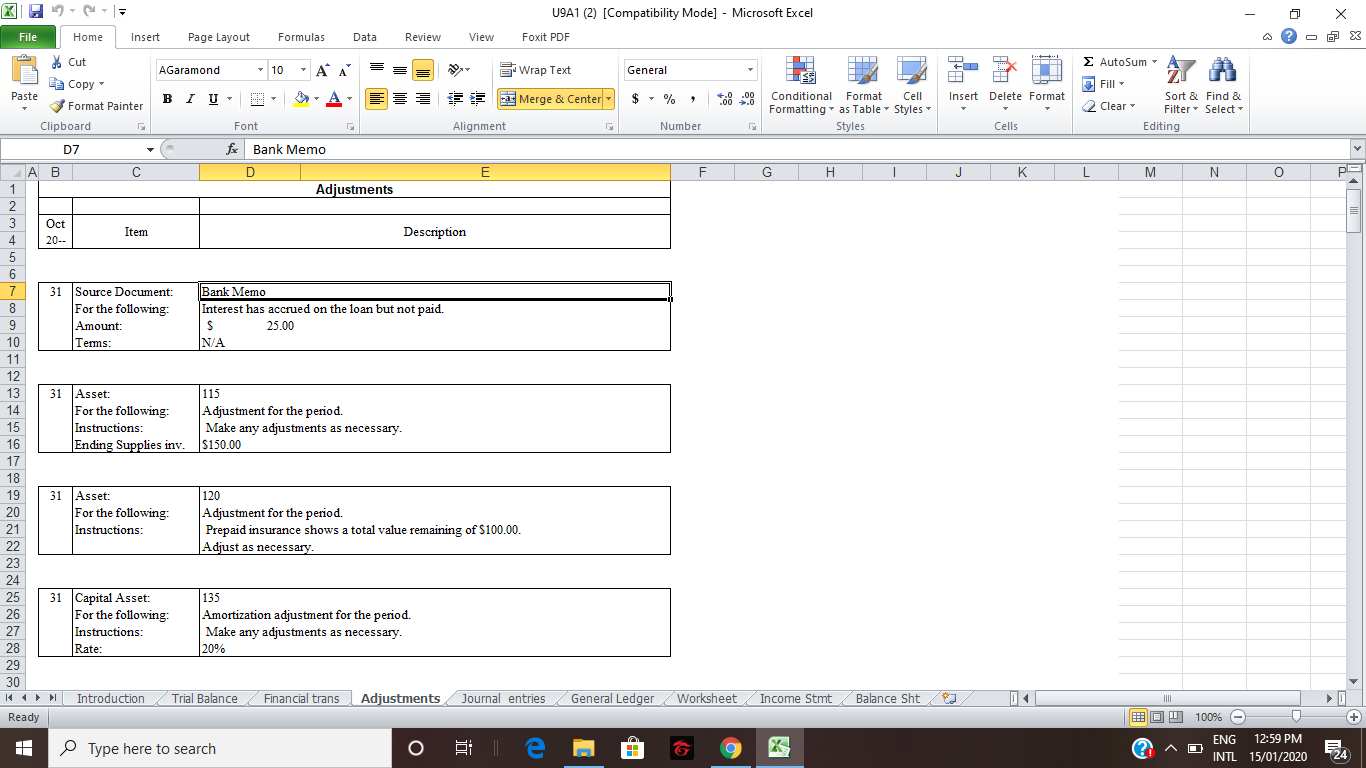

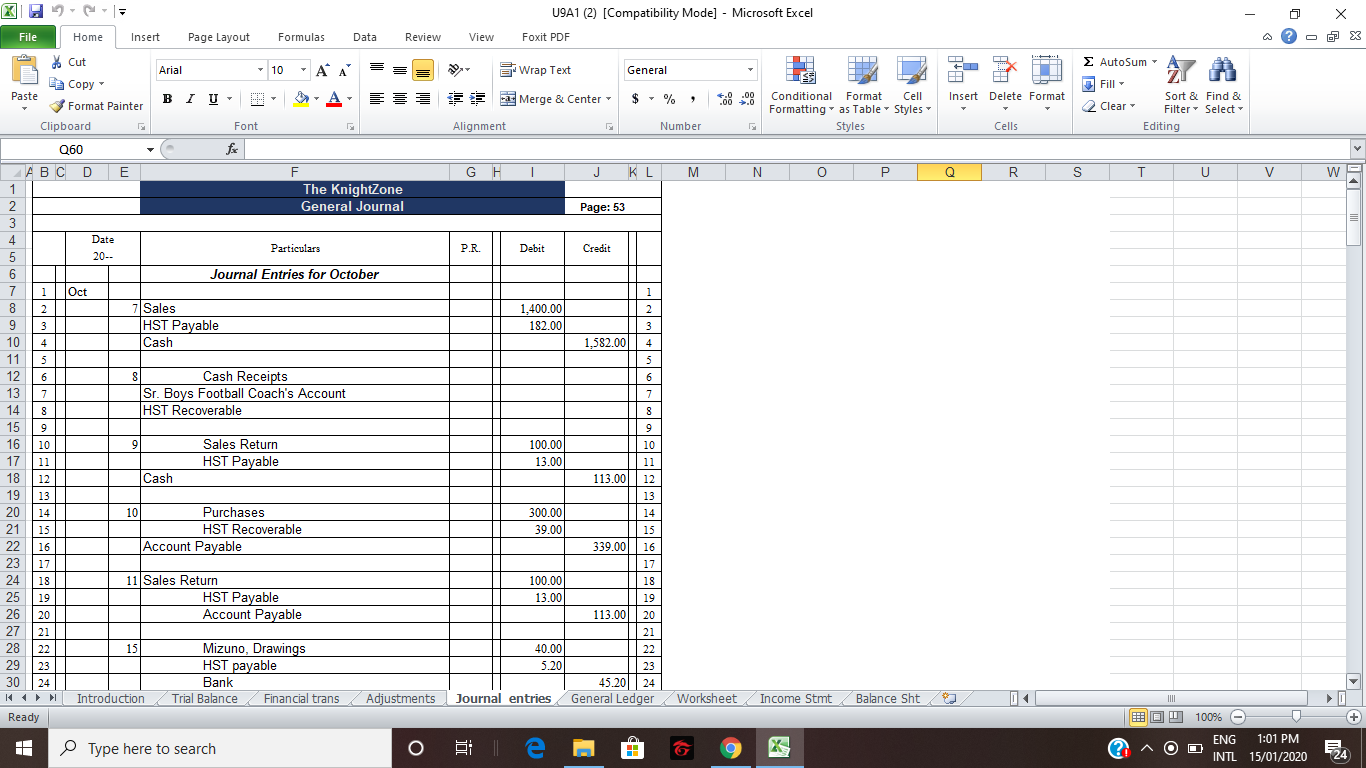

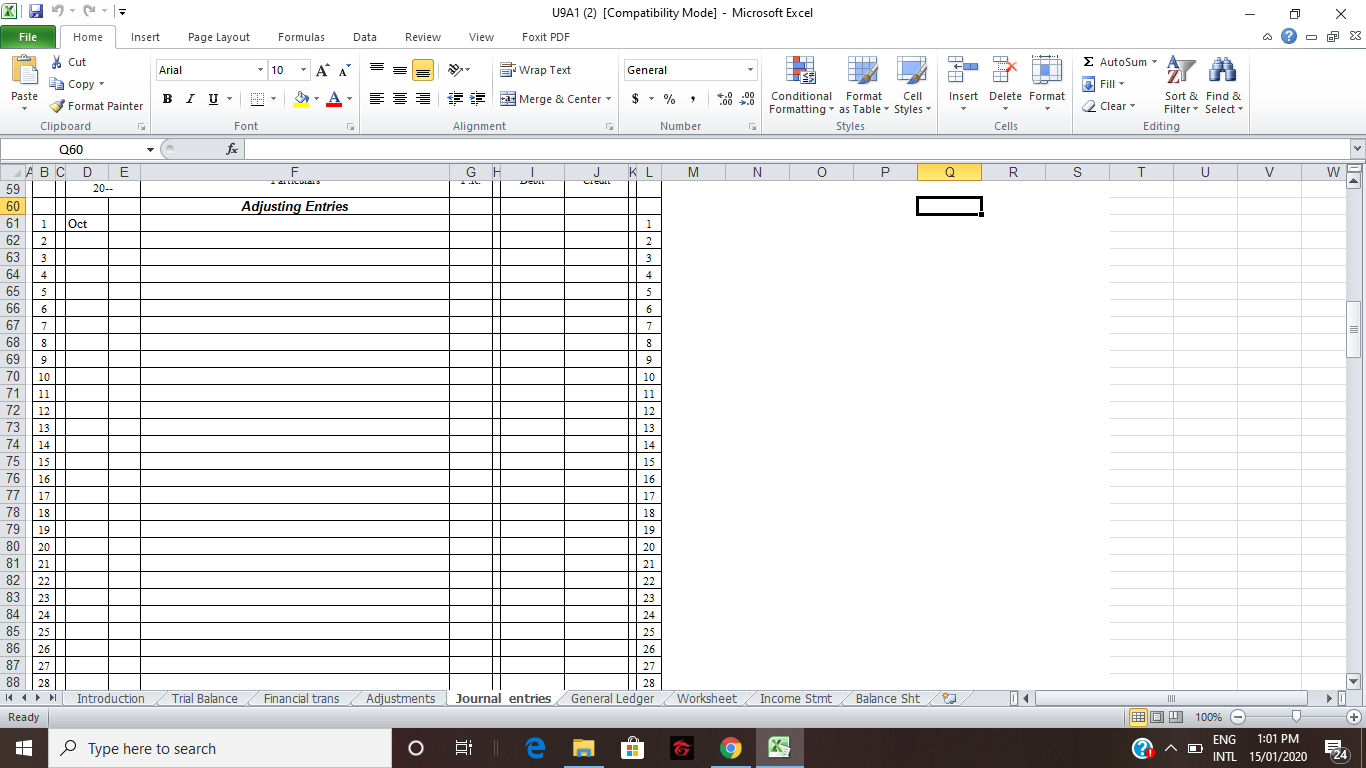

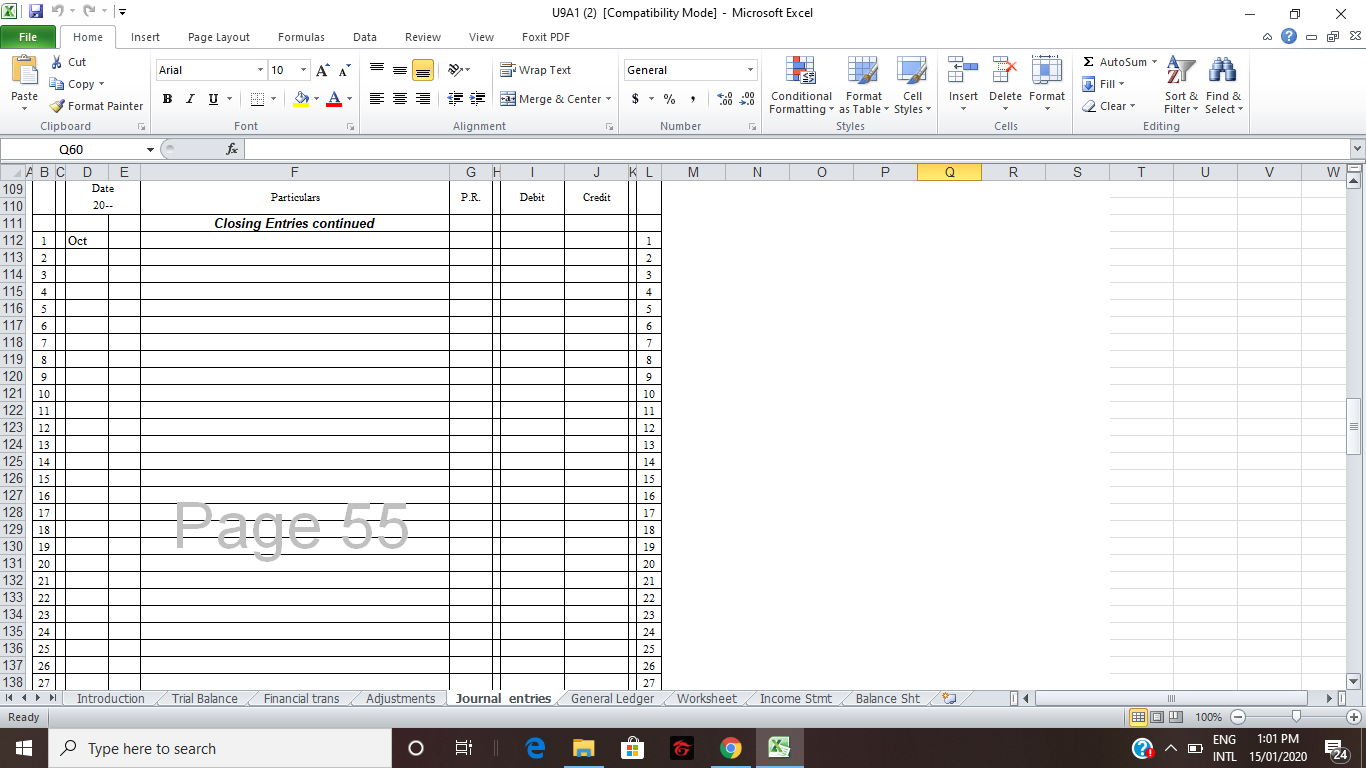

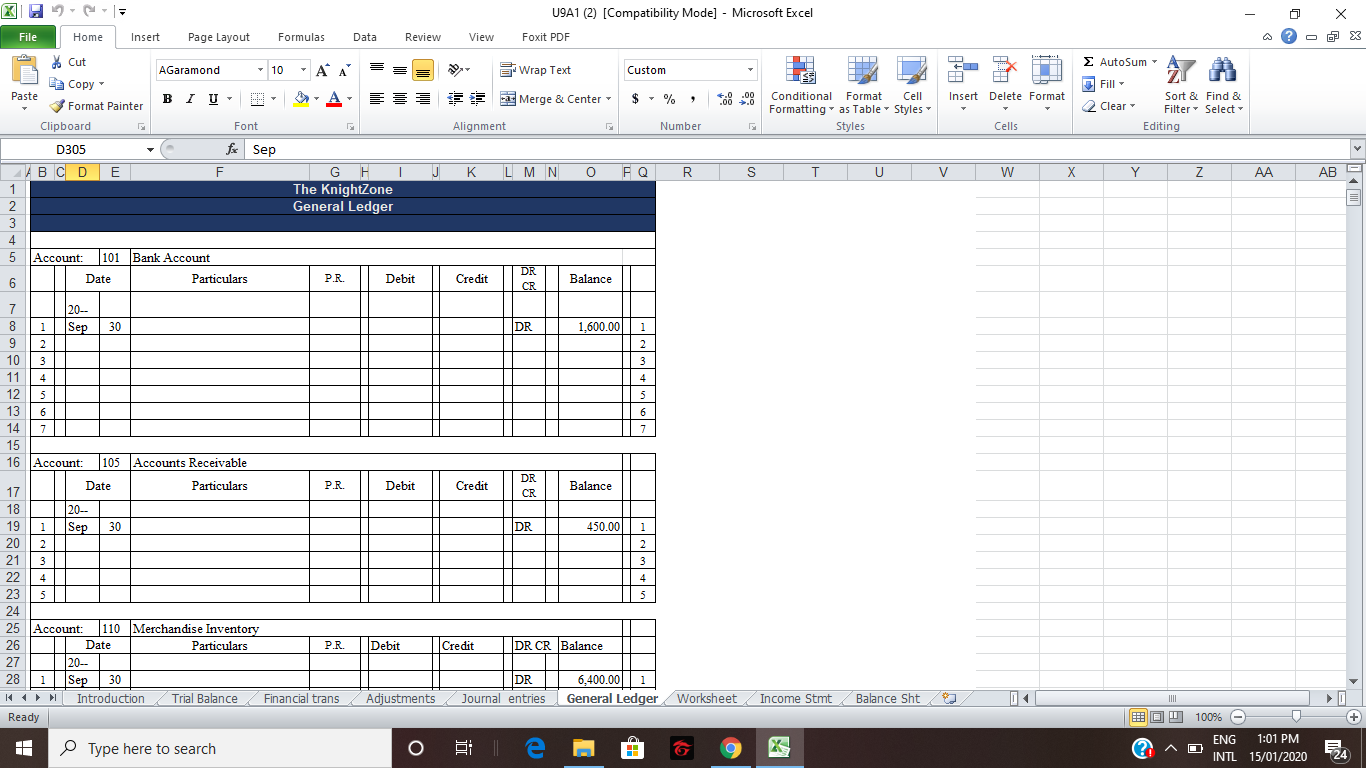

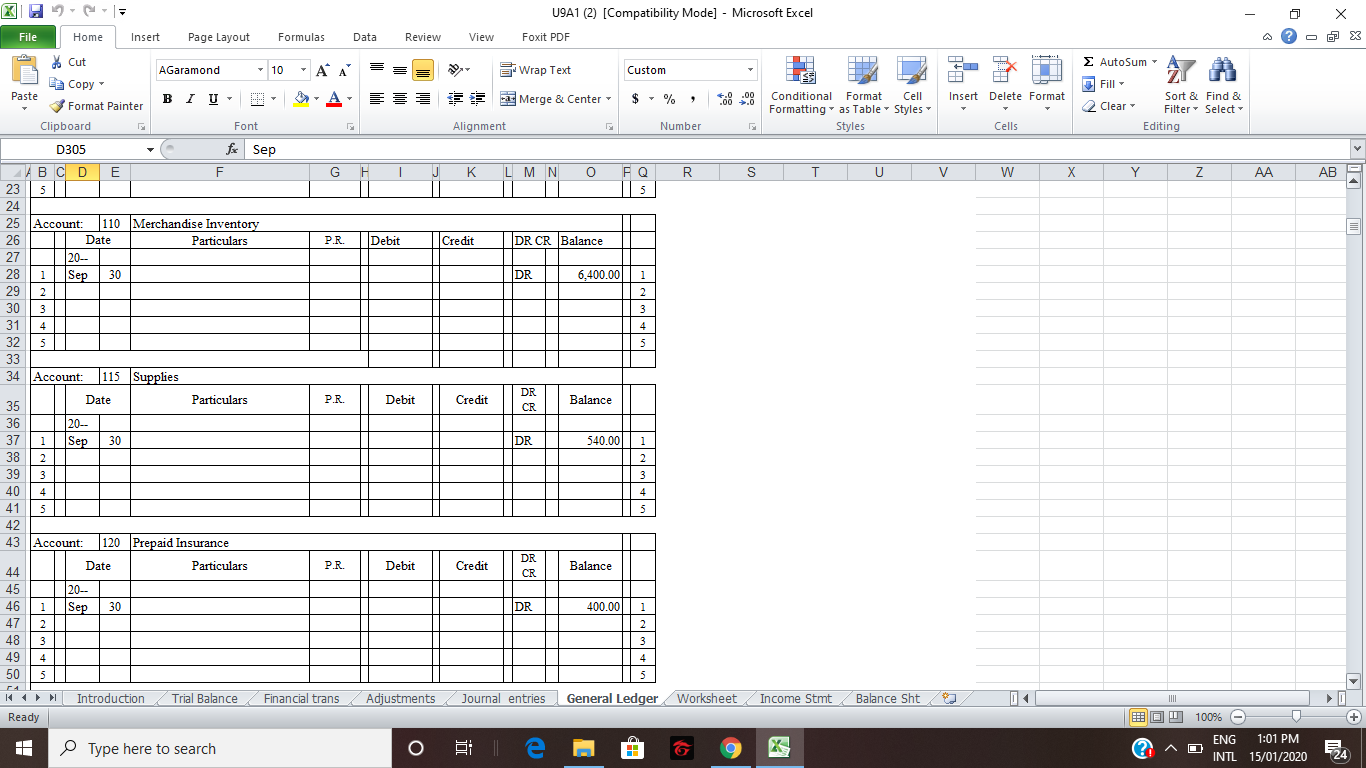

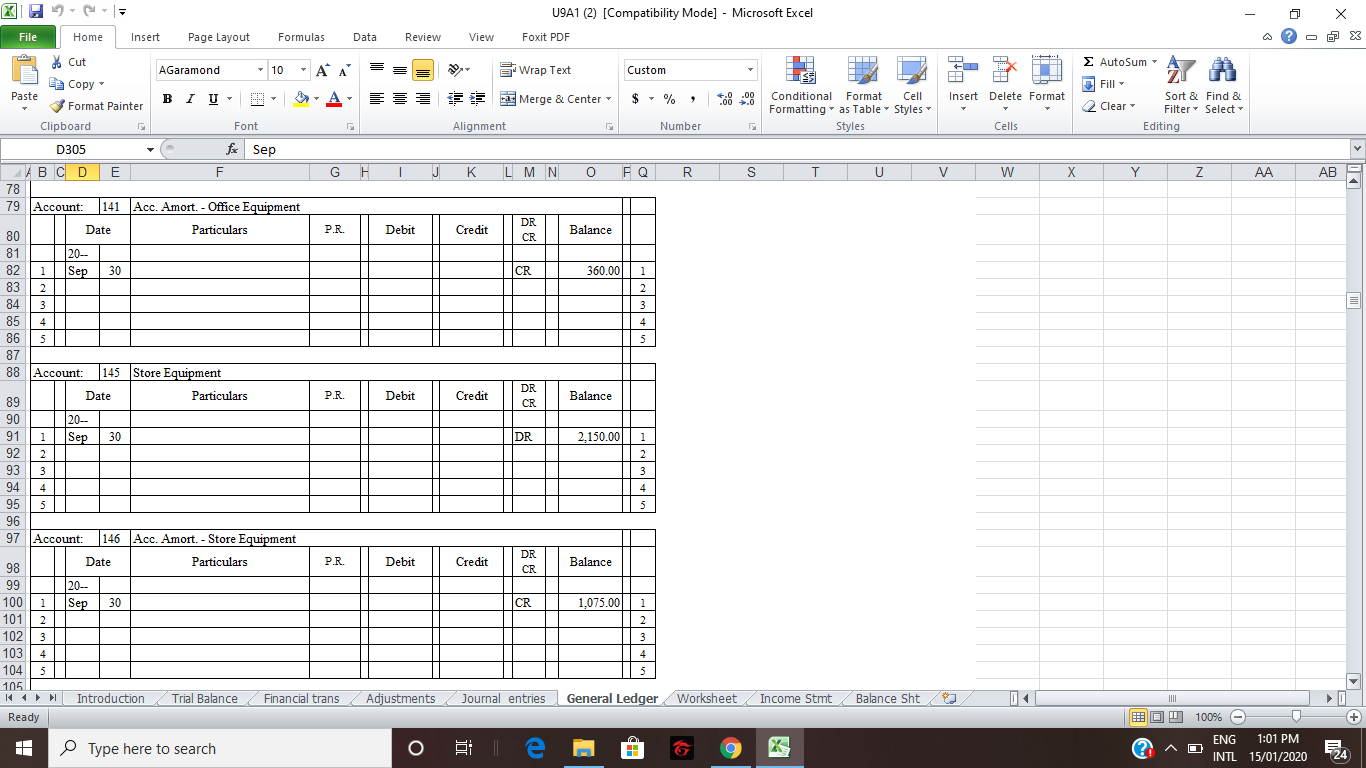

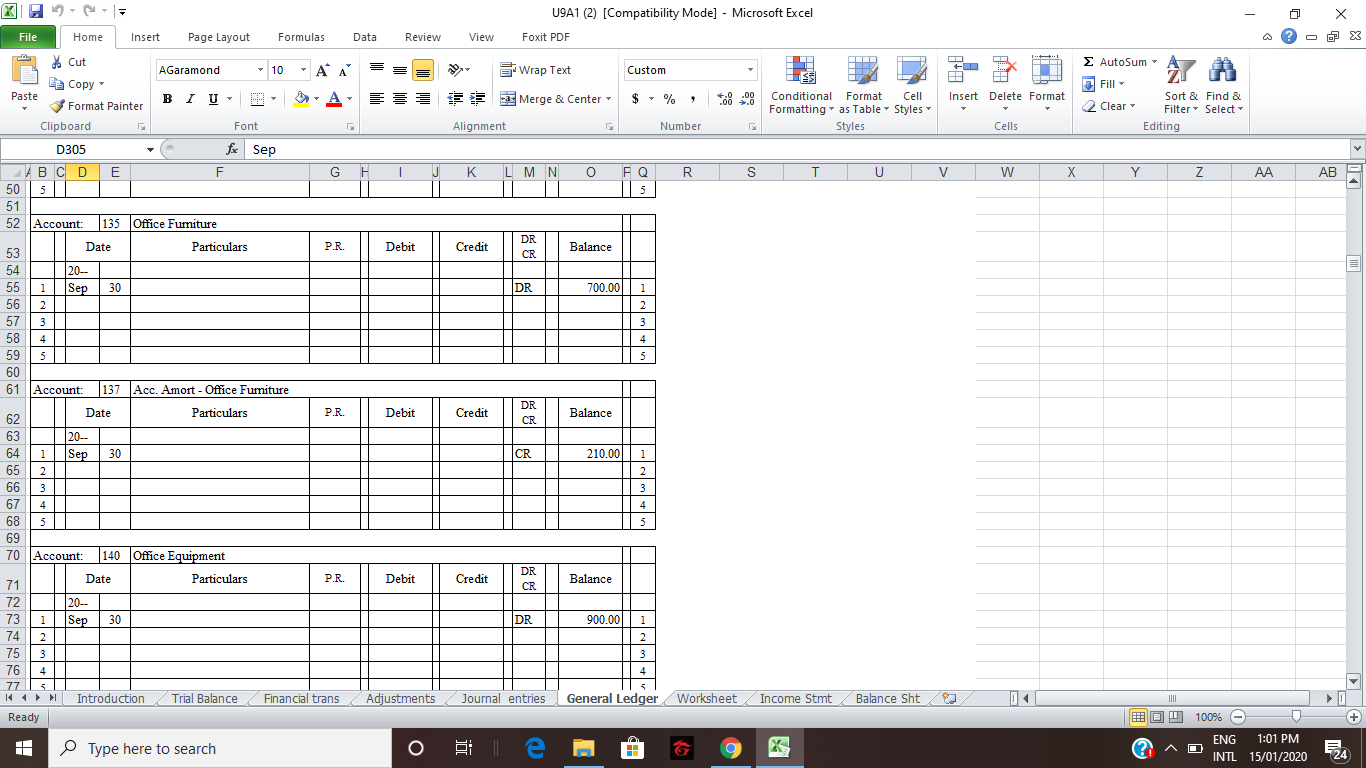

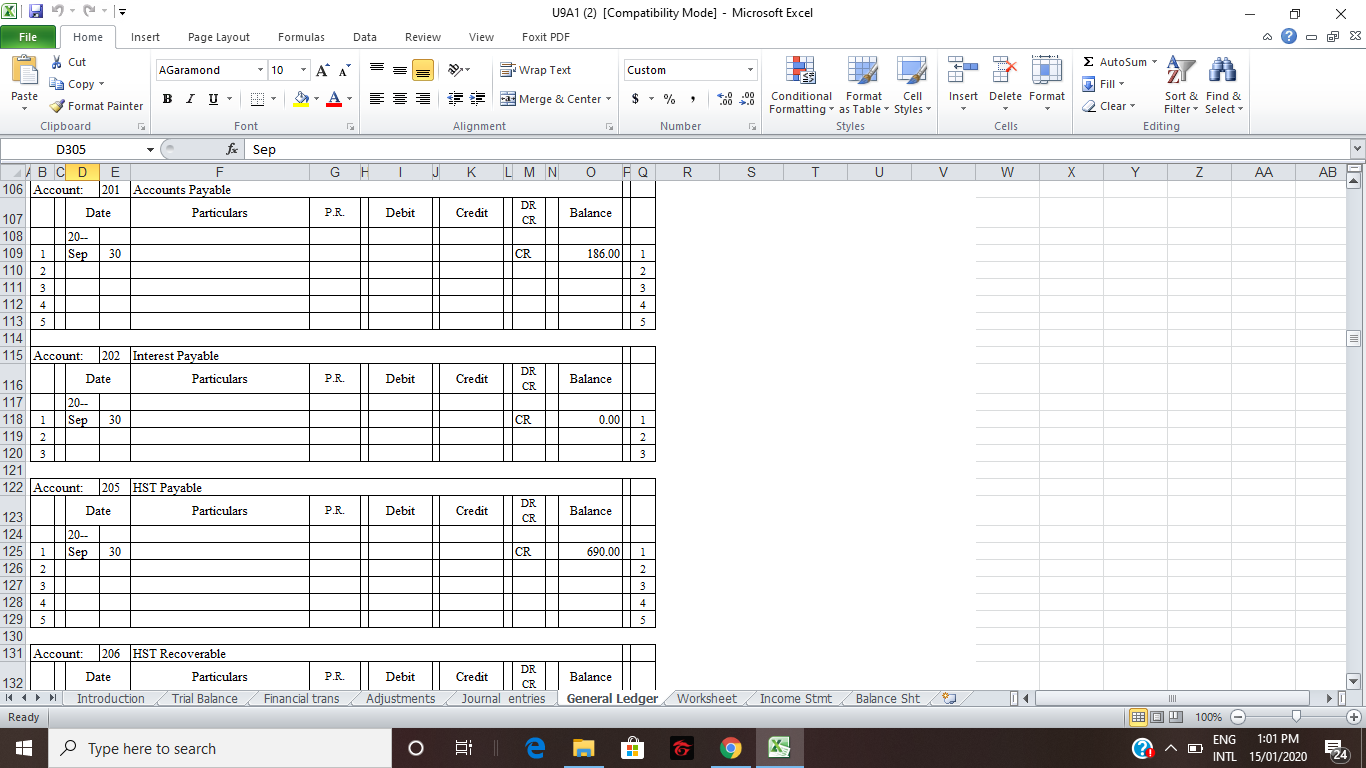

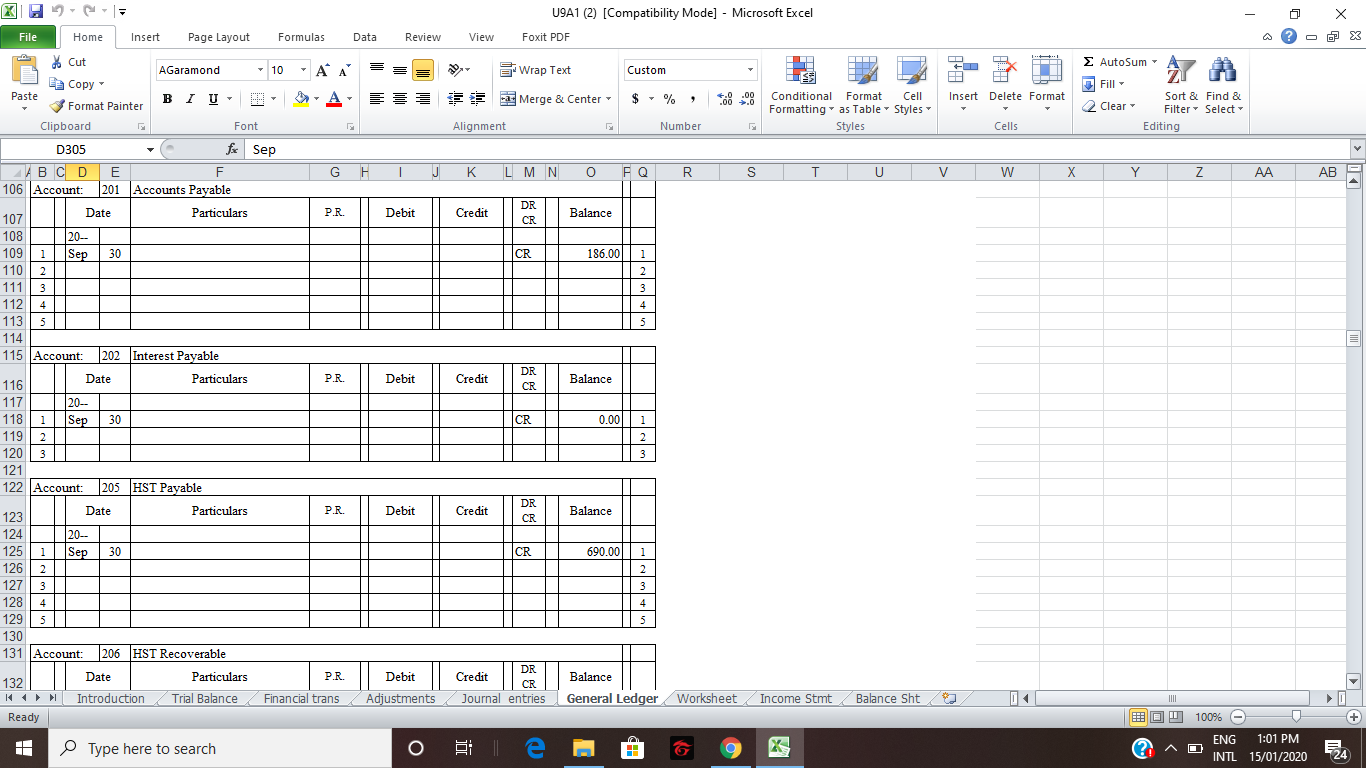

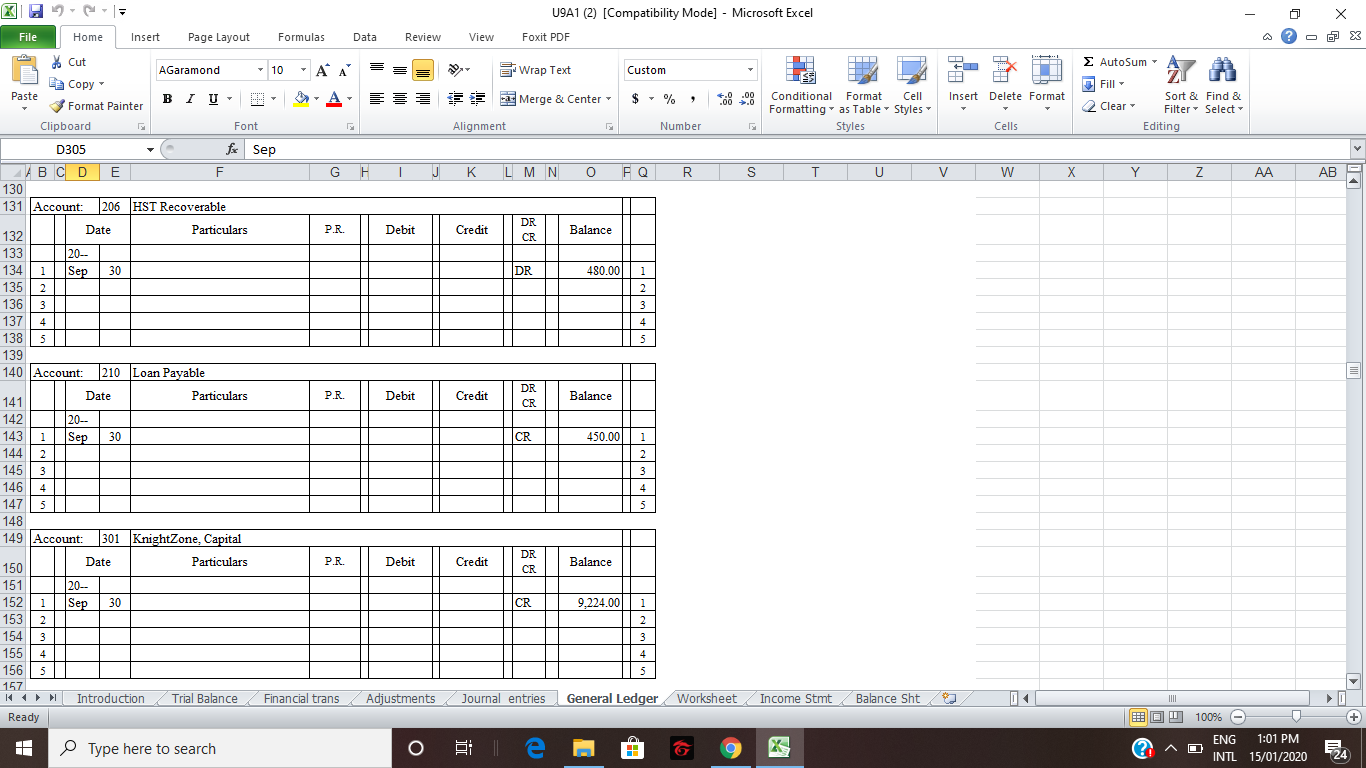

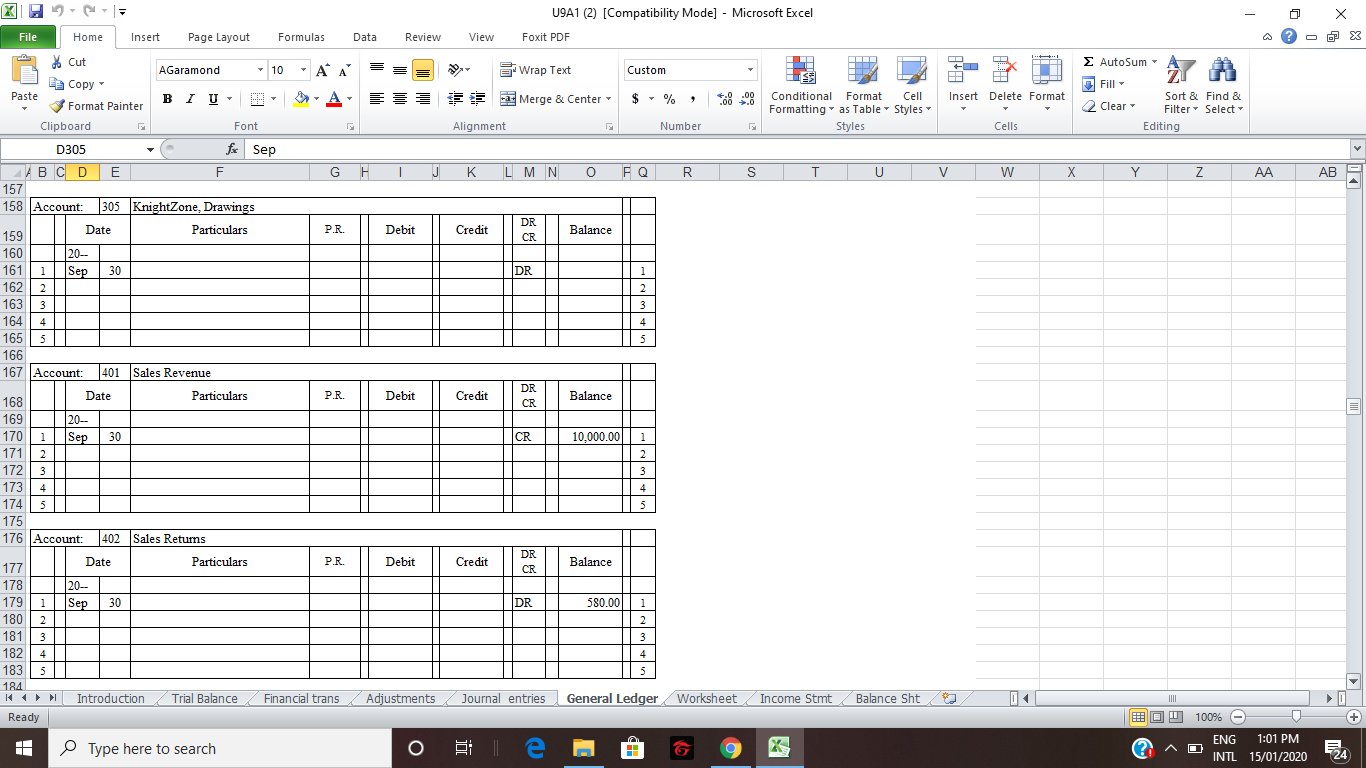

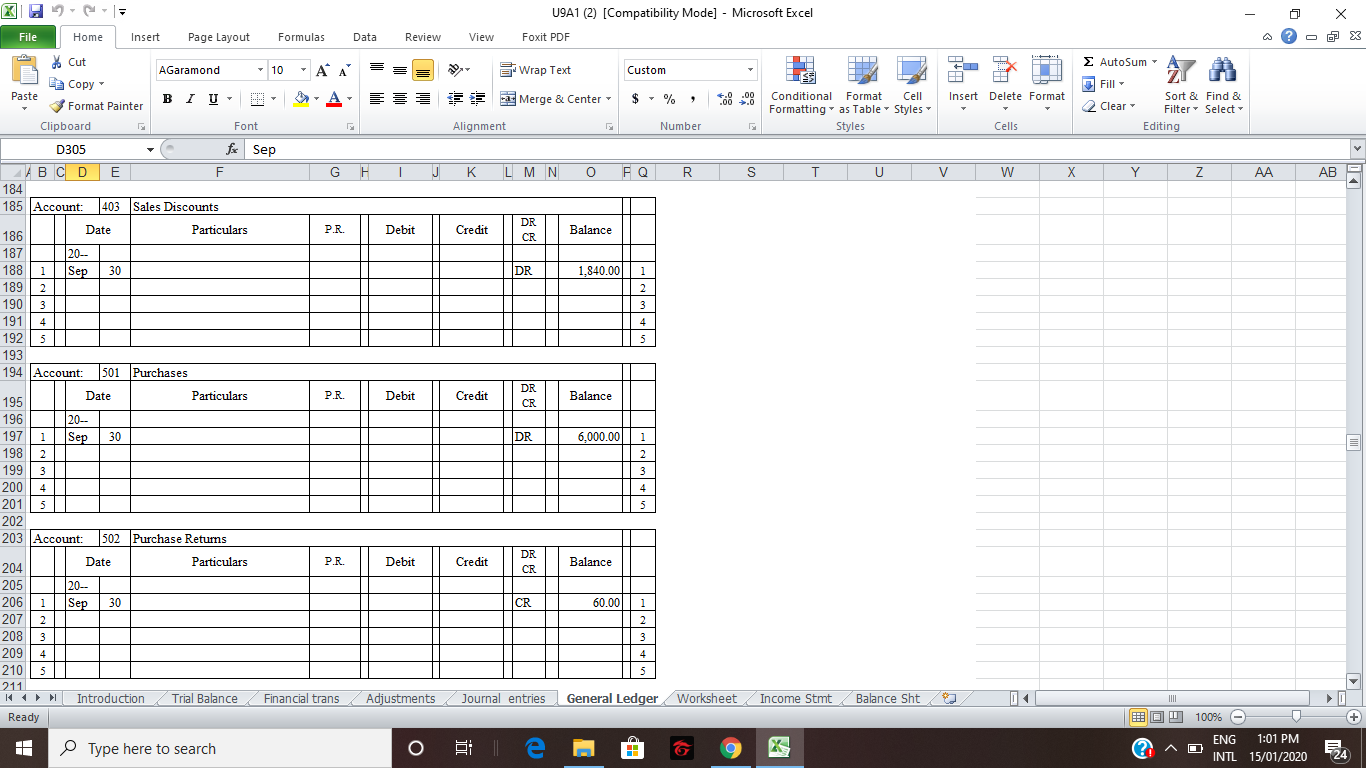

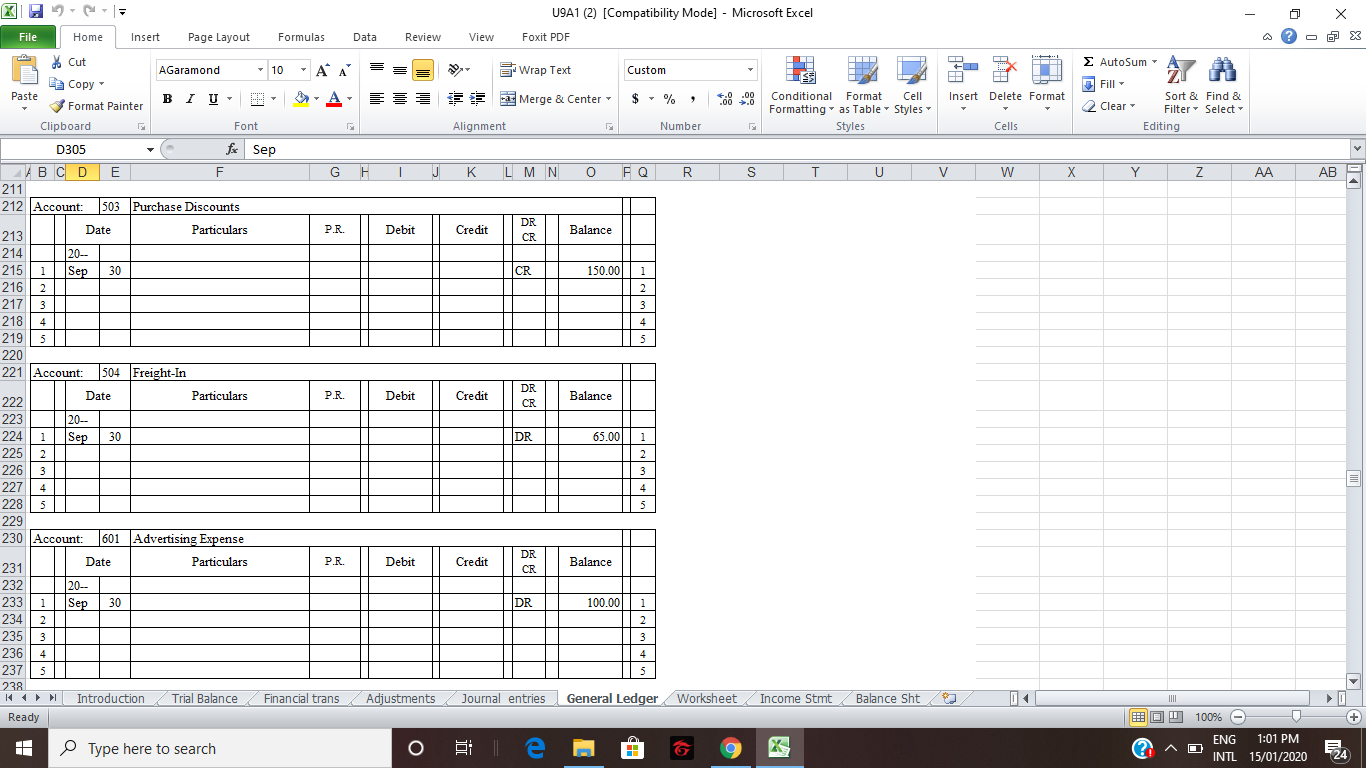

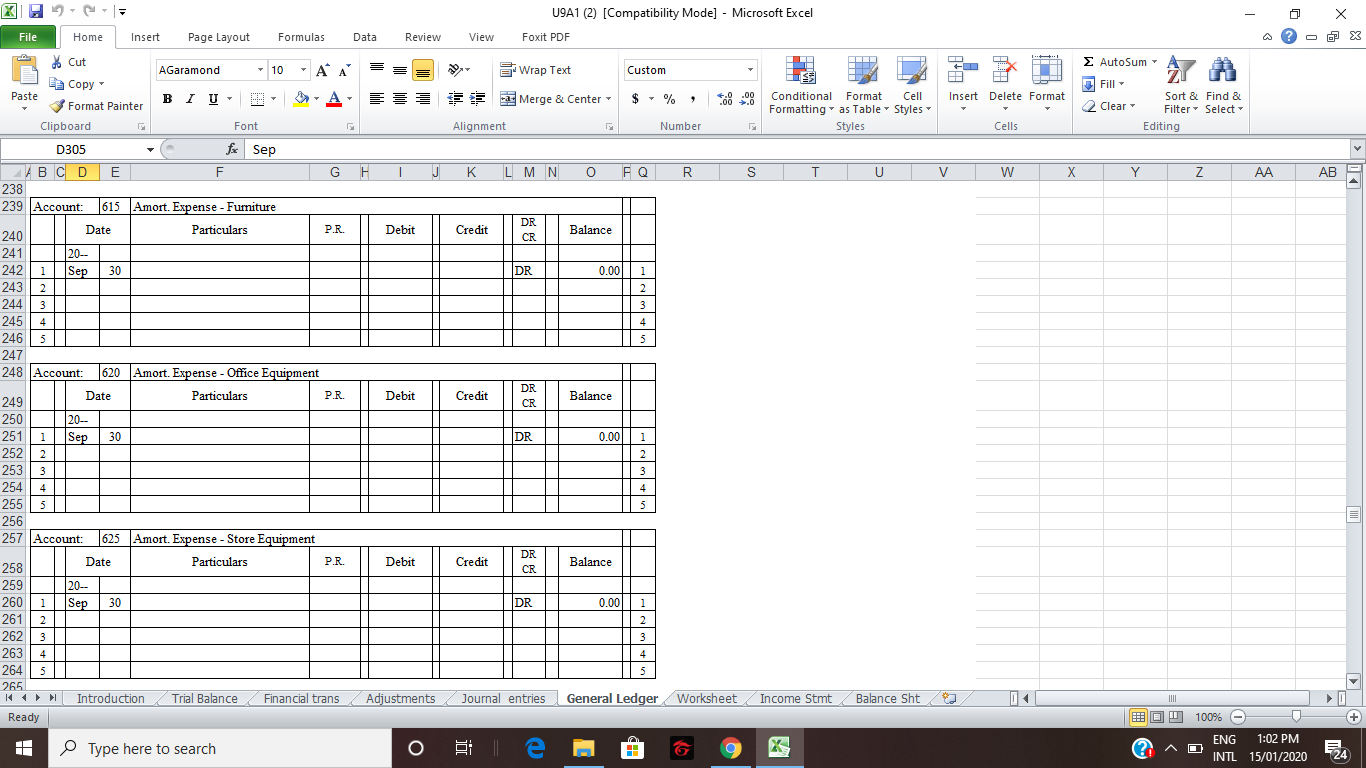

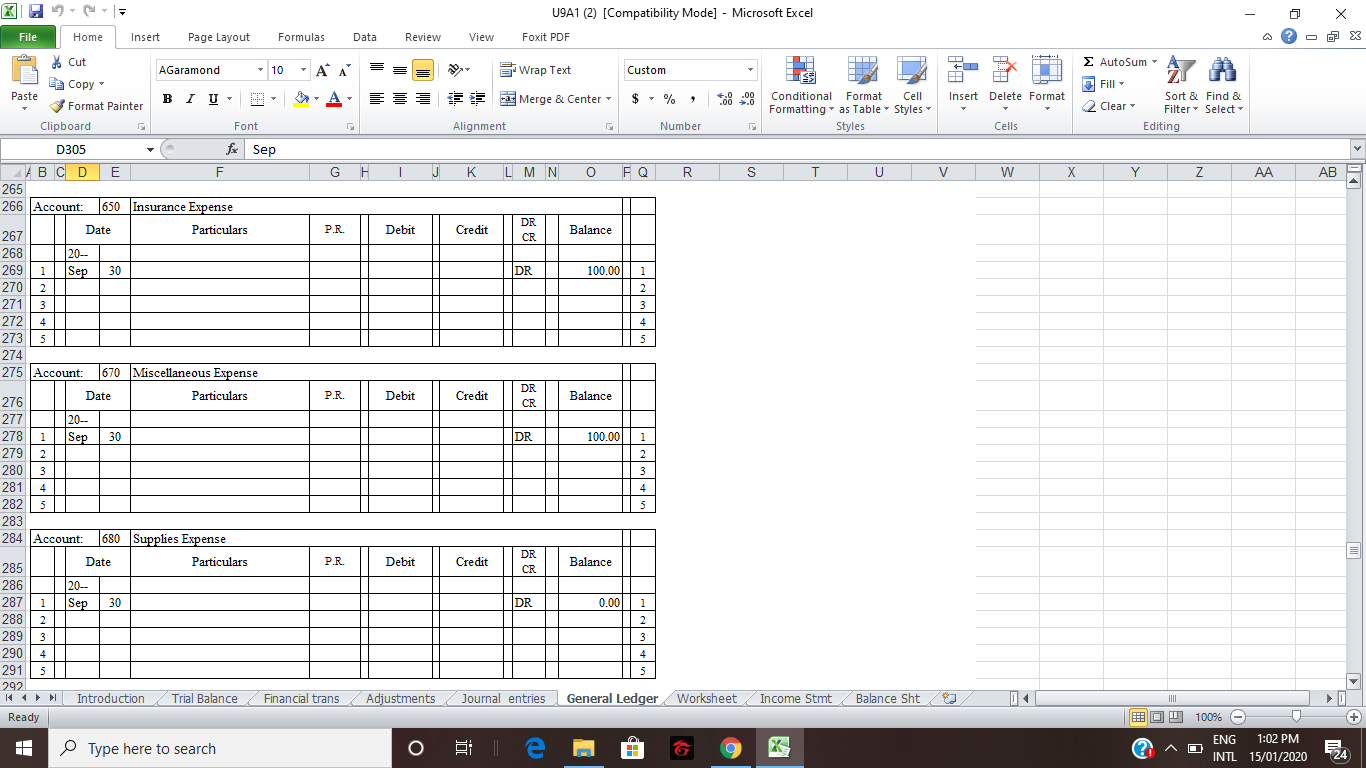

Summative Project BAF3M Financial Accounting Fundamentals... Summative Project BAF3M Financial Accounting Fundamentals Introduction This is a simulation of the accounting cycle of a merchandising business. It is part of the summative evaluation. You are the professional accountant for The KnightZone. You have the task of preparing the financial statements for The KnightZone. The KnightZone sells services as well as merchandise (spirit wear, school supplies, etc.). The KnightZone uses the Periodic Inventory method. You have been given the following: Tab # Tab 1 The introductory page - this page. Tab 2 The Trial Balance at the end of September 30, 20--. Tab 3 The Financial transactions for the month of October 20--, the last month of the fiscal year. Tab 4 The adjustments and additional information required to complete the accounting cycle for the year. Tab 5 Journal paper for Journal entries, Adjusting entries and Closing Entries. Tab 6 The General Ledger with the balances at September 30, 20--. Tab 7 Worksheet paper. Tab 8 Income Statement paper. Tab 9 Balance Sheet paper. NOTE: This business has a fiscal year ended October 31, 20--. When taxes are applicable, you will be given this information. HST is 13%. You will make the adjustments and closing entries for the year. Instructions From the information you have received, complete the following steps. Step 1 Journalize the transactions for the month of October 20--. Journal descriptions are not required. Step 2 Post the journal entries to the General Ledger Accounts. Step 3 Produce a Trial Balance on the Worksheet for the year ended October 31, 20--. Step 4 Add the adjusting entries and complete the Worksheet. Step 5 Create the Financial Statements from the completed Worksheet (include a detailed cost of goods sold section). Step 6 Journalize the adjusting and closing entries. Include all your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started