Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Summer Smith started Summer Smith Shipping, SSS, on July 1st, and had the following transactions: 7-1: Summer Smith contributed $400,000, cash to SSS. 7-1: SSS

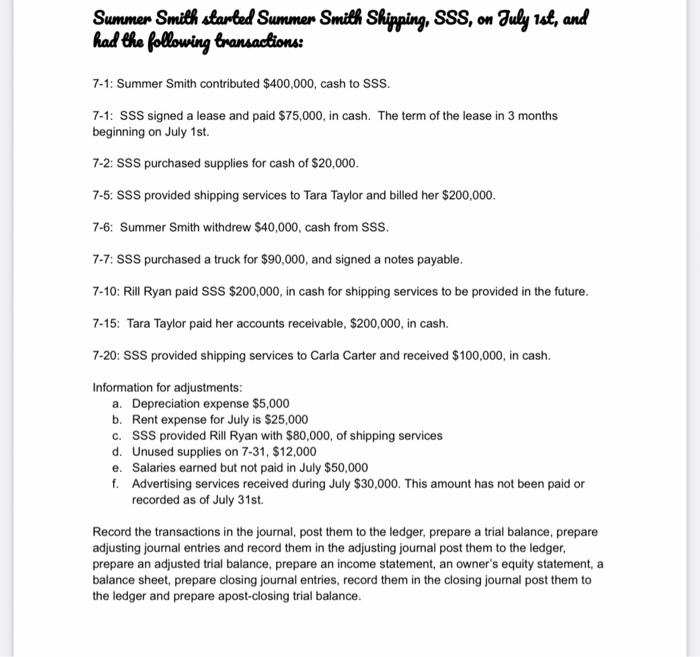

Summer Smith started Summer Smith Shipping, SSS, on July 1st, and had the following transactions: 7-1: Summer Smith contributed $400,000, cash to SSS. 7-1: SSS signed a lease and paid $75,000, in cash. The term of the lease in 3 months beginning on July 1st. 7-2: SSS purchased supplies for cash of $20,000. 7-5: SSS provided shipping services to Tara Taylor and billed her $200,000. 7-6: Summer Smith withdrew $40,000, cash from SSS. 7-7: SSS purchased a truck for $90,000, and signed a notes payable. 7-10: Rill Ryan paid SSS $200,000, in cash for shipping services to be provided in the future. 7-15: Tara Taylor paid her accounts receivable, $200,000, in cash. 7-20: SSS provided shipping services to Carla Carter and received $100,000, in cash. Information for adjustments: a. Depreciation expense $5,000 b. Rent expense for July is $25,000 c. SSS provided Rill Ryan with $80,000, of shipping services d. Unused supplies on 7-31, $12,000 e. Salaries earned but not paid in July $50,000 f. Advertising services received during July $30,000. This amount has not been paid or recorded as of July 31st. Record the transactions in the journal, post them to the ledger, prepare a trial balance, prepare adjusting journal entries and record them in the adjusting journal post them to the ledger, prepare an adjusted trial balance, prepare an income statement, an owner's equity statement, a balance sheet, prepare closing journal entries, record them in the closing journal post them to the ledger and prepare apost-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started