Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Summertime Golf Ltd. (SGL) was founded by Mike Kostanski on January 1, 2012. SGL is a small private c poration selling golf equipment. After

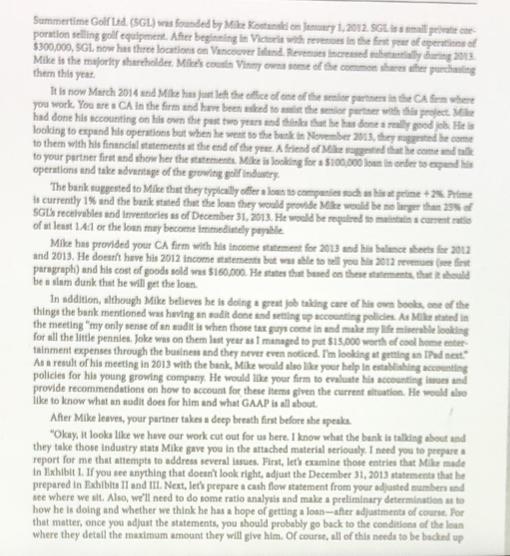

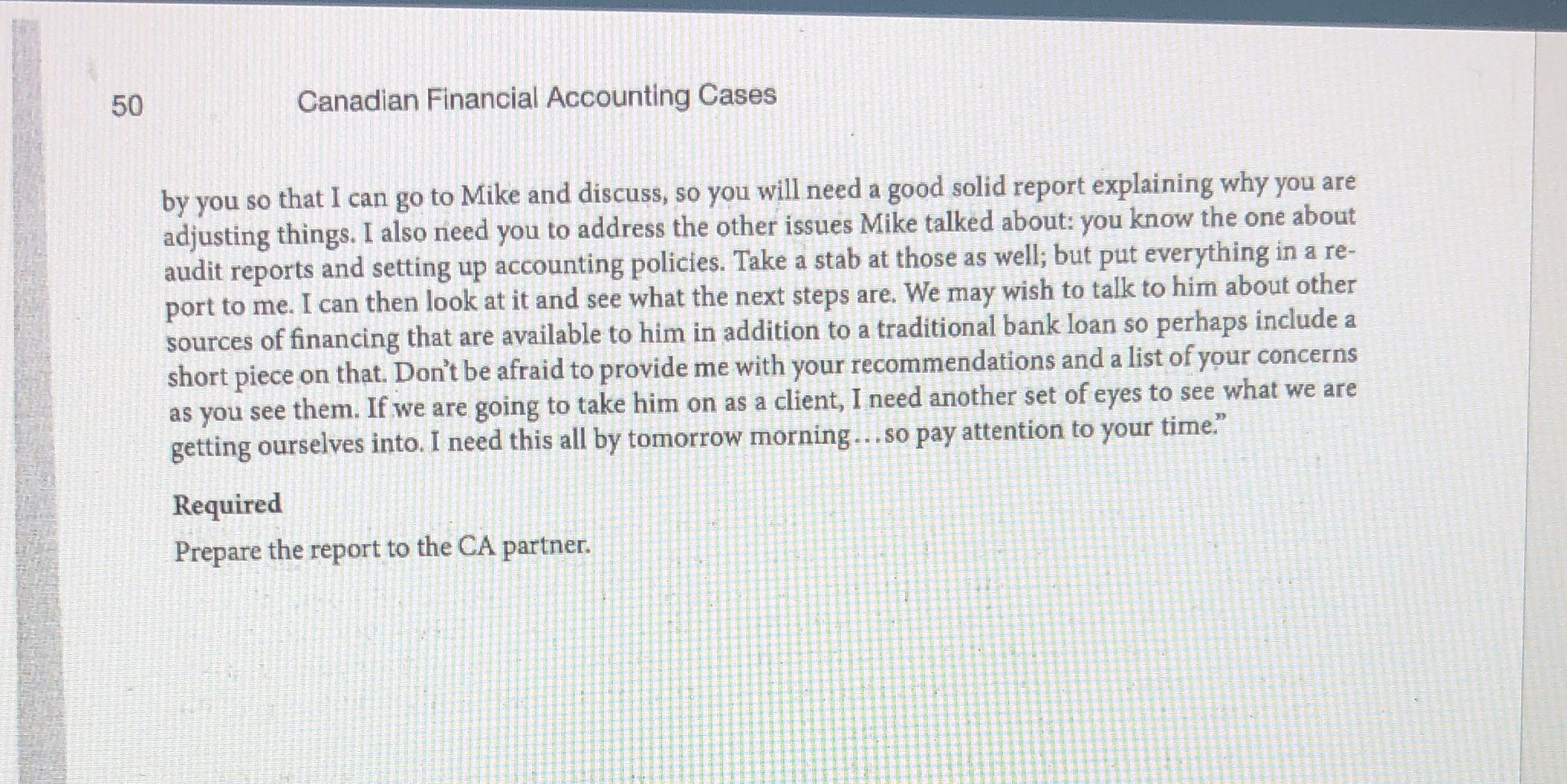

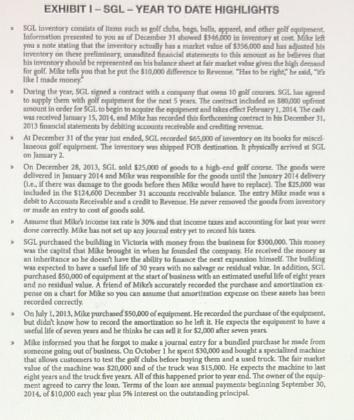

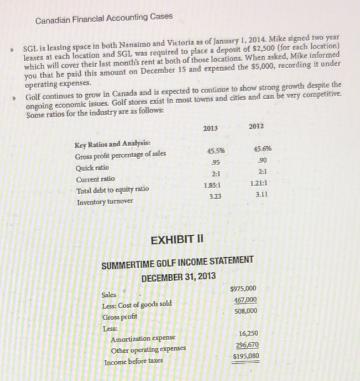

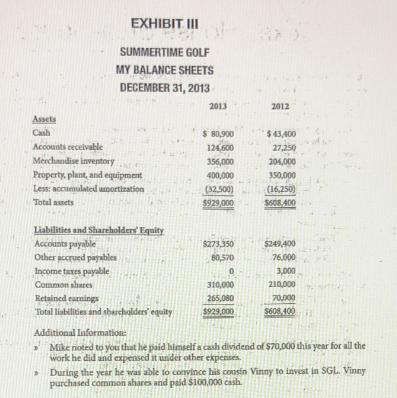

Summertime Golf Ltd. (SGL) was founded by Mike Kostanski on January 1, 2012. SGL is a small private c poration selling golf equipment. After beginning in Victoria with revenions in the first year of operations of $300,000, SGL now has three locations on Vancouver Island Revenues increased suhtannially during 2013 Mike is the majority shareholder. Mike's cousin Vinny owns some of the common shares her purchasing them this year. It is now March 2014 and Mike has just left the office of one of the senior partners in the CA firm where you work. You are a CA in the firm and have been asked to assist the senior partner with this project. Mike had done his accounting on his own the past two years and thinks that he has done a really good job. He is looking to expand his operations but when he went to the bank in November 2013, they suggested he come to them with his financial statements at the end of the year. A friend of Mike suggested that he come and talk to your partner first and show her the statements Mike is looking for a $100,000 loan in order to expand his operations and take advantage of the growing golf industry The bank suggested to Mike that they typically offer a loan to companies such as his at prime +2%. Prime is currently 1% and the bank stated that the loan they would provide Mike would be no larger than 25% of SGL's receivables and Inventories as of December 31, 2013. He would be required to maintain a current rati of at least 1.4:1 or the loan may become immediately payable Mike has provided your CA firm with his income statement for 2013 and his balance sheets for 2012 and 2013. He doesn't have his 2012 income statements but was able to tell you his 2012 revenues (e first paragraph) and his cost of goods sold was $160,000. He states that based on these statements, that it should be a slam dunk that he will get the loan. In addition, although Mike believes he is doing a great job taking care of his own books, one of the things the bank mentioned was having an audit done and setting up accounting policies. As Mike stated in the meeting "my only sense of an audit is when those tax guys come in and make my life miserable looking for all the little pennies. Joke was on them last year as I managed to put $15,000 worth of cool home enter tainment expenses through the business and they never even noticed. I'm looking at getting an IPad nest As a result of his meeting in 2013 with the bank, Mike would also like your help in establishing accounting policies for his young growing company. He would like your firm to evaluate his accounting issors and provide recommendations on how to account for these items given the current situation. He would also like to know what an saudit does for him and what GAAP is all about. After Mike leaves, your partner takes a deep breath first before she speaks "Okay, it looks like we have our work cut out for us here. I know what the bank is talking about and they take those industry stats Mike gave you in the attached material seriously. I need you to prepare a report for me that attempts to address several issues. First, let's examine those entries that Mike made in Exhibit 1. If you see anything that doesn't look right, adjust the December 31, 2013 statements that he prepared in Exhibits II and III. Next, let's prepare a cash flow statement from your adjusted numbers and see where we sit. Also, we'll need to do some ratio analysis and make a preliminary determination as to how he is doing and whether we think he has a hope of getting a loan-after adjustments of course. For that matter, once you adjust the statements, you should probably go back to the conditions of the loan where they detail the maximum amount they will give him. Of course, all of this needs to be backed up 50 Canadian Financial Accounting Cases by you so that I can go to Mike and discuss, so you will need a good solid report explaining why you are adjusting things. I also need you to address the other issues Mike talked about: you know the one about audit reports and setting up accounting policies. Take a stab at those as well; but put everything in a re- port to me. I can then look at it and see what the next steps are. We may wish to talk to him about other sources of financing that are available to him in addition to a traditional bank loan so perhaps include a short piece on that. Don't be afraid to provide me with your recommendations and a list of your concerns as you see them. If we are going to take him on as a client, I need another set of eyes to see what we are getting ourselves into. I need this all by tomorrow morning...so pay attention to your time." Required Prepare the report to the CA partner. . EXHIBITI-SGL-YEAR TO DATE HIGHLIGHTS SGL inventory consists of liems such as golf clube, bogs, holls, apperel, and other golf equipment Information presented to you as of December 31 showed $346.000 in inventory at con Mike left you a note stating that the inventory actually has a market value of $356,000 and has inventory on these preliminary, unasdited financial statements to this amount as he l his inventory should be represented on his balance sheet at fair market value given the l for golf. Mike tells you that he put the $10,000 difference to Revene "Het to be right," he said, " the I made money M ves that demand During the year, SGL signed a contract with a company that owns 10 golf cours SGL and to supply them with golf equipment for the next 5 years. The contract included an $80,000 p amount in order for SGL to begin to acquire the equipment and takes effect February 1, 2014 The cas was received January 15, 2014, and Mike has recorded this forthcoming contract in his December 31. 2013 financial statements by debiting accounts receivable and crediting At December 31 of the year just ended, SGL recorded $65,000 of inventory on its books for miscel laneous golf equipment. The inventory was shipped FOB destination. It physically arrived at SGL on January 2 On December 28, 2013, SGL onld $25,000 of goods to a high-end golf course. The goods were delivered in January 2014 and Mikr was responsible for the goods until the lemory 2014 delivery (Le. If there was damage to the goods before then Mike would have to replace). The $25,000 war included in the $124,600 December 31 accounts receivable balance. The entry Mike made was a debit to Accounts Receivable and a credit to Revenue. He never removed the goods from inventory or made an entry to cost of goods sold. Assume that Mike's Income tax rate is 30% and that income taxes and accounting for last year were done correctly Mike has not set up any journal entry yet to record his taxes SGL purchased the building in Victoria with money from the business for $300,000. This money was the capital that Mike brought in when he founded the company. He received the money a an inheritance so he doesn't have the ability to finance the next expansion himself. The building was expected to have a useful life of 30 years with no salvage or residual valar. In addition, SGL purchased $50,000 of equipment at the start of business with an estimated useful life of eight years and no residual value. A friend of Mike's accurately recorded the purchase and amortition ex pense on a chart for Mike so you can assume that amortization expense on these assets has been recorded correctly. On July 1, 2013, Mike purchased $50,000 of equipment. He recorded the purchase of the equipment, but didn't know how to record the amortization so he left it. He expects the equipment to have a uneful life of seven years and he thinks he can sell it for $2,000 after seven years > Mike informed you that he forgot to make a journal entry for a bundled purchase he made from someone going out of business. On October 1 he spent $30,000 and bought a specialized machine that allows customers to test the golf clubs before buying them and a used track. The fair market value of the machine was $20,000 and of the truck was $15,000. He expects the machine to last eight years and the truck five years. All of this happened prior to year end. The owner of the equip ment agreed to carry the loan. Terms of the loan are anmaal payments beginning September 30, 2014, of $10,000 each year plus 5% interest on the outstanding principal Canadian Financial Accounting Cases SGL is leasing space in both Nanaimo and Victoria as of January 1, 2014. Mike signed two year leases at each location and SGL, was required to place a deposit of $2,500 (for each location) which will cover their last month's rent at both of those locations. When asked, Mike informed you that he paid this amount on December 15 and expensed the $5,000, recording it under operating expenses. Golf continues to grow in Canada and is expected to continue to show strong growth despite the ongoing economic issues. Golf stores exist in most towns and cities and can be very competitive Some ratios for the industry are as followe Key Ratins and Analysis Gross profit percentage of sales Current ratio Total debit to equity ratio Inventory turnover Sales Les: Cost of goods sold Clos prot Le 2013 Amortisation expense Other operating expenses Income before taxes 45.5% 95 2:1 1951 313 2012 EXHIBIT II SUMMERTIME GOLF INCOME STATEMENT DECEMBER 31, 2013 45.6% 90 21 121:1 3.11 $175.000 167,000 501.000 16,250 26,670 $195,080 Assets Cash EXHIBIT III SUMMERTIME GOLF MY BALANCE SHEETS DECEMBER 31, 2013 Accounts receivable Merchandise inventory Property, plant, and equipment Less: accumulated amortization Total assets Liabilities and Shareholders' Equity Accounts payable Other accrued payables Income taxes payable Common shares Retained earnings Total liabilities and shareholders' equity 2013 $ 80,900 124,600 356,000 400,000 (32,500) $929,000 $273,350 80,570 0 310,000 265,080 $929,000 2012 $43,400 27,250 204,000 350,000 (16,250) $608,400 $249,400 76,000 3,000 210,000 70,000 $608,400 Additional Information: Mike noted to you that he paid himself a cash dividend of $70,000 this year for all the work he did and expensed it under other expenses. During the year he was able to convince his cousin Vinny to invest in SGL. Vinny purchased common shares and paid $100,000 cash

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To the CA Partner Thank you for having me evaluate Summertime Golfs financial statements and business operations As requested I have completed an anal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started