Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Summit Inc., an Australian company, has concluded a large sale of computer systems for inventory management to a customer in Germany for 5,000,000 with

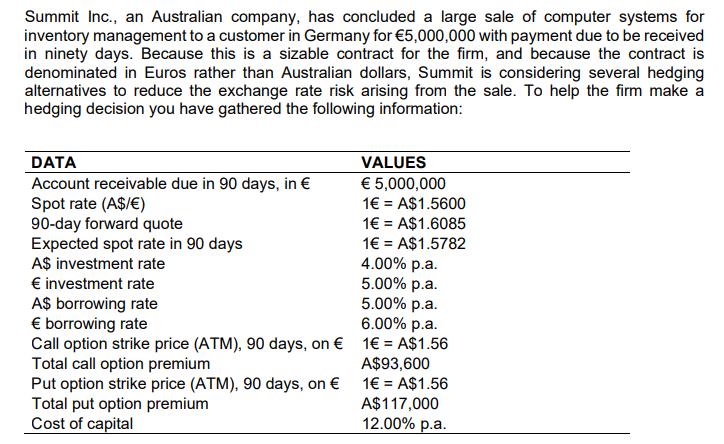

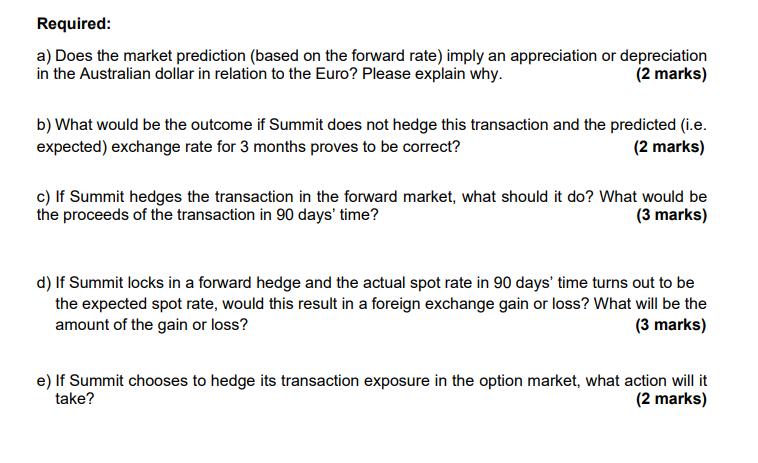

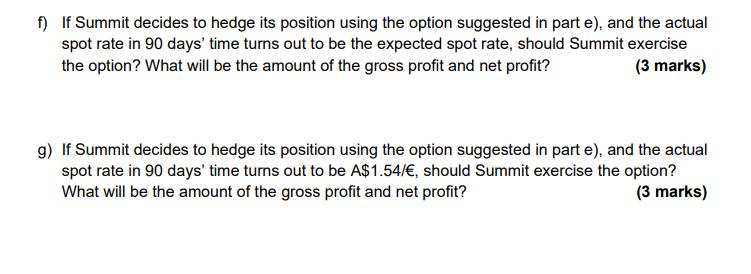

Summit Inc., an Australian company, has concluded a large sale of computer systems for inventory management to a customer in Germany for 5,000,000 with payment due to be received in ninety days. Because this is a sizable contract for the firm, and because the contract is denominated in Euros rather than Australian dollars, Summit is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the following information: DATA Account receivable due in 90 days, in Spot rate (A$/) 90-day forward quote Expected spot rate in 90 days A$ investment rate investment rate A$ borrowing rate borrowing rate Call option strike price (ATM), 90 days, on Total call option premium Put option strike price (ATM), 90 days, on Total put option premium Cost of capital VALUES 5,000,000 1 = A$1.5600 1 = A$1.6085 1 = A$1.5782 4.00% p.a. 5.00% p.a. 5.00% p.a. 6.00% p.a. 1 = A$1.56 A$93,600 1 = A$1.56 A$117,000 12.00% p.a. Required: a) Does the market prediction (based on the forward rate) imply an appreciation or depreciation in the Australian dollar in relation to the Euro? Please explain why. (2 marks) b) What would be the outcome if Summit does not hedge this transaction and the predicted (i.e. expected) exchange rate for 3 months proves to be correct? (2 marks) c) If Summit hedges the transaction in the forward market, what should it do? What would be the proceeds of the transaction in 90 days' time? (3 marks) d) If Summit locks in a forward hedge and the actual spot rate in 90 days' time turns out to be the expected spot rate, would this result in a foreign exchange gain or loss? What will be the amount of the gain or loss? (3 marks) e) If Summit chooses to hedge its transaction exposure in the option market, what action will it take? (2 marks) f) If Summit decides to hedge its position using the option suggested in part e), and the actual spot rate in 90 days' time turns out to be the expected spot rate, should Summit exercise the option? What will be the amount of the gross profit and net profit? (3 marks) g) If Summit decides to hedge its position using the option suggested in part e), and the actual spot rate in 90 days' time turns out to be A$1.54/, should Summit exercise the option? What will be the amount of the gross profit and net profit? (3 marks)

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The market prediction based on the forward rate implies an appreciation of the Australian dollar i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started