Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sun Dept Store, a well-known retailer company in the world, has a beta of 1.3 for its asset. The risk free rates of 8%

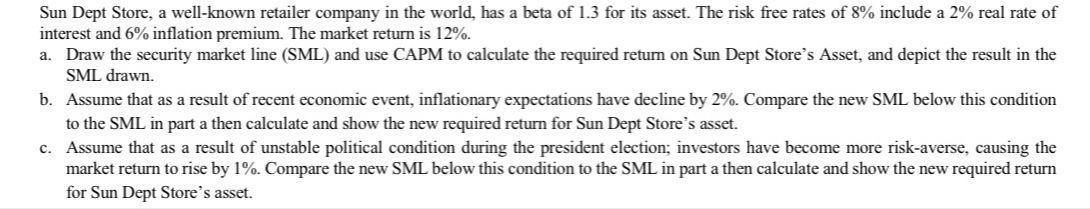

Sun Dept Store, a well-known retailer company in the world, has a beta of 1.3 for its asset. The risk free rates of 8% include a 2% real rate of interest and 6% inflation premium. The market return is 12%. a. Draw the security market line (SML) and use CAPM to calculate the required return on Sun Dept Store's Asset, and depict the result in the SML drawn. b. Assume that as a result of recent economic event, inflationary expectations have decline by 2%. Compare the new SML below this condition to the SML in part a then calculate and show the new required return for Sun Dept Store's asset. c. Assume that as a result of unstable political condition during the president election; investors have become more risk-averse, causing the market return to rise by 1%. Compare the new SML below this condition to the SML in part a then calculate and show the new required return for Sun Dept Store's asset.

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Ans The security market line SML is a graphical representation of the relationship between the requi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started