Answered step by step

Verified Expert Solution

Question

1 Approved Answer

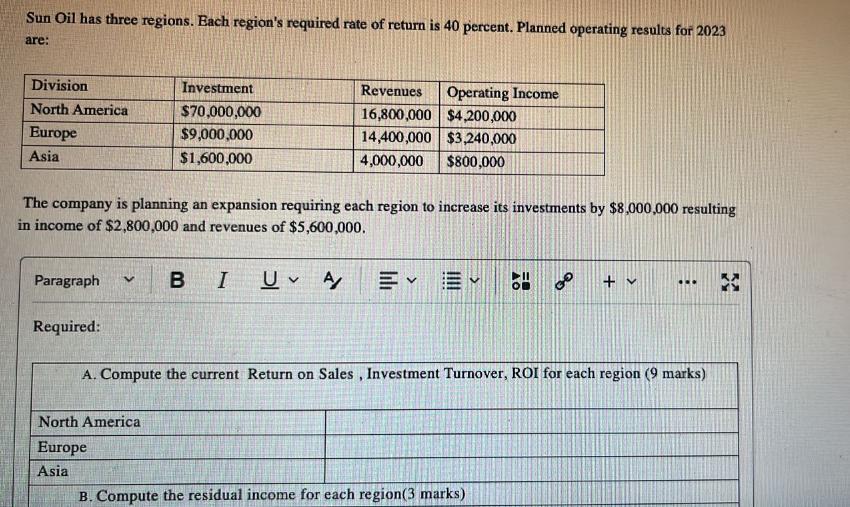

Sun Oil has three regions. Each region's required rate of return is 40 percent. Planned operating results for 2023 are: Division North America Europe

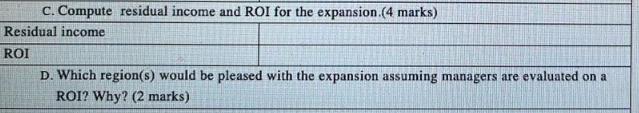

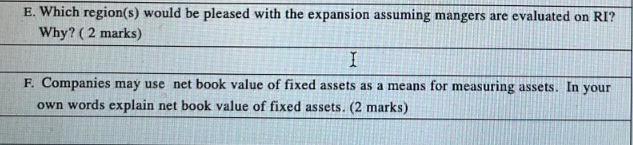

Sun Oil has three regions. Each region's required rate of return is 40 percent. Planned operating results for 2023 are: Division North America Europe Asia Paragraph V The company is planning an expansion requiring each region to increase its investments by $8,000,000 resulting in income of $2,800,000 and revenues of $5,600,000. Required: Investment $70,000,000 $9,000,000 $1,600,000 North America Europe Asia Revenues Operating Income 16,800,000 $4,200,000 14,400,000 $3,240,000 4,000,000 $800,000 B I U A + v A. Compute the current Return on Sales, Investment Turnover, ROI for each region (9 marks) B. Compute the residual income for each region(3 marks) *** 3 C. Compute residual income and ROI for the expansion. (4 marks) Residual income ROI D. Which region(s) would be pleased with the expansion assuming managers are evaluated on a ROI? Why? (2 marks) E. Which region(s) would be pleased with the expansion assuming mangers are evaluated on RI? Why? (2 marks) I F. Companies may use net book value of fixed assets as a means for measuring assets. In your own words explain net book value of fixed assets. (2 marks) Sun Oil has three regions. Each region's required rate of return is 40 percent. Planned operating results for 2023 are: Division North America Europe Asia Paragraph V The company is planning an expansion requiring each region to increase its investments by $8,000,000 resulting in income of $2,800,000 and revenues of $5,600,000. Required: Investment $70,000,000 $9,000,000 $1,600,000 North America Europe Asia Revenues Operating Income 16,800,000 $4,200,000 14,400,000 $3,240,000 4,000,000 $800,000 B I U A + v A. Compute the current Return on Sales, Investment Turnover, ROI for each region (9 marks) B. Compute the residual income for each region(3 marks) *** 3 C. Compute residual income and ROI for the expansion. (4 marks) Residual income ROI D. Which region(s) would be pleased with the expansion assuming managers are evaluated on a ROI? Why? (2 marks) E. Which region(s) would be pleased with the expansion assuming mangers are evaluated on RI? Why? (2 marks) I F. Companies may use net book value of fixed assets as a means for measuring assets. In your own words explain net book value of fixed assets. (2 marks) Sun Oil has three regions. Each region's required rate of return is 40 percent. Planned operating results for 2023 are: Division North America Europe Asia Paragraph V The company is planning an expansion requiring each region to increase its investments by $8,000,000 resulting in income of $2,800,000 and revenues of $5,600,000. Required: Investment $70,000,000 $9,000,000 $1,600,000 North America Europe Asia Revenues Operating Income 16,800,000 $4,200,000 14,400,000 $3,240,000 4,000,000 $800,000 B I U A + v A. Compute the current Return on Sales, Investment Turnover, ROI for each region (9 marks) B. Compute the residual income for each region(3 marks) *** 3 C. Compute residual income and ROI for the expansion. (4 marks) Residual income ROI D. Which region(s) would be pleased with the expansion assuming managers are evaluated on a ROI? Why? (2 marks) E. Which region(s) would be pleased with the expansion assuming mangers are evaluated on RI? Why? (2 marks) I F. Companies may use net book value of fixed assets as a means for measuring assets. In your own words explain net book value of fixed assets. (2 marks)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION A To compute the current return on sales investment turnover and ROI for each region we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started