Answered step by step

Verified Expert Solution

Question

1 Approved Answer

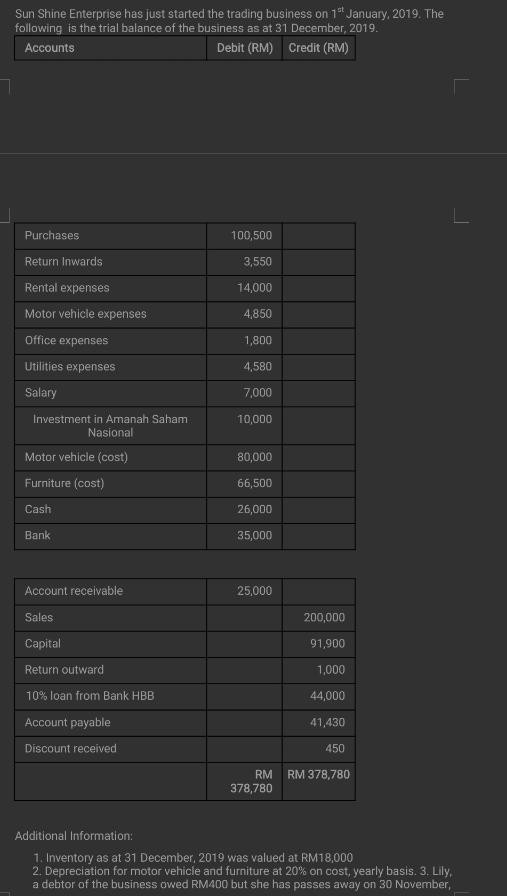

Sun Shine Enterprise has just started the trading business on 1st January, 2019. The following is the trial balance of the business as at

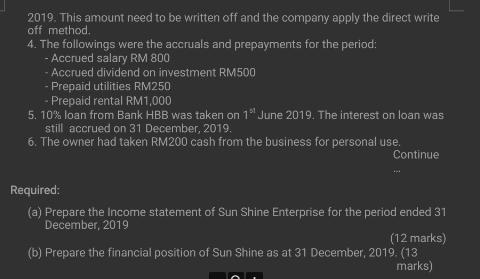

Sun Shine Enterprise has just started the trading business on 1st January, 2019. The following is the trial balance of the business as at 31 December, 2019. Accounts Debit (RM) Credit (RM) Purchases Return Inwards Rental expenses Motor vehicle expenses Office expenses Utilities expenses Salary Investment in Amanah Saham Nasional Motor vehicle (cost) Furniture (cost) Cash Bank Account receivable Sales Capital Return outward 10% loan from Bank HBB Account payable Discount received 100,500 3,550 14,000 4,850 1,800 4,580 7,000 10,000 80,000 66,500 26,000 35,000 25,000 200,000 91,900 1,000 44,000 41,430 378,780 450 RM RM 378,780 r Additional Information: 1. Inventory as at 31 December, 2019 was valued at RM18,000 2. Depreciation for motor vehicle and furniture at 20% on cost, yearly basis. 3. Lily, a debtor of the business owed RM400 but she has passes away on 30 November, 2019. This amount need to be written off and the company apply the direct write off method. 4. The followings were the accruals and prepayments for the period: - Accrued salary RM 800 - Accrued dividend on investment RM500 - Prepaid utilities RM250 - Prepaid rental RM1,000 5. 10% loan from Bank HBB was taken on 1 June 2019. The interest on loan was still accrued on 31 December, 2019. 6. The owner had taken RM200 cash from the business for personal use. Continue Required: (a) Prepare the Income statement of Sun Shine Enterprise for the period ended 31 December, 2019 (12 marks) (b) Prepare the financial position of Sun Shine as at 31 December, 2019. (13 marks)

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started