Question

Sun Solar Inc Part-1 Sun Solar Inc. designs and manufactures solar modules using a proprietary thin film semiconductor technology that is one of the lowest

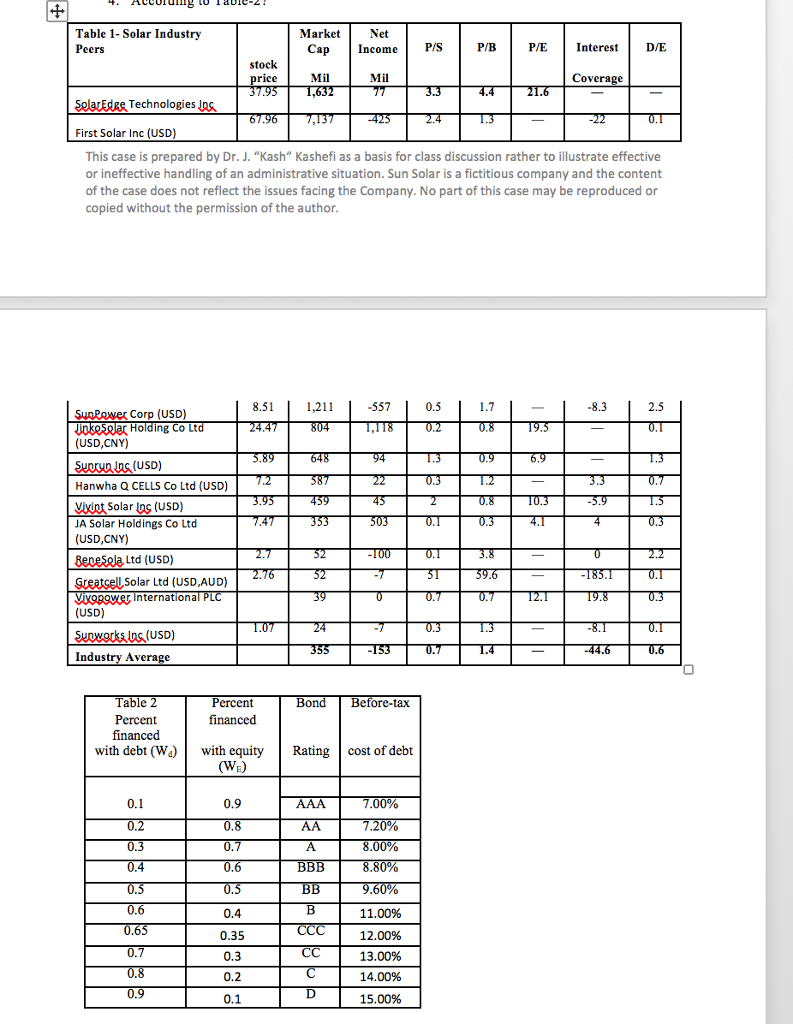

Sun Solar Inc Part-1 Sun Solar Inc. designs and manufactures solar modules using a proprietary thin film semiconductor technology that is one of the lowest costs in the world. Our objective is to reduce the cost of solar electricity to levels that compete on a non-subsidized basis with the price of retail electricity in key markets throughout the world, said Travis Allen, the CEO of the company. Travis Allen after reading an article on companies' debt policies when the names Modigliani and Miller (MM) 1&2 were mentioned several times as leading researchers on the theory of capital structure became concerned about his firm's level of debt financing compared to his competitors (Table-1). In 1963, Modigliani and Miller (MM) published a follow up paper (original paper published in 1958) that the tax code favors debt financing as corporation could write off the interest expense. This means that interest payment reduces the taxes a corporation pays and adds to the cash flows available to stockholders. Upon his analysis of his competitor financials, he noticed that some of his competitors are paying off their long-term debt and some of them are adding more debt. Until now, his company has used short-term debt to finance its temporary working capital needs. Other solar technology companies average about 60 percent debt-equity ratio (Table-1), and Travis wonders what are the effects on stock price and the firm value. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant. 1. Briefly, who are Modigliani and Miller (MM), and what assumptions are embedded in the MM models? 2. What are the MM models? Explain in details. Sun Solar has earnings before interest and taxes of $106 million and considering making a change to its capital structure to reduce its cost of capital and increase firm value. Right now, Sun is all equity with unlevered cost of capital of 12 % based on CAPM. The risk-free rate is 6%, the market risk premium (MRP=RM - RRF) of 5% and tax rate of 40%. 3. What would be Suns estimated levered cost of equity and cost of capital if it were to change its capital structure to the industry average in Table 1? 4. According to Table-2? Table 1- Solar Industry Peers Market Cap Net Income P/S P/B P/E Interest D/E stock price Mil Mil Coverage SolarEdge Technologies Inc 37.95 1,632 77 3.3 4.4 21.6 First Solar Inc (USD) 67.96 7,137 -425 2.4 1.3 -22 0.1 SunPower Corp (USD) 8.51 1,211 -557 0.5 1.7 -8.3 2.5 JinkoSolar Holding Co Ltd (USD,CNY) 24.47 804 1,118 0.2 0.8 19.5 0.1 Sunrun Inc (USD) 5.89 648 94 1.3 0.9 6.9 1.3 Hanwha Q CELLS Co Ltd (USD) 7.2 587 22 0.3 1.2 3.3 0.7 Vivint Solar Inc (USD) 3.95 459 45 2 0.8 10.3 -5.9 1.5 JA Solar Holdings Co Ltd (USD,CNY) 7.47 353 503 0.1 0.3 4.1 4 0.3 ReneSola Ltd (USD) 2.7 52 -100 0.1 3.8 0 2.2 Greatcell Solar Ltd (USD,AUD) 2.76 52 -7 51 59.6 -185.1 0.1 Vivopower International PLC (USD) 39 0 0.7 0.7 12.1 19.8 0.3 Sunworks Inc (USD) 1.07 24 -7 0.3 1.3 -8.1 0.1 Industry Average 355 -153 0.7 1.4 -44.6 0.6 Table 2 Percent financed Percent financed Bond Before-tax with debt (Wd) with equity (WE) Rating cost of debt 0.1 0.9 AAA 7.00% 0.2 0.8 AA 7.20% 0.3 0.7 A 8.00% 0.4 0.6 BBB 8.80% 0.5 0.5 BB 9.60% 0.6 0.4 B 11.00% 0.65 0.35 CCC 12.00% 0.7 0.3 CC 13.00% 0.8 0.2 C 14.00% 0.9 0.1 D 15.00% Assume the company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS), 5. What would be the total market value (in millions) of the firm? Assume Sun Solar finds its optimal capital structure based on your calculation in part 4 and is considering a new project that is being a little riskier than its current operations. Thus, the company has decided to add an additional 1.5 percent to the company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $62,000 and projected cash inflows of $17,000 in year one, $28,000 in year two, and $30,000 in year three. 6. What is the projected net present value of the new project? Part 2- Dynamic Capital Structure of Modigliani-Miller- Adjusted Present Value (APV) Sun expects its EBIT to increase by 5 percent for the next 3 years and after which at a constant rate of 3 percent in perpetuity. The expected interest expense is also expected to grow over next 3 years before the capital structure becomes constant. The cost of debt and the cost of capital is based on the calculation of part 4. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. Using any information from part I to answer the following questions: a. What is the estimated terminal unlevered value of operations? b. What is the current unlevered value of operations? c. What is the terminal value of the tax shield at Year 3? d. What is the current value of the tax shield? e. What is the current total value? 1. Franco Modigliani and Merton Miller, The Cost of Capital, Corporation Finance and the Theory of Investment, American Economic Review (June 1958). 2. Franco Modigliani and Merton Miller (1963), "Corporate Income Taxes and the Cost of Capital: A Correction," American Economic Review, June 1963.

Sun Solar Inc Part-1 Sun Solar Inc. designs and manufactures solar modules using a proprietary thin film semiconductor technology that is one of the lowest costs in the world. Our objective is to reduce the cost of solar electricity to levels that compete on a non-subsidized basis with the price of retail electricity in key markets throughout the world, said Travis Allen, the CEO of the company. Travis Allen after reading an article on companies' debt policies when the names Modigliani and Miller (MM) 1&2 were mentioned several times as leading researchers on the theory of capital structure became concerned about his firm's level of debt financing compared to his competitors (Table-1). In 1963, Modigliani and Miller (MM) published a follow up paper (original paper published in 1958) that the tax code favors debt financing as corporation could write off the interest expense. This means that interest payment reduces the taxes a corporation pays and adds to the cash flows available to stockholders. Upon his analysis of his competitor financials, he noticed that some of his competitors are paying off their long-term debt and some of them are adding more debt. Until now, his company has used short-term debt to finance its temporary working capital needs. Other solar technology companies average about 60 percent debt-equity ratio (Table-1), and Travis wonders what are the effects on stock price and the firm value. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant. 1. Briefly, who are Modigliani and Miller (MM), and what assumptions are embedded in the MM models? 2. What are the MM models? Explain in details. Sun Solar has earnings before interest and taxes of $106 million and considering making a change to its capital structure to reduce its cost of capital and increase firm value. Right now, Sun is all equity with unlevered cost of capital of 12 % based on CAPM. The risk-free rate is 6%, the market risk premium (MRP=RM - RRF) of 5% and tax rate of 40%. 3. What would be Suns estimated levered cost of equity and cost of capital if it were to change its capital structure to the industry average in Table 1? 4. According to Table-2? Table 1- Solar Industry Peers Market Cap Net Income P/S P/B P/E Interest D/E stock price Mil Mil Coverage SolarEdge Technologies Inc 37.95 1,632 77 3.3 4.4 21.6 First Solar Inc (USD) 67.96 7,137 -425 2.4 1.3 -22 0.1 SunPower Corp (USD) 8.51 1,211 -557 0.5 1.7 -8.3 2.5 JinkoSolar Holding Co Ltd (USD,CNY) 24.47 804 1,118 0.2 0.8 19.5 0.1 Sunrun Inc (USD) 5.89 648 94 1.3 0.9 6.9 1.3 Hanwha Q CELLS Co Ltd (USD) 7.2 587 22 0.3 1.2 3.3 0.7 Vivint Solar Inc (USD) 3.95 459 45 2 0.8 10.3 -5.9 1.5 JA Solar Holdings Co Ltd (USD,CNY) 7.47 353 503 0.1 0.3 4.1 4 0.3 ReneSola Ltd (USD) 2.7 52 -100 0.1 3.8 0 2.2 Greatcell Solar Ltd (USD,AUD) 2.76 52 -7 51 59.6 -185.1 0.1 Vivopower International PLC (USD) 39 0 0.7 0.7 12.1 19.8 0.3 Sunworks Inc (USD) 1.07 24 -7 0.3 1.3 -8.1 0.1 Industry Average 355 -153 0.7 1.4 -44.6 0.6 Table 2 Percent financed Percent financed Bond Before-tax with debt (Wd) with equity (WE) Rating cost of debt 0.1 0.9 AAA 7.00% 0.2 0.8 AA 7.20% 0.3 0.7 A 8.00% 0.4 0.6 BBB 8.80% 0.5 0.5 BB 9.60% 0.6 0.4 B 11.00% 0.65 0.35 CCC 12.00% 0.7 0.3 CC 13.00% 0.8 0.2 C 14.00% 0.9 0.1 D 15.00% Assume the company has no growth opportunities (g = 0), so the company pays out all of its earnings as dividends (EPS = DPS), 5. What would be the total market value (in millions) of the firm? Assume Sun Solar finds its optimal capital structure based on your calculation in part 4 and is considering a new project that is being a little riskier than its current operations. Thus, the company has decided to add an additional 1.5 percent to the company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $62,000 and projected cash inflows of $17,000 in year one, $28,000 in year two, and $30,000 in year three. 6. What is the projected net present value of the new project? Part 2- Dynamic Capital Structure of Modigliani-Miller- Adjusted Present Value (APV) Sun expects its EBIT to increase by 5 percent for the next 3 years and after which at a constant rate of 3 percent in perpetuity. The expected interest expense is also expected to grow over next 3 years before the capital structure becomes constant. The cost of debt and the cost of capital is based on the calculation of part 4. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. Using any information from part I to answer the following questions: a. What is the estimated terminal unlevered value of operations? b. What is the current unlevered value of operations? c. What is the terminal value of the tax shield at Year 3? d. What is the current value of the tax shield? e. What is the current total value? 1. Franco Modigliani and Merton Miller, The Cost of Capital, Corporation Finance and the Theory of Investment, American Economic Review (June 1958). 2. Franco Modigliani and Merton Miller (1963), "Corporate Income Taxes and the Cost of Capital: A Correction," American Economic Review, June 1963.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started