Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sun Yacht Company just signed a three-year lease with Island Yacht Manufacturers for a 51-foot sloop. Sun Yacht will pay Island Yacht $74,837 at

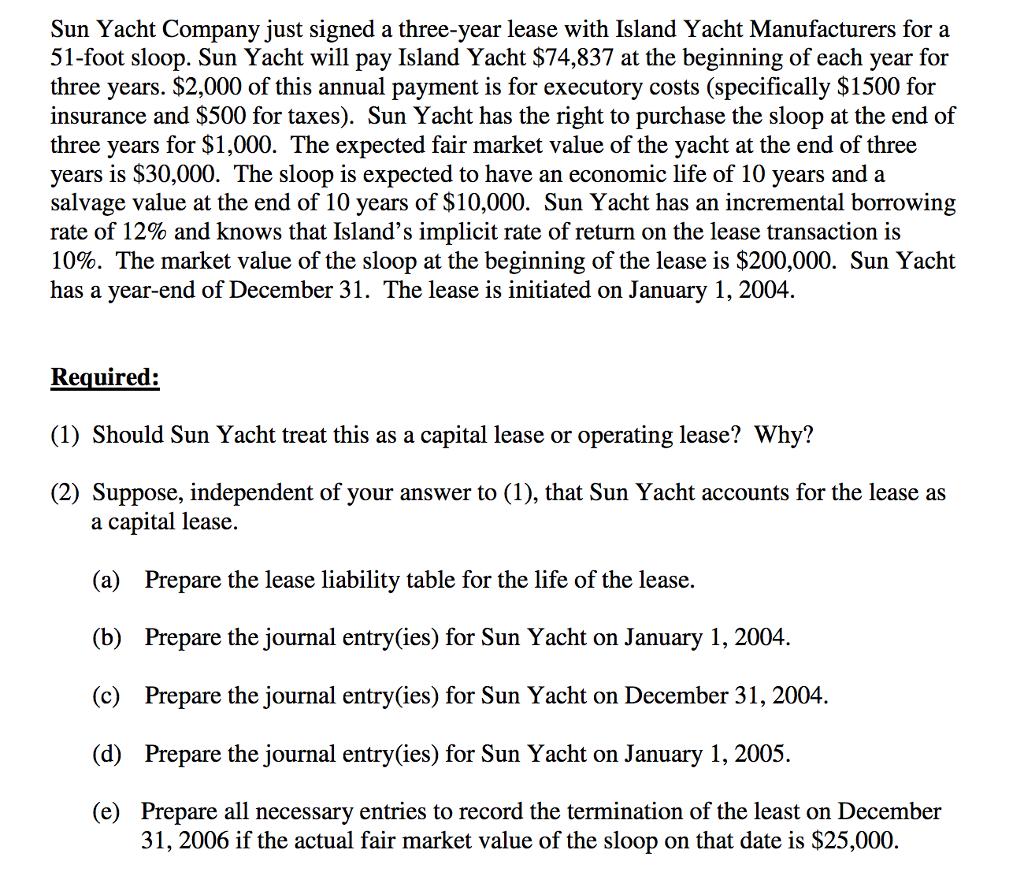

Sun Yacht Company just signed a three-year lease with Island Yacht Manufacturers for a 51-foot sloop. Sun Yacht will pay Island Yacht $74,837 at the beginning of each year for three years. $2,000 of this annual payment is for executory costs (specifically $1500 for insurance and $500 for taxes). Sun Yacht has the right to purchase the sloop at the end of three years for $1,000. The expected fair market value of the yacht at the end of three years is $30,000. The sloop is expected to have an economic life of 10 years and a salvage value at the end of 10 years of $10,000. Sun Yacht has an incremental borrowing rate of 12% and knows that Island's implicit rate of return on the lease transaction is 10%. The market value of the sloop at the beginning of the lease is $200,000. Sun Yacht has a year-end of December 31. The lease is initiated on January 1, 2004. Required: (1) Should Sun Yacht treat this as a capital lease or operating lease? Why? (2) Suppose, independent of your answer to (1), that Sun Yacht accounts for the lease as a capital lease. (a) Prepare the lease liability table for the life of the lease. (b) Prepare the journal entry(ies) for Sun Yacht on January 1, 2004. (c) Prepare the journal entry(ies) for Sun Yacht on December 31, 2004. (d) Prepare the journal entry(ies) for Sun Yacht on January 1, 2005. (e) Prepare all necessary entries to record the termination of the least on December 31, 2006 if the actual fair market value of the sloop on that date is $25,000.

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Sun Yacht should treat this as a capital lease because the expected fair market value of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started