Answered step by step

Verified Expert Solution

Question

1 Approved Answer

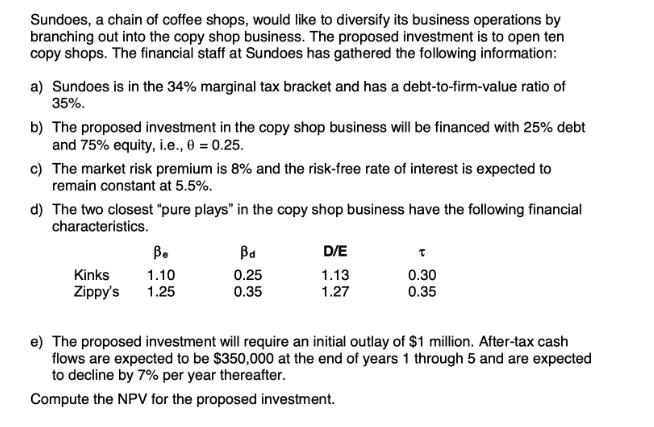

Sundoes, a chain of coffee shops, would like to diversify its business operations by branching out into the copy shop business. The proposed investment

Sundoes, a chain of coffee shops, would like to diversify its business operations by branching out into the copy shop business. The proposed investment is to open ten copy shops. The financial staff at Sundoes has gathered the following information: a) Sundoes is in the 34% marginal tax bracket and has a debt-to-firm-value ratio of 35%. b) The proposed investment in the copy shop business will be financed with 25% debt and 75% equity, i.e., 0 = 0.25. c) The market risk premium is 8% and the risk-free rate of interest is expected to remain constant at 5.5%. d) The two closest "pure plays" in the copy shop business have the following financial characteristics. d D/E Kinks Zippy's 1.10 0.25 1.13 0.30 1.25 0.35 1.27 0.35 e) The proposed investment will require an initial outlay of $1 million. After-tax cash flows are expected to be $350,000 at the end of years 1 through 5 and are expected to decline by 7% per year thereafter. Compute the NPV for the proposed investment. Sundoes, a chain of coffee shops, would like to diversify its business operations by branching out into the copy shop business. The proposed investment is to open ten copy shops. The financial staff at Sundoes has gathered the following information: a) Sundoes is in the 34% marginal tax bracket and has a debt-to-firm-value ratio of 35%. b) The proposed investment in the copy shop business will be financed with 25% debt and 75% equity, i.e., 0 = 0.25. c) The market risk premium is 8% and the risk-free rate of interest is expected to remain constant at 5.5%. d) The two closest "pure plays" in the copy shop business have the following financial characteristics. d D/E Kinks Zippy's 1.10 0.25 1.13 0.30 1.25 0.35 1.27 0.35 e) The proposed investment will require an initial outlay of $1 million. After-tax cash flows are expected to be $350,000 at the end of years 1 through 5 and are expected to decline by 7% per year thereafter. Compute the NPV for the proposed investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To calculate the NPV of the proposed investment we need to first calculate the weighted ave...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started