Question

Sunflower Shop in Oakville, Ontario employs an assistant manager, Anna Swanson, and a part-time assistant, Louise Blanger, to operate the flower shop. Anna has an

Sunflower Shop in Oakville, Ontario employs an assistant manager, Anna Swanson, and a part-time assistant, Louise Blanger, to operate the flower shop. Anna has an annual salary of $50,200 and Louise is paid $22 per hour. Both employees are paid biweekly (every two weeks). In the pay period ended May 31, 2021, Louise worked 92 hours and is paid time and one half for hours worked in excess of 80.

a) Determine the gross and net pay of each employee, using the following table.

| CPP | EI | Federal Tax | Provincial Tax | Total Tax | ||||||

| Anna Swanson | $88.91 | $32.05 | $220.20 | $111.78 | $331.98 | |||||

| Louise Blanger | $100.06 | $35.79 | $206.80 | $105.42 | $312.22 |

(Round answers to 2 decimal places, e.g. 52.75.)

| Anna Swanson | Louise Blanger | |||

| Gross pay | $ | $ | ||

| Net pay | $ | $ |

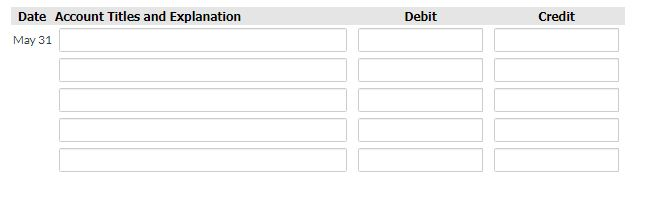

b) Prepare the journal entry to record the payment of the May 31 payroll to employees. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

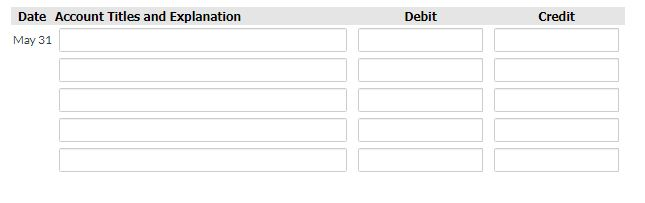

c) Prepare a journal entry on May 31 to accrue Sunflower Shop's employer payroll costs. Assume that Sunflower Shop is assessed Workers Compensation at a rate of 2% per pay period and accrues for vacation pay at a rate of 4% per pay period. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

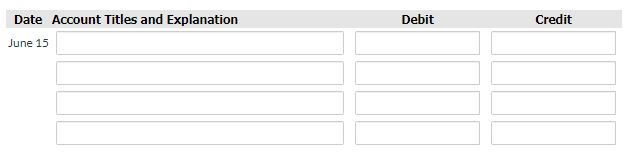

d) Prepare the journal entry to record Sunflowers remittance to the Receiver General for the payroll of May 31. The cheque is issued on June 15, 2021. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started