Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunland Cleaners is considering replacing one of its tired cleaning machines for a new model that can dry-clean clothes in half the time of

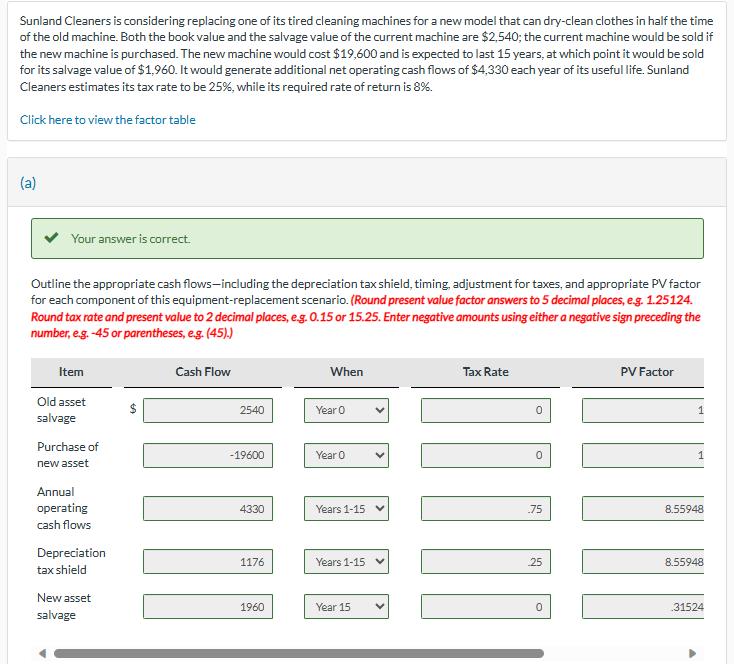

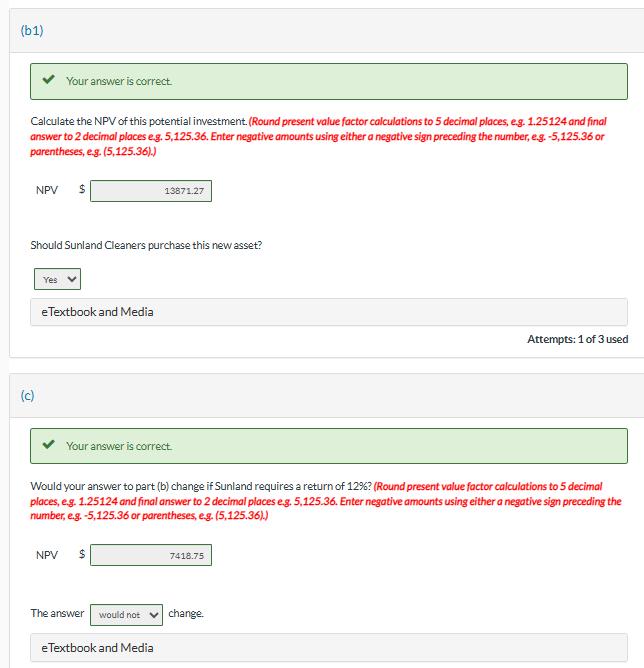

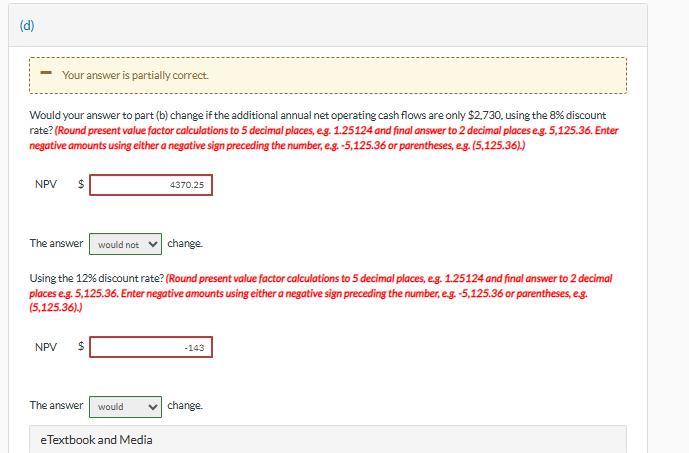

Sunland Cleaners is considering replacing one of its tired cleaning machines for a new model that can dry-clean clothes in half the time of the old machine. Both the book value and the salvage value of the current machine are $2,540; the current machine would be sold if the new machine is purchased. The new machine would cost $19,600 and is expected to last 15 years, at which point it would be sold for its salvage value of $1,960. It would generate additional net operating cash flows of $4,330 each year of its useful life. Sunland Cleaners estimates its tax rate to be 25%, while its required rate of return is 8%. Click here to view the factor table (a) Your answer is correct. Outline the appropriate cash flows-including the depreciation tax shield, timing, adjustment for taxes, and appropriate PV factor for each component of this equipment-replacement scenario. (Round present value factor answers to 5 decimal places, e.g. 1.25124. Round tax rate and present value to 2 decimal places, e.g. 0.15 or 15.25. Enter negative amounts using either a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45).) Item Old asset salvage Purchase of new asset Annual operating cash flows Depreciation tax shield New asset salvage $ Cash Flow 2540 -19600 4330 1176 1960 When Year O Year 0 Years 1-15 v Years 1-15 Year 15 Tax Rate 75 25 0 PV Factor 1 1 8.55948 8.55948 31524 (b1) Calculate the NPV of this potential investment. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36).) Your answer is correct. (c) NPV $ Should Sunland Cleaners purchase this new asset? Yes e Textbook and Media Your answer is correct. 13871.27 NPV $ Would your answer to part (b) change if Sunland requires a return of 12%? (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36).) The answer would not eTextbook and Media 7418.75 Attempts: 1 of 3 used change. (d) - Your answer is partially correct. Would your answer to part (b) change if the additional annual net operating cash flows are only $2,730, using the 8% discount rate? (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36).) NPV $ The answer would not change. Using the 12% discount rate? (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36).) NPV $ The answer would 4370.25 e Textbook and Media -143 change.

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Cash Flows 1 Old asset salvage 2540 Year 0 Tax Rate 0 not deductible PV Factor 1 2 Purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started