Answered step by step

Verified Expert Solution

Question

1 Approved Answer

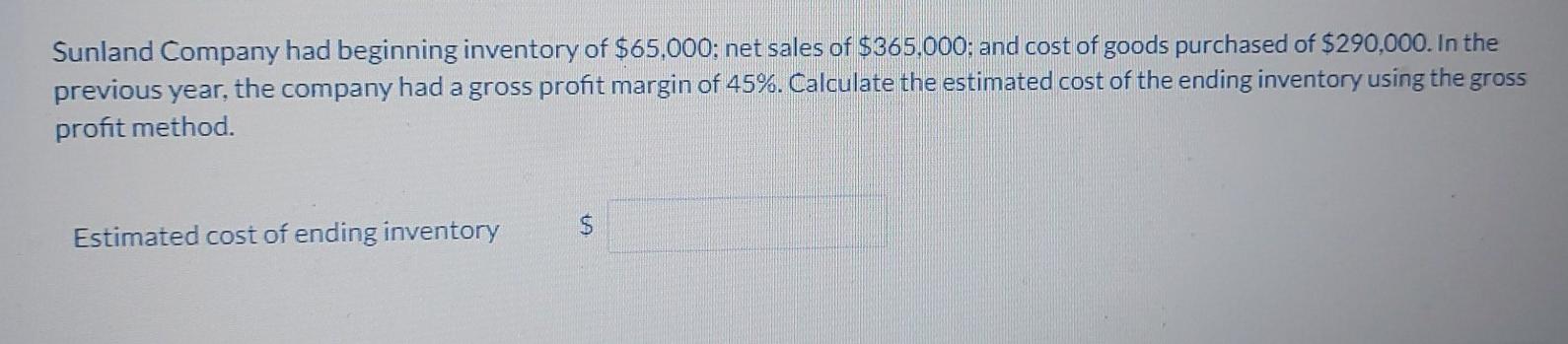

Sunland Company had beginning inventory of $65,000: net sales of $365,000: and cost of goods purchased of $290,000. In the previous year, the company had

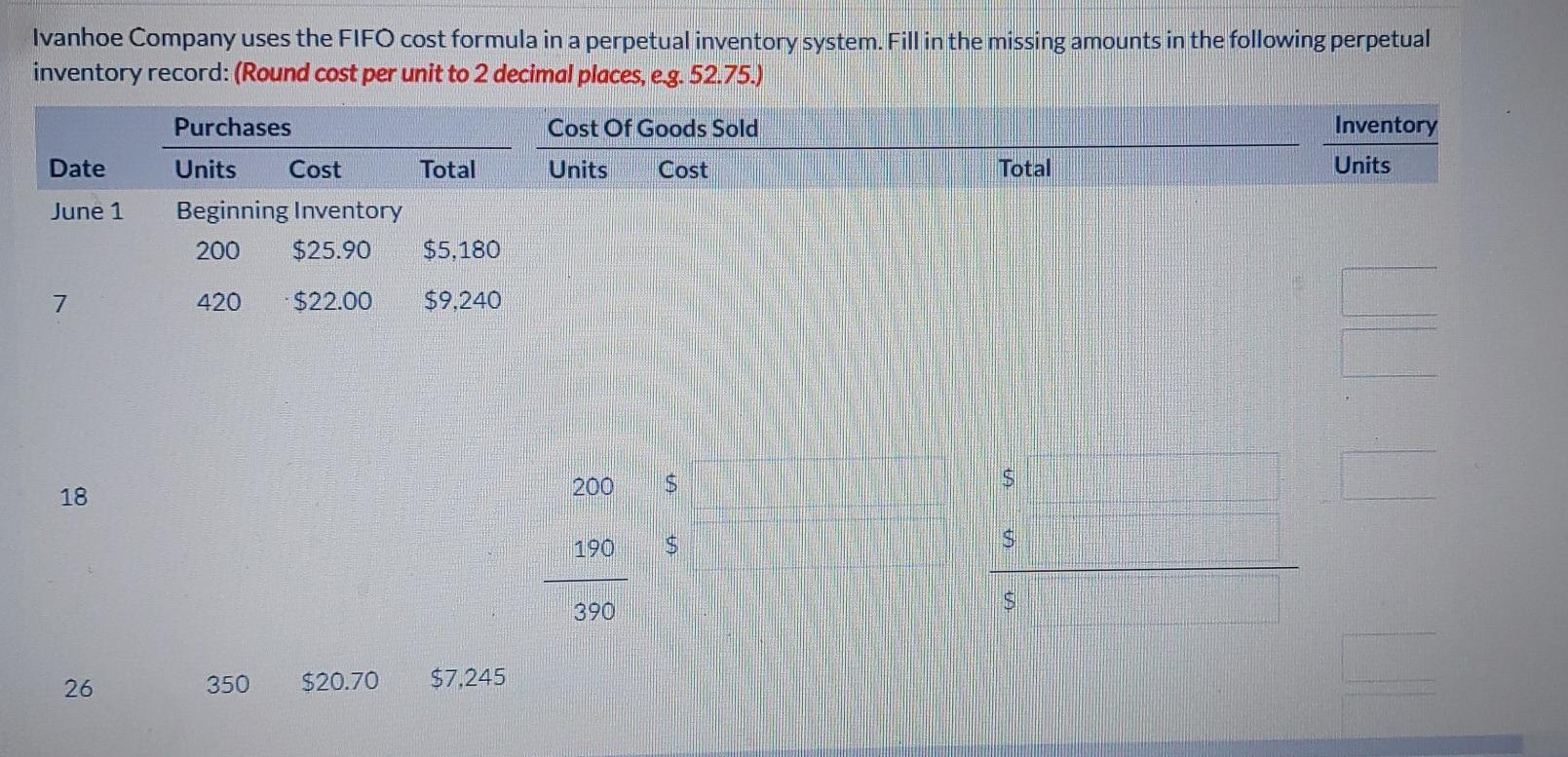

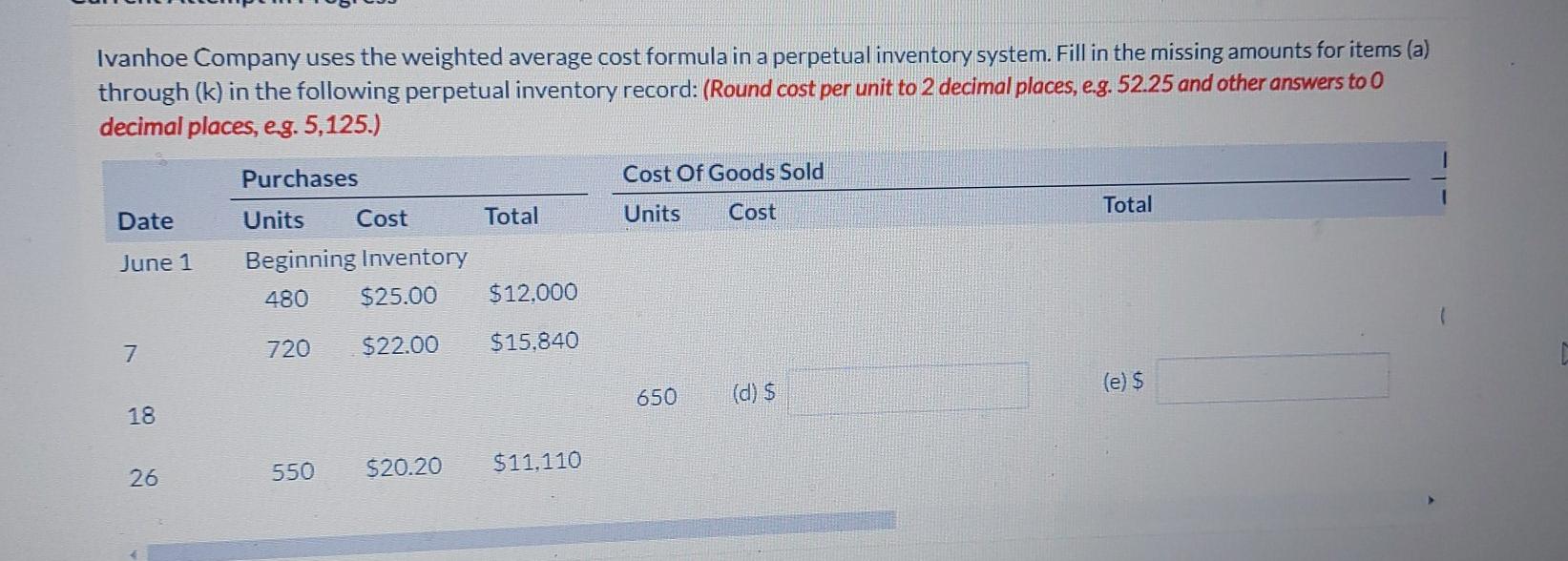

Sunland Company had beginning inventory of $65,000: net sales of $365,000: and cost of goods purchased of $290,000. In the previous year, the company had a gross profit margin of 45%. Calculate the estimated cost of the ending inventory using the gross profit method. $ Estimated cost of ending inventory Ivanhoe Company uses the FIFO cost formula in a perpetual inventory system. Fill in the missing amounts in the following perpetual inventory record: (Round cost per unit to 2 decimal places, eg. 52.75.) Purchases Cost Of Goods Sold Inventory Units Date Total Units Cost Total June 1 Units Cost Beginning Inventory 200 $25.90 $5,180 7 420 $22.00 $9.240 200 $ S 18 190 $ $ 390 26 350 $20.70 $7.245 Ivanhoe Company uses the weighted average cost formula in a perpetual inventory system. Fill in the missing amounts for items (a) through (k) in the following perpetual inventory record: (Round cost per unit to 2 decimal places, e.g. 52.25 and other answers to O decimal places, eg. 5,125.) Purchases Cost Of Goods Sold Date Units Total Cost Total Units Cost June 1 Beginning Inventory 480 $25.00 $12.000 7 720 $22.00 $15.840 (e)s 650 (d) $ 18 26 550 $20.20 $11.110

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started