Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunland Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special- purpose equipment for a period

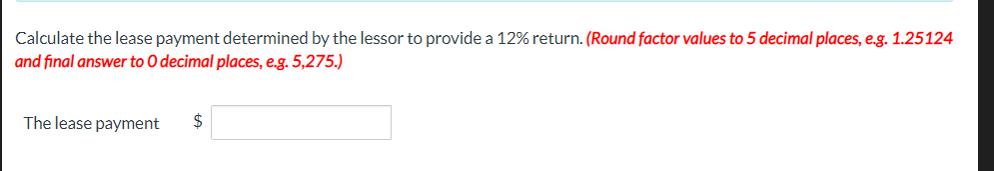

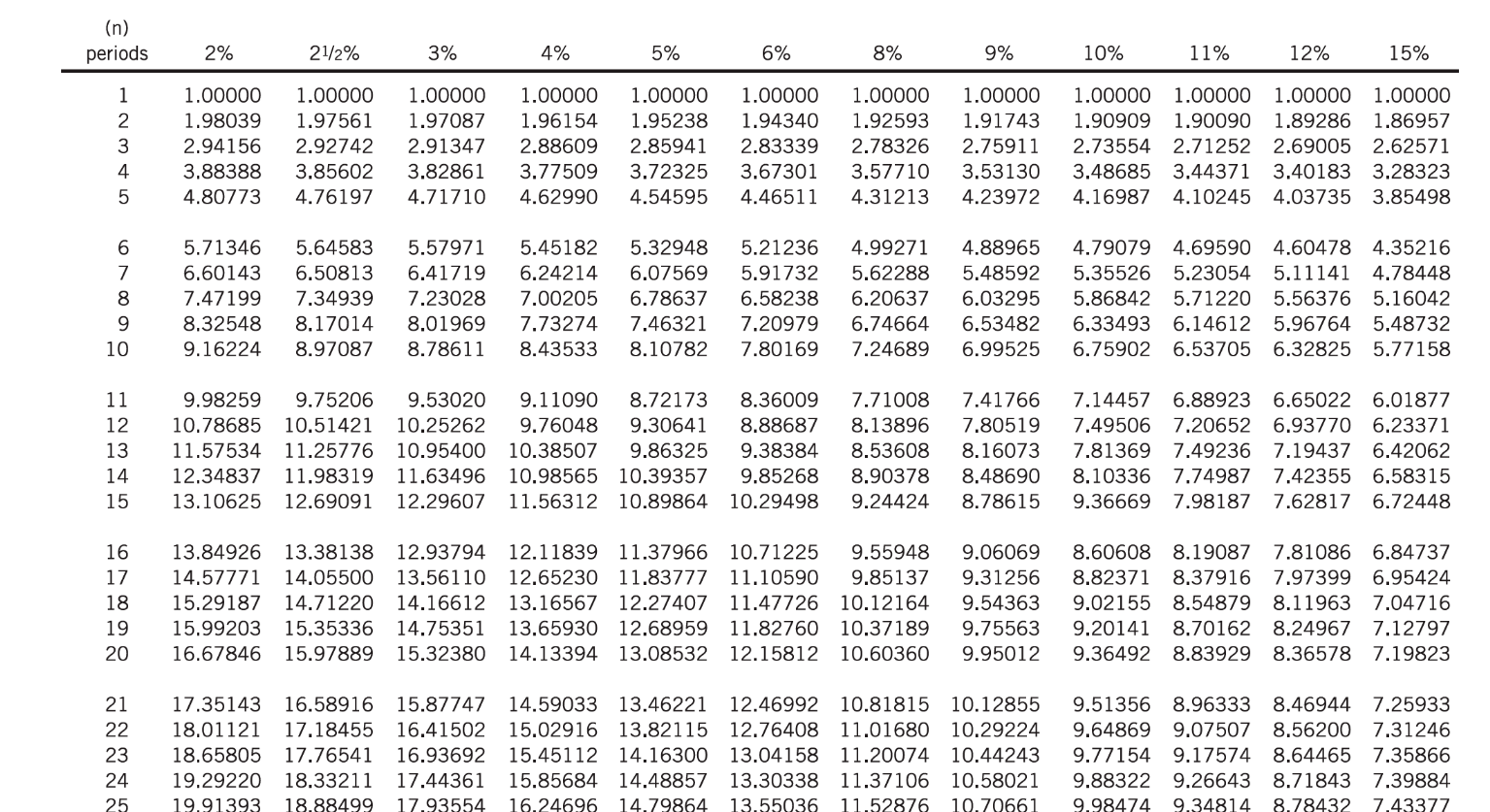

Sunland Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special- purpose equipment for a period of seven years. Sunland follows IFRS and Galt follows ASPE. The following information relates to the agreement: Lease inception Annual lease payment due at the beginning of each lease year Residual value of equipment at end of lease term, guaranteed by an independent third party Economic life of equipment Usual selling price of equipment Manufacturing cost of equipment on lessor's books Lessor's implicit interest rate, known to lessee Lessee's incremental borrowing rate Repairs and maintenance per year to be paid by lessee, estimated May 2, 2023 $? $98,850 10 years $408,700 $322,300 12% 12% $14,170 The leased equipment reverts to Galt at the end of the lease, although Sunland has an option to purchase it at its expected fair value at that time. Calculate the lease payment determined by the lessor to provide a 12% return. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 5,275.) The lease payment $ (n) periods 2% 1 GAW NI 2 3 4 5 6 7 8 9 10 1.00000 1.98039 2.94156 3.88388 4.80773 16 17 18 19 20 21/2% 3% 5% 8% 15% 9% 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 1.97561 1.97087 1.96154 1.95238 1.94340 1.92593 1.91743 1.90909 1.90090 1.89286 1.86957 2.92742 2.91347 2.88609 2.85941 2.83339 2.78326 2.75911 2.73554 2.71252 2.69005 2.62571 3.85602 3.82861 3.77509 3.72325 3.67301 3.57710 3.53130 3.48685 3.44371 3.40183 3.28323 4.76197 4.71710 4.62990 4.54595 4.46511 4.31213 4.23972 4.16987 4.10245 4.03735 3.85498 4% 6% 5.71346 5.64583 5.57971 5.45182 5.32948 5.21236 4.99271 4.88965 6.60143 6.50813 6.41719 6.24214 6.07569 5.91732 5.62288 5.48592 7.47199 7.34939 7.23028 7.00205 6.78637 6.58238 6.20637 6.03295 8.32548 8.17014 8.01969 7.73274 7.46321 7.20979 6.74664 6.53482 9.16224 8.97087 8.78611 8.43533 8.10782 7.80169 7.24689 6.99525 10% 11% 21 17.35143 16.58916 15.87747 14.59033 13.46221 12.46992 10.81815 10.12855 22 18.01121 17.18455 16.41502 15.02916 13.82115 12.76408 11.01680 10.29224 23 18.65805 17.76541 16.93692 15.45112 14.16300 13.04158 11.20074 10.44243 24 19.29220 18.33211 17.44361 15.85684 14.48857 13.30338 11.37106 10.58021 25 19.91393 18.88499 17.93554 16.24696 14.79864 13.55036 11.52876 10.70661 12% 11 9.98259 9.75206 9.53020 9.11090 8.72173 8.36009 7.71008 7.41766 7.14457 6.88923 6.65022 6.01877 12 10.78685 10.51421 10.25262 9.76048 9.30641 8.88687 8.13896 7.80519 7.49506 7.20652 6.93770 6.23371 13 11.57534 11.25776 10.95400 10.38507 9.86325 9.38384 8.53608 8.16073 7.81369 7.49236 7.19437 6.42062 14 12.34837 11.98319 11.63496 10.98565 10.39357 9.85268 8.90378 8.48690 8.10336 7.74987 7.42355 6.58315 15 13.10625 12.69091 12.29607 11.56312 10.89864 10.29498 9.24424 8.78615 9.36669 7.98187 7.62817 6.72448 4.79079 4.69590 4.60478 4.35216 5.35526 5.23054 5.11141 4.78448 5.86842 5.71220 5.56376 5.16042 6.33493 6.14612 5.96764 5.48732 6.75902 6.53705 6.32825 5.77158 13.84926 13.38138 12.93794 12.11839 11.37966 10.71225 9.55948 9.06069 8.60608 8.19087 7.81086 6.84737 14.57771 14.05500 13.56110 12.65230 11.83777 11.10590 9.85137 9.31256 8.82371 8.37916 7.97399 6.95424 15.29187 14.71220 14.16612 13.16567 12.27407 11.47726 10.12164 9.54363 9.02155 8.54879 8.11963 7.04716 15.99203 15.35336 14.75351 13.65930 12.68959 11.82760 10.37189 9.75563 9.20141 8.70162 8.24967 7.12797 16.67846 15.97889 15.32380 14.13394 13.08532 12.15812 10.60360 9.95012 9.36492 8.83929 8.36578 7.19823 9.51356 8.96333 8.46944 7.25933 9.64869 9.07507 8.56200 7.31246 9.77154 9.17574 8.64465 7.35866 9.88322 9.26643 8.71843 7.39884 9.98474 9.34814 8.78432 7.43377

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started