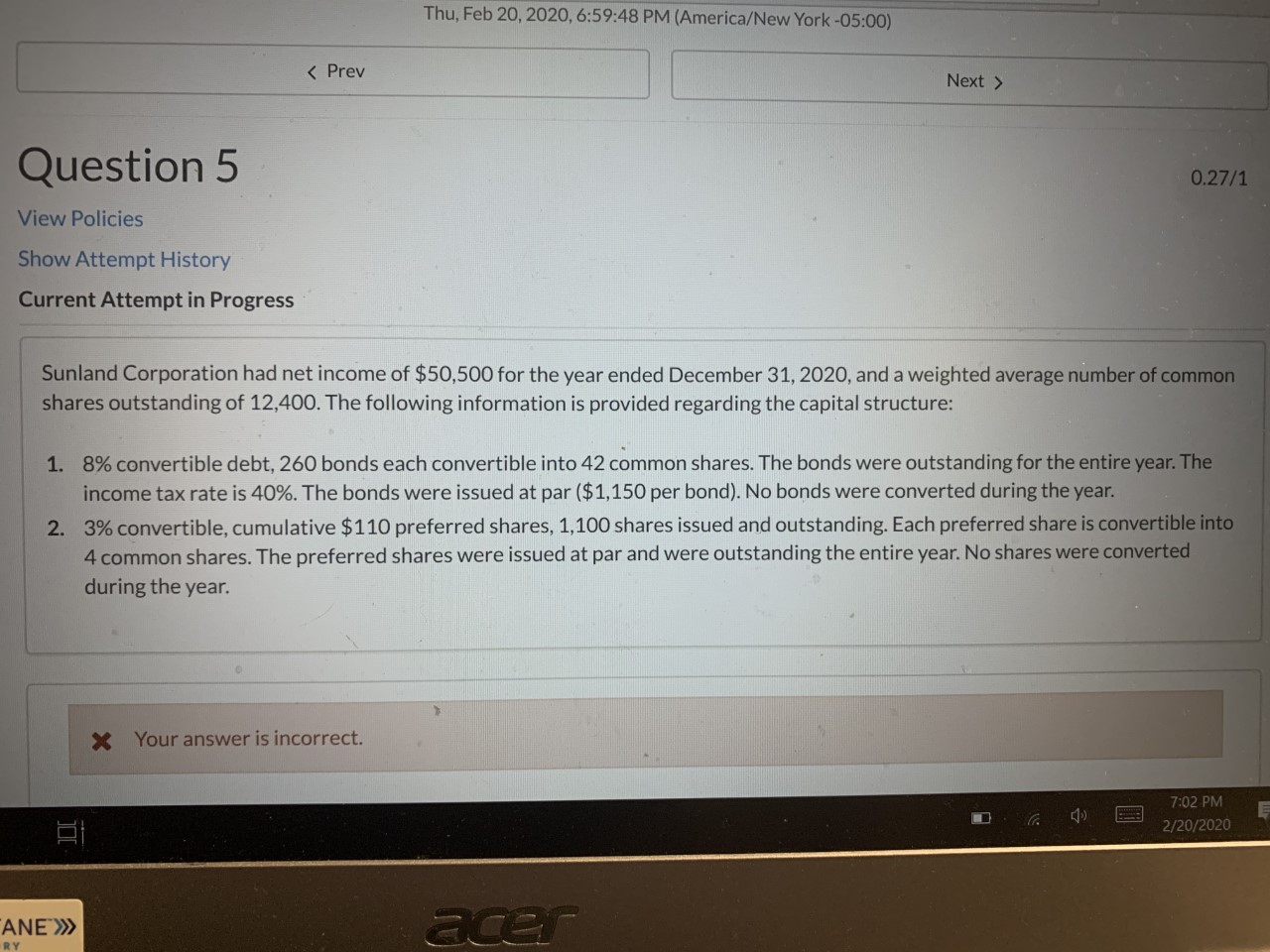

Sunland Corporation had net income of $50,500 for the year ended December 31, 2020, and a weighted average number of common shares outstanding of 12,400. The following information is provided regarding the capital structure:

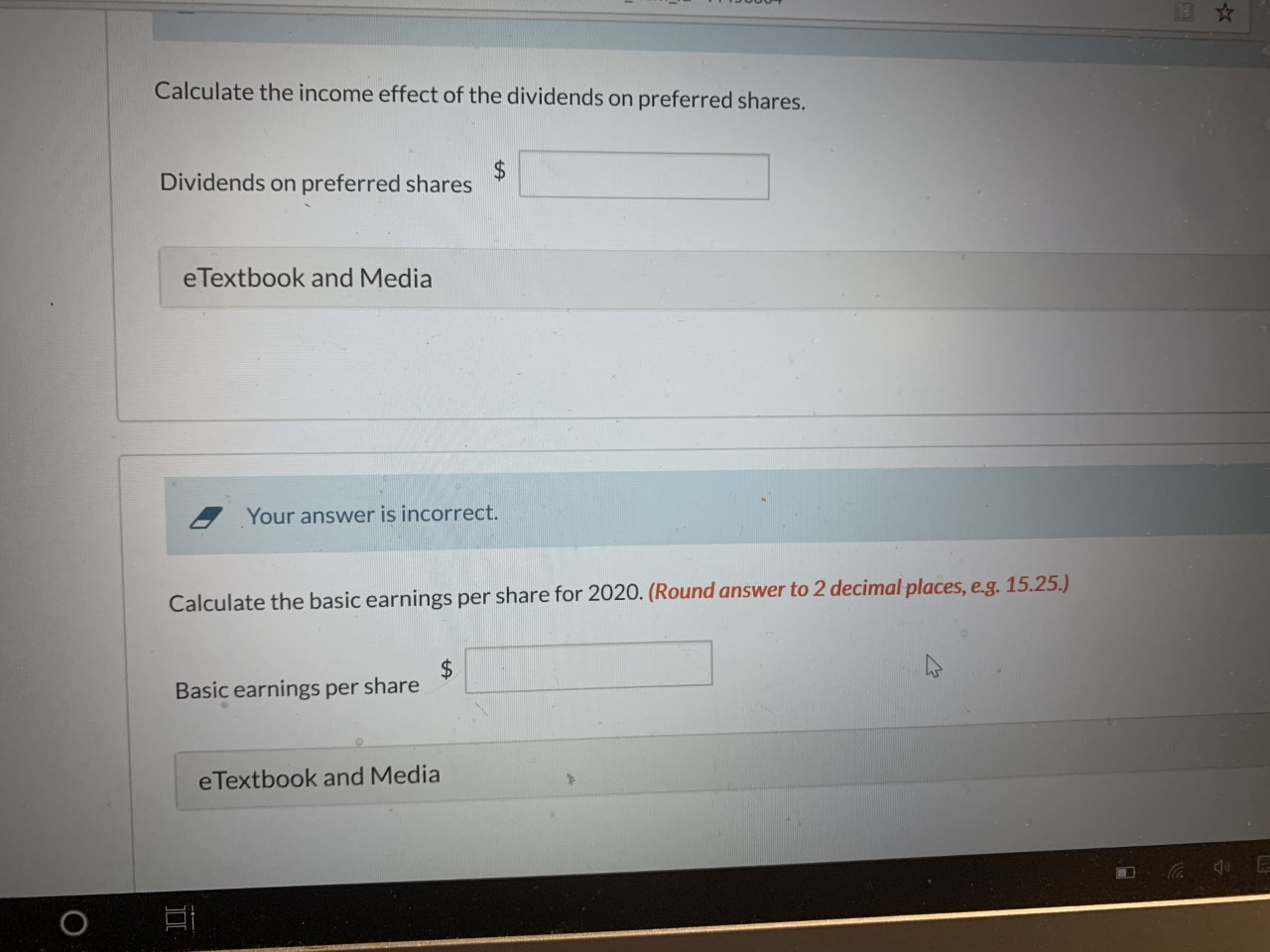

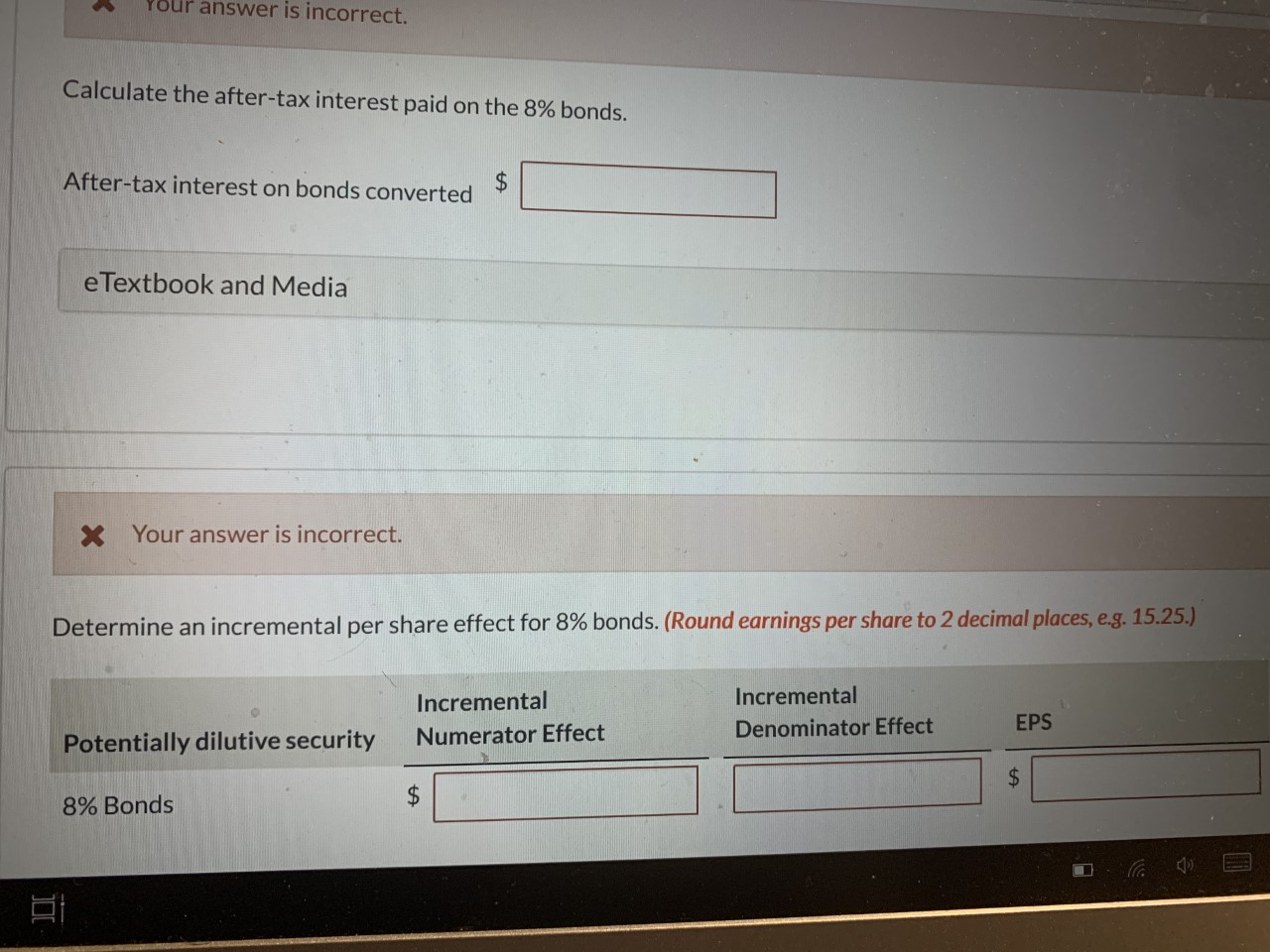

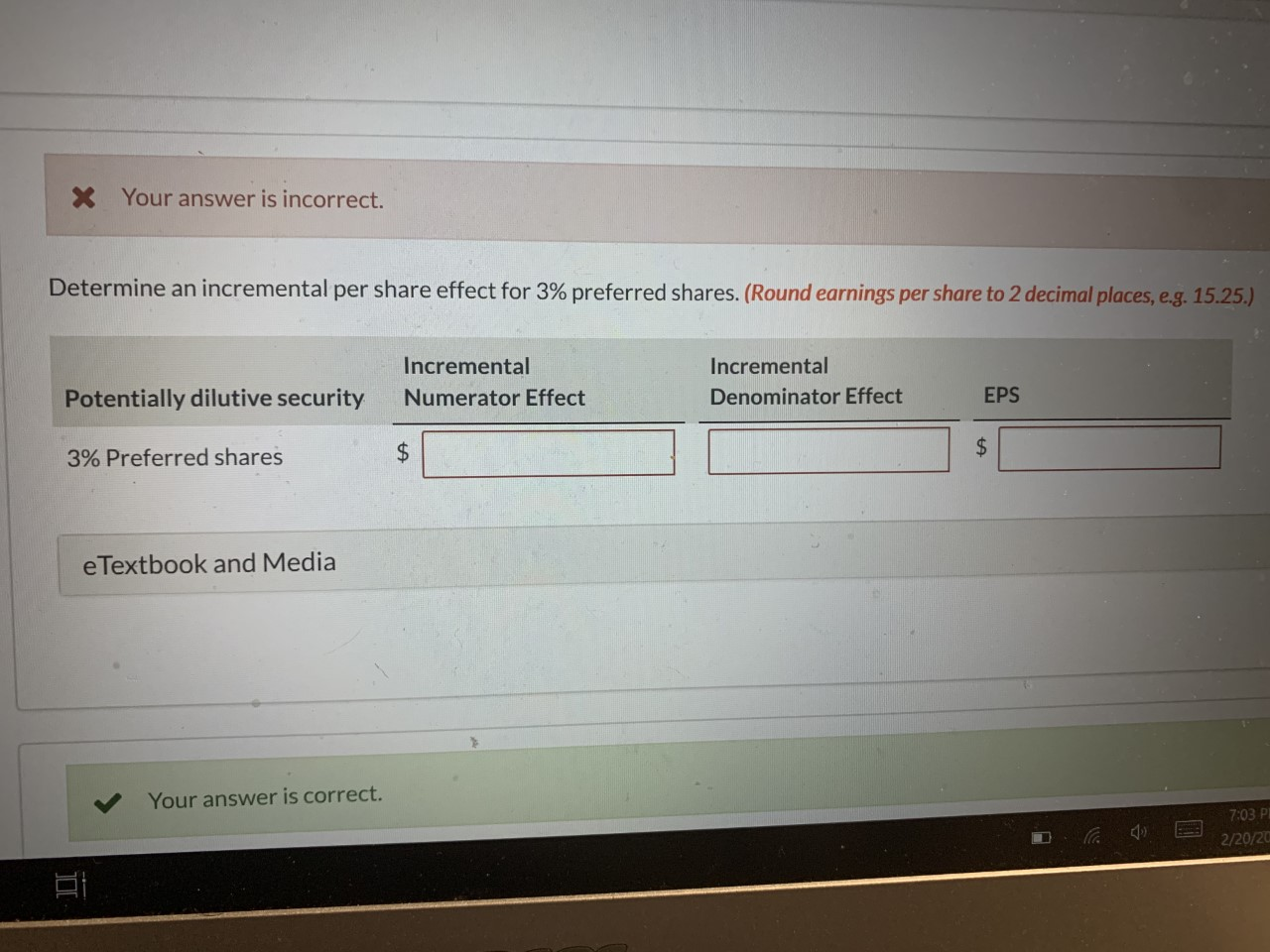

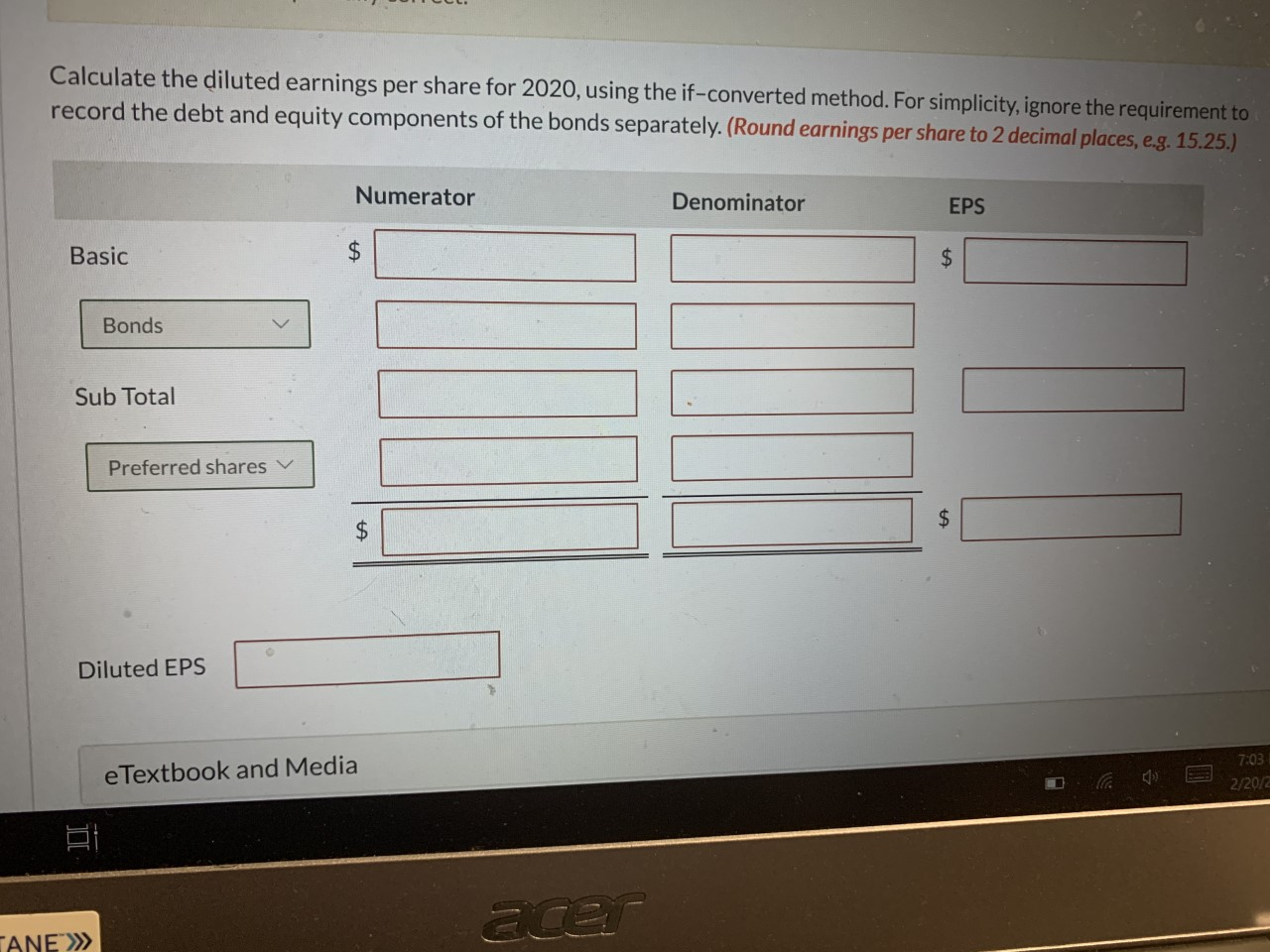

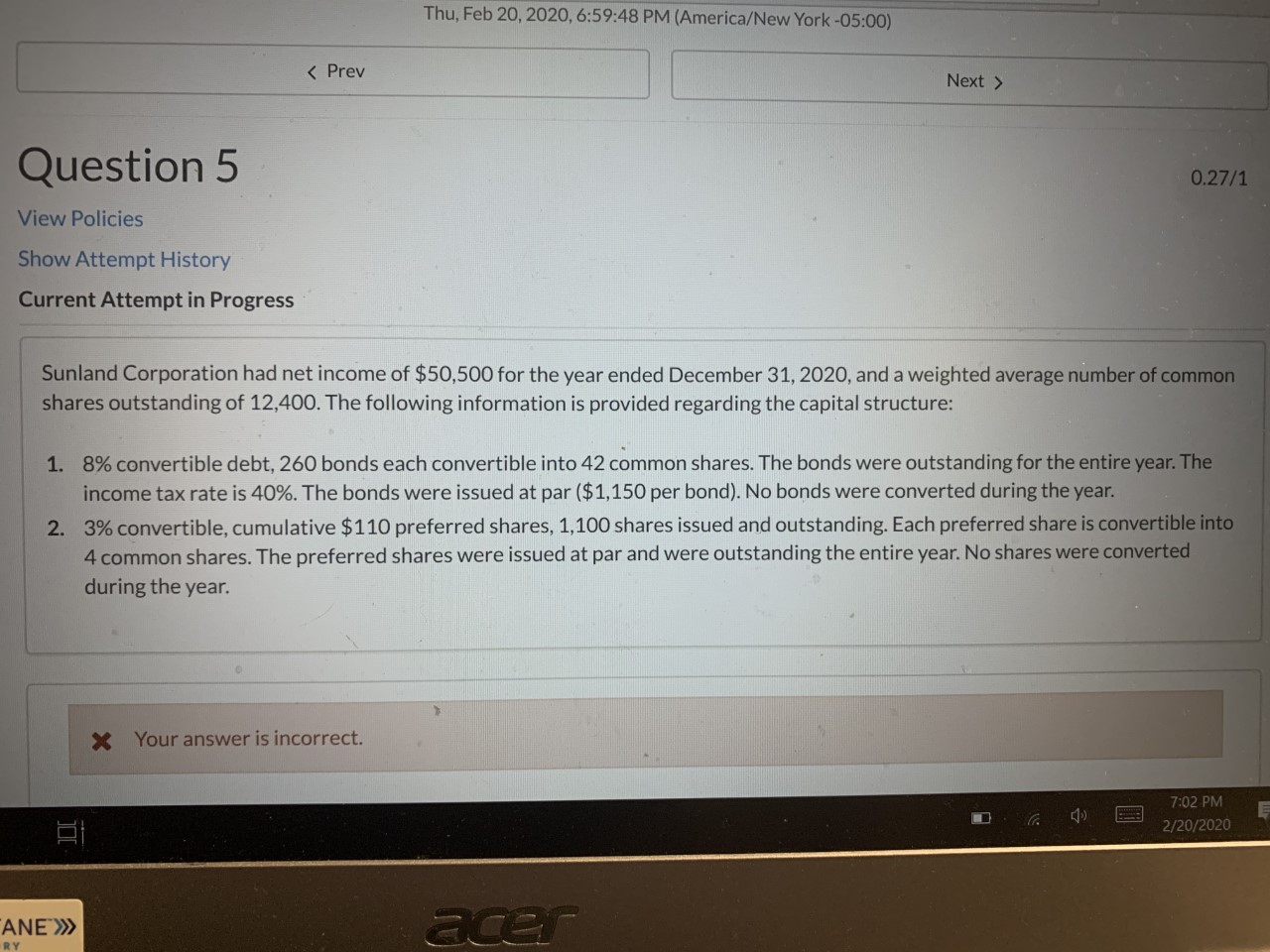

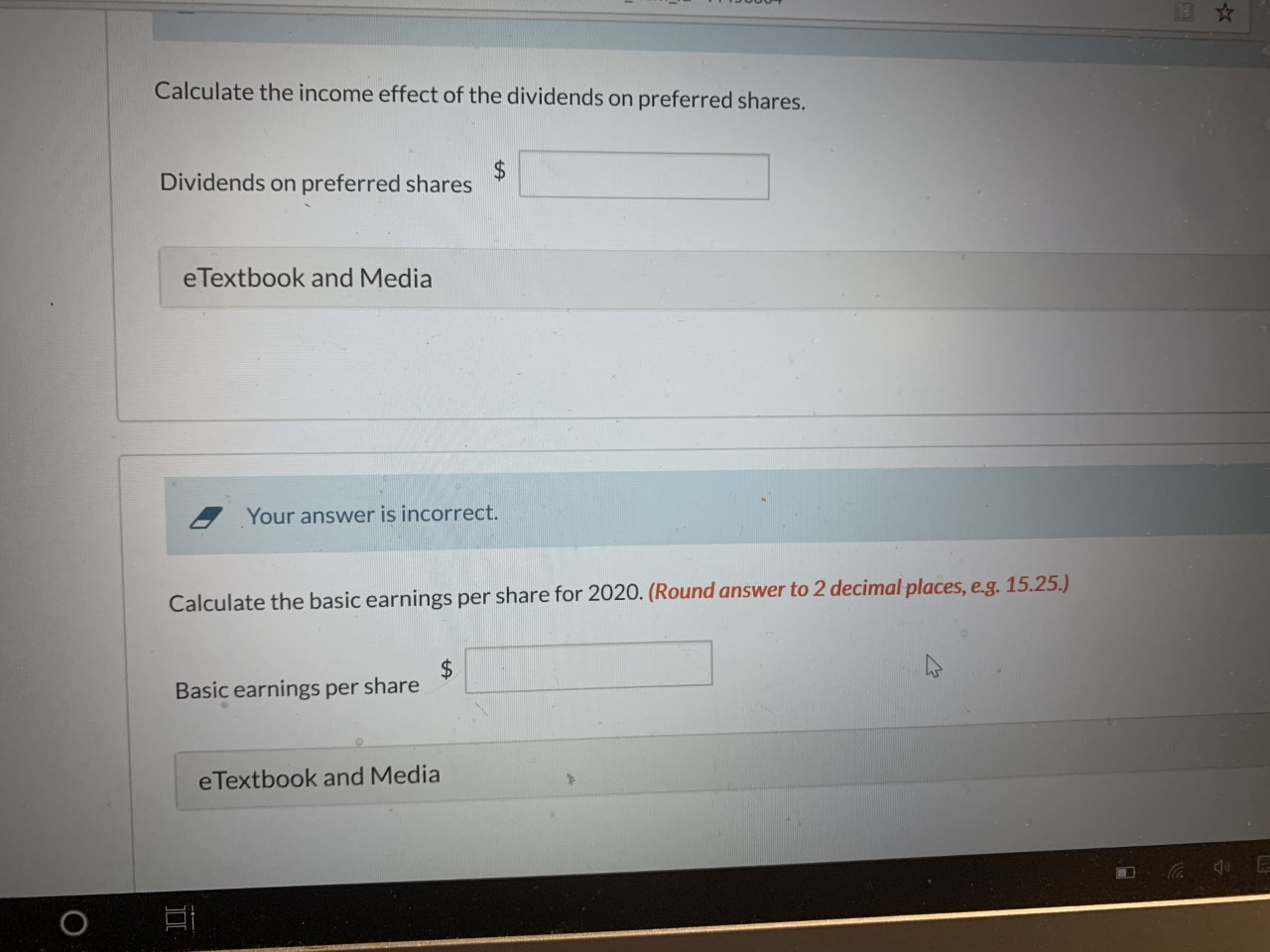

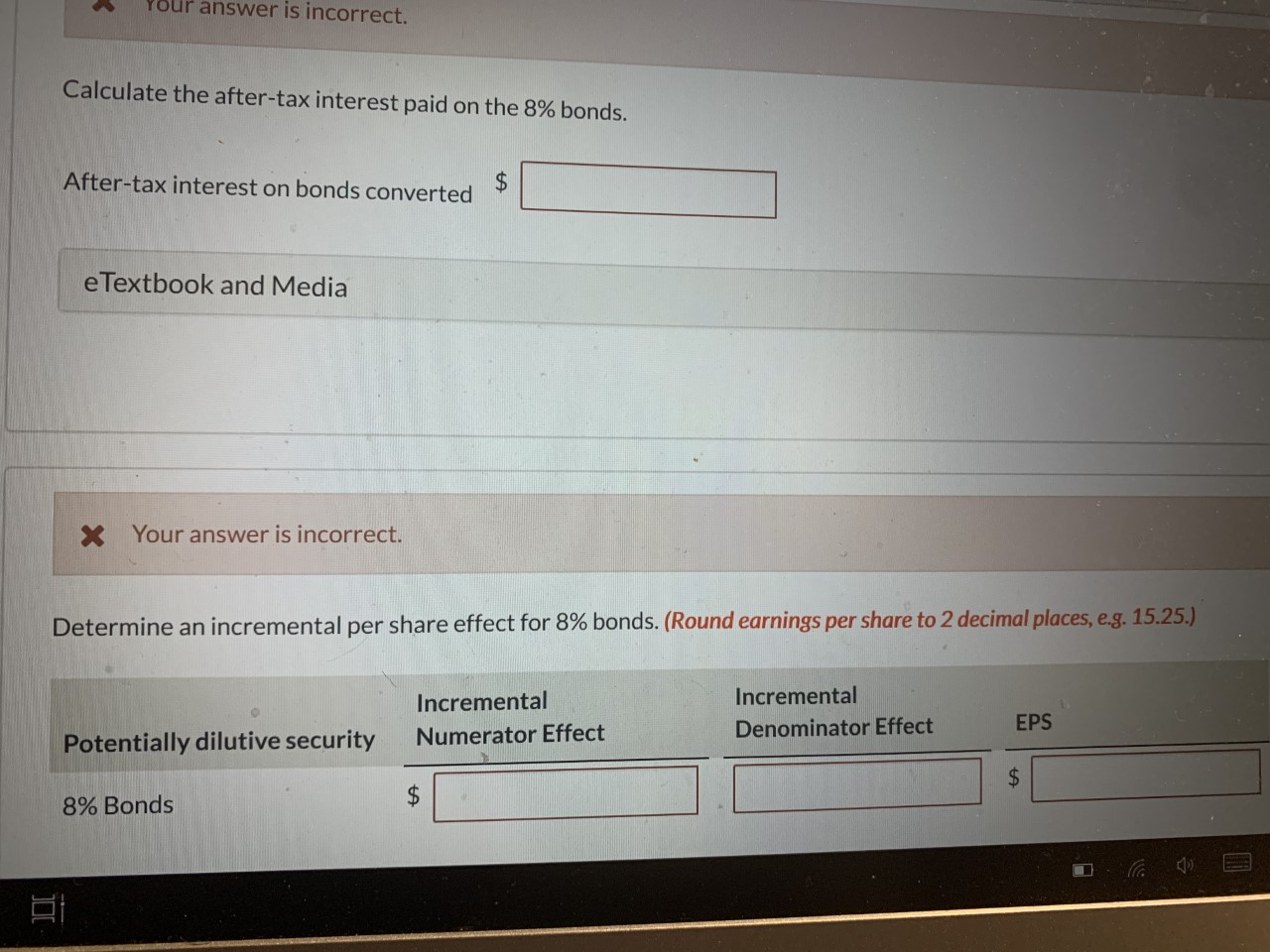

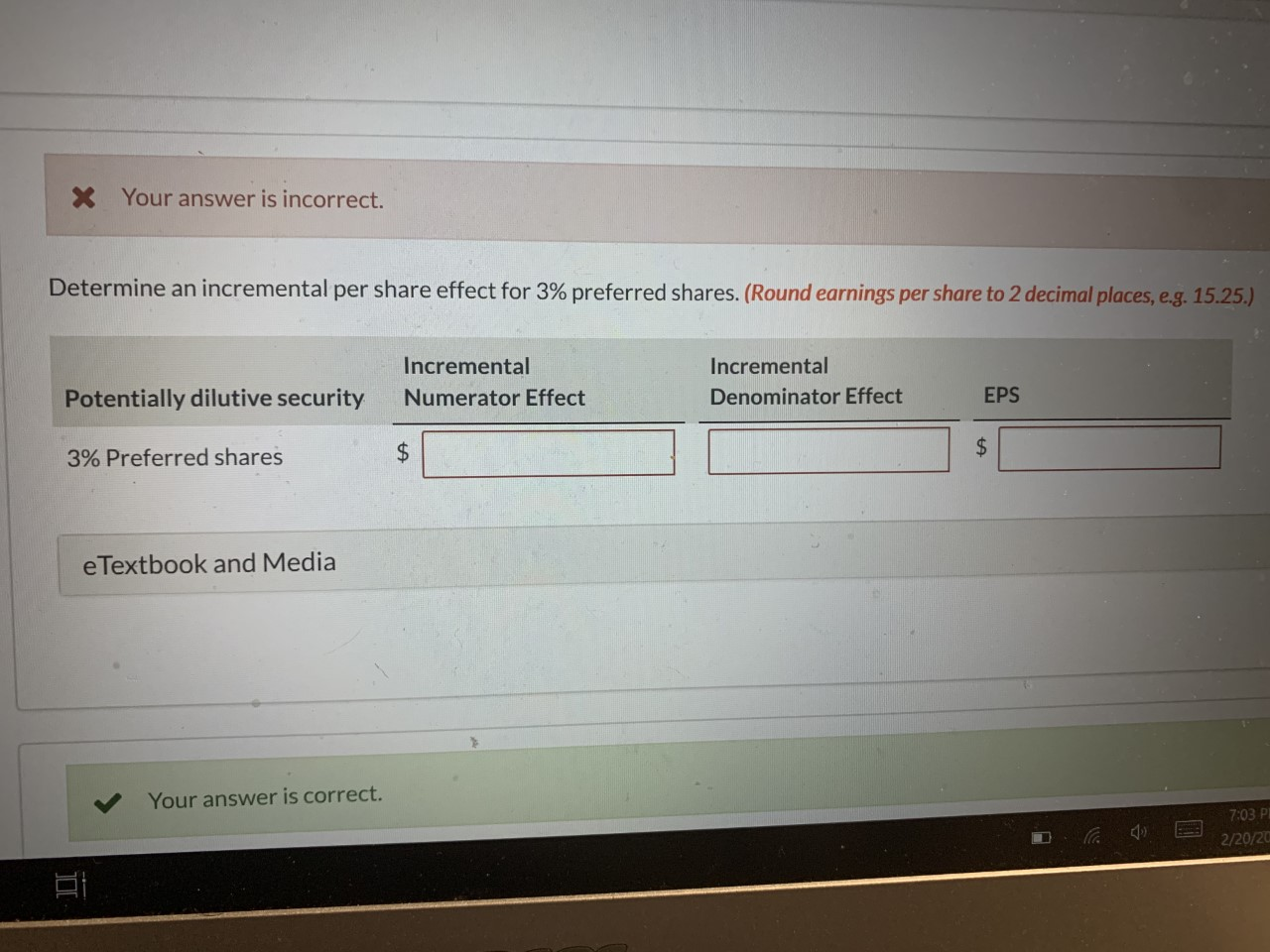

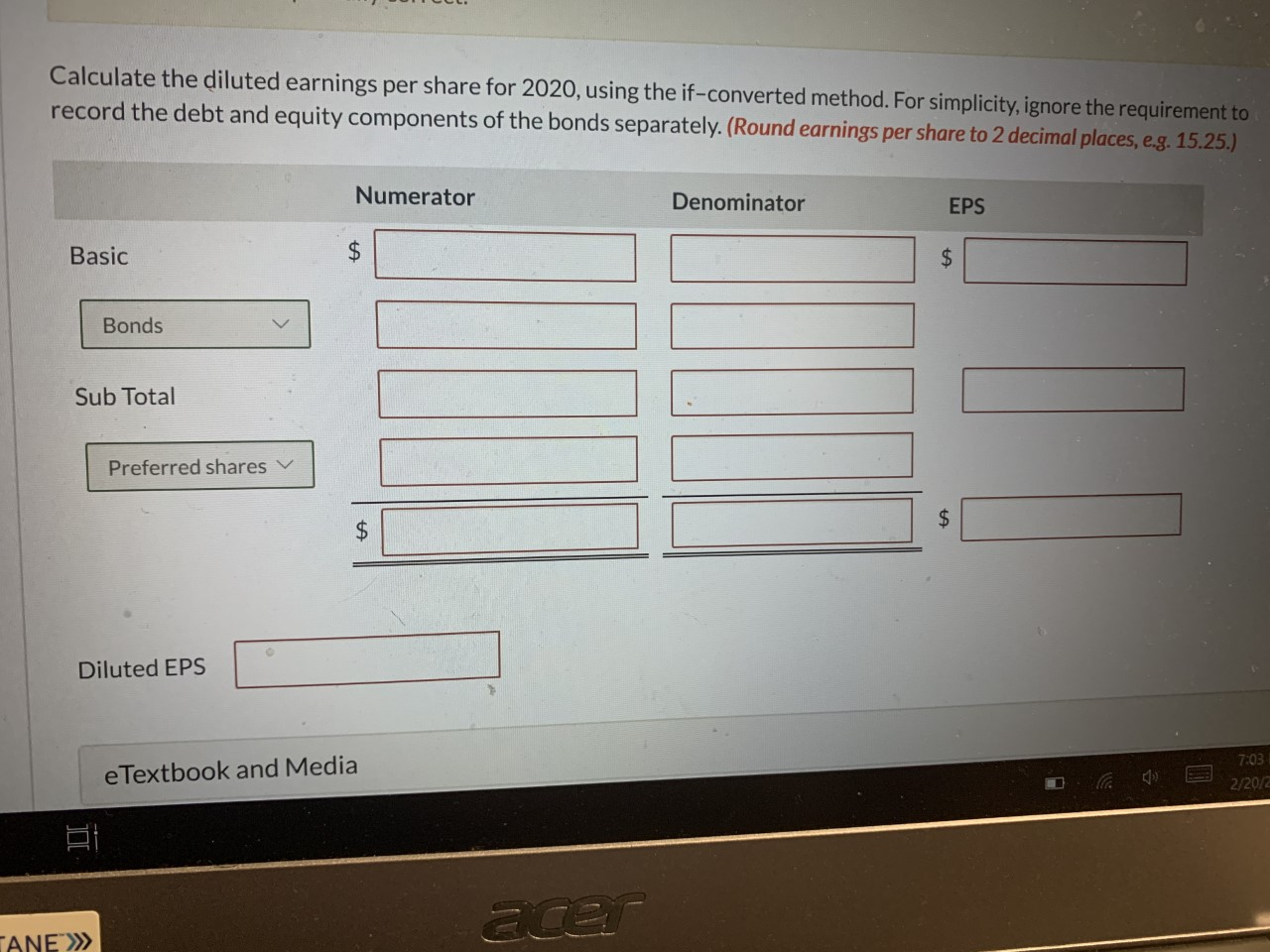

Thu, Feb 20, 2020, 6:59:48 PM (America/New York -05:00) Question 5 View Policies 0.27/1 Show Attempt History Current Attempt in Progress Sunland Corporation had net income of $50,500 for the year ended December 31, 2020, and a weighted average number of common shares outstanding of 12,400. The following information is provided regarding the capital structure: 1. 8% convertible debt, 260 bonds each convertible into 42 common shares. The bonds were outstanding for the entire year. The income tax rate is 40%. The bonds were issued at par ($1,150 per bond). No bonds were converted during the year. 2. 3% convertible, cumulative $110 preferred shares, 1,100 shares issued and outstanding. Each preferred share is convertible into 4 common shares. The preferred shares were issued at par and were outstanding the entire year. No shares were converted during the year. X Your answer is incorrect. D 7:02 PM E 2/20/2020 ANE >>> Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares eTextbook and Media Your answer is incorrect. Calculate the basic earnings per share for 2020. (Round answer to 2 decimal places, e.g. 15.25.) Basic earnings per share e Textbook and Media Your answer is incorrect. Calculate the after-tax interest paid on the 8% bonds. After-tax interest on bonds converted e Textbook and Media X Your answer is incorrect. Determine an incremental per share effect for 8% bonds. (Round earnings per share to 2 decimal places, e.g. 15.25.) Incremental Numerator Effect Incremental Denominator Effect EPS Potentially dilutive security 8% Bonds X Your answer is incorrect. Determine an incremental per share effect for 3% preferred shares. (Round earnings per share to 2 decimal places, e.g. 15.25.) Incremental Numerator Effect Incremental Denominator Effect Potentially dilutive security EPS 3% Preferred shares e Textbook and Media Your answer is correct. 7:03 D. a Ty 3 2/2012 Calculate the diluted earnings per share for 2020, using the if-converted method. For simplicity, ignore the requirement to record the debt and equity components of the bonds separately. (Round earnings per share to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS Basic Bonds Sub Total Preferred shares Diluted EPS e Textbook and Media 7:031 Das E 2/20/2 sce TANE >>> Thu, Feb 20, 2020, 6:59:48 PM (America/New York -05:00) Question 5 View Policies 0.27/1 Show Attempt History Current Attempt in Progress Sunland Corporation had net income of $50,500 for the year ended December 31, 2020, and a weighted average number of common shares outstanding of 12,400. The following information is provided regarding the capital structure: 1. 8% convertible debt, 260 bonds each convertible into 42 common shares. The bonds were outstanding for the entire year. The income tax rate is 40%. The bonds were issued at par ($1,150 per bond). No bonds were converted during the year. 2. 3% convertible, cumulative $110 preferred shares, 1,100 shares issued and outstanding. Each preferred share is convertible into 4 common shares. The preferred shares were issued at par and were outstanding the entire year. No shares were converted during the year. X Your answer is incorrect. D 7:02 PM E 2/20/2020 ANE >>> Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares eTextbook and Media Your answer is incorrect. Calculate the basic earnings per share for 2020. (Round answer to 2 decimal places, e.g. 15.25.) Basic earnings per share e Textbook and Media Your answer is incorrect. Calculate the after-tax interest paid on the 8% bonds. After-tax interest on bonds converted e Textbook and Media X Your answer is incorrect. Determine an incremental per share effect for 8% bonds. (Round earnings per share to 2 decimal places, e.g. 15.25.) Incremental Numerator Effect Incremental Denominator Effect EPS Potentially dilutive security 8% Bonds X Your answer is incorrect. Determine an incremental per share effect for 3% preferred shares. (Round earnings per share to 2 decimal places, e.g. 15.25.) Incremental Numerator Effect Incremental Denominator Effect Potentially dilutive security EPS 3% Preferred shares e Textbook and Media Your answer is correct. 7:03 D. a Ty 3 2/2012 Calculate the diluted earnings per share for 2020, using the if-converted method. For simplicity, ignore the requirement to record the debt and equity components of the bonds separately. (Round earnings per share to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS Basic Bonds Sub Total Preferred shares Diluted EPS e Textbook and Media 7:031 Das E 2/20/2 sce TANE >>>