Question

Sunland, Inc. purchased 1,890 shares of Oneida Corporation common stock for $89,400. During the year, Oneida paid a cash dividend of $1.00 per share. At

Sunland, Inc. purchased 1,890 shares of Oneida Corporation common stock for $89,400. During the year, Oneida paid a cash dividend of $1.00 per share. At year-end, Oneida stock was selling for $45.90 per share. Prepare Sunland’s journal entries to record.

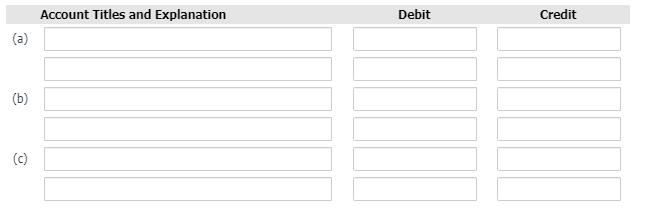

(a) the purchase of the investment,

(b) the dividends received, and

(c) the fair value adjustment.

(Assume a zero balance in the Fair Value Adjustment account.)

(a) (b) (c) Account Titles and Explanation Debit Credit

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App