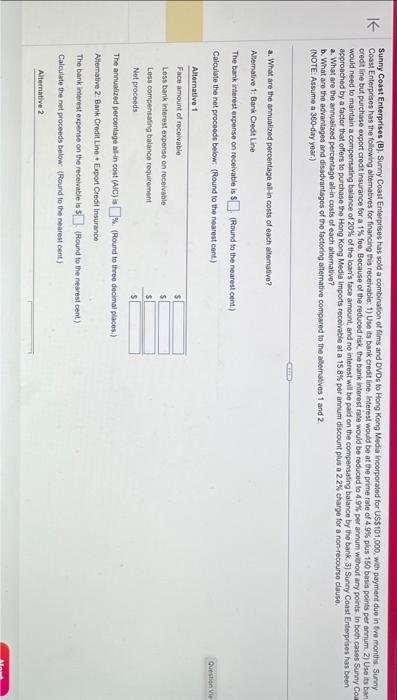

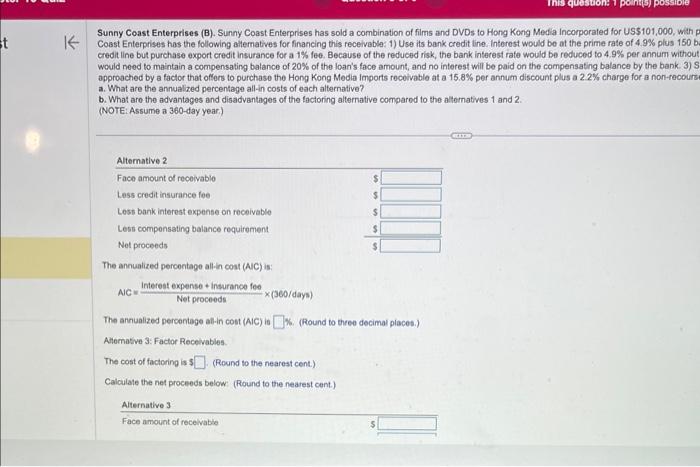

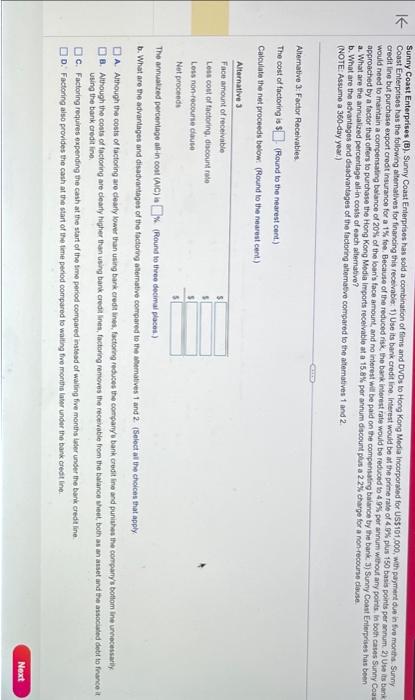

Sunny Coast Enterprises (B). Sunny Coast Enterprises has sold a combinaton of fims and DVDs to Hong Kong Media incorporated for USS101, ooo, with payment due in fve months. Surny Cosst Enterprises has the following alternatives for financing this receivable: 1) Use its bank cedit line. Interest would be at the prime fale of 4.98 plus 150 bisis poins per annum. 2) Use its ban credt line but purchase export credt insurance for a 1\% foe. Bocause of the reduced tisk, the bank interest rate would be reduced to 4.9$ per annum without any points. In boch cases 5 unny Con would need to maintain a compensathy balance of 20% of the loar's face amount, and no interest will be paid on the compensasing balance by the bank. 3 Sunny Coast Enterprises has been approached by a factor that offers to purchase the Hong Kong Media imports recoivable at a 15.8% per annum discount plus a 2.2% charge for a non-recourso clause. a. What are the annualized percentage all-in costs of each alternative? b. What aro the advantages and disadvantsges of the factoring alternative compared to the abernasives 1 and 2 . (NOTE: Assume a 3e0-day year) a. What are the annualized percentage allin costs of each aternative? ARemative 1: Bark Credt Line The bank interest expense on recelvable is $ (Round to the nearest cent) Calculate the net proceeds below: (Round to the nearest cent) The annuaized percontage at-in cost (AIC) is Wo. (Found to three decimal places.) Ahematve 2: Bank Credit Line + Expot Credit Insurance The bank interest expense on the recetvable is 1 (Rlound to the rearest cont) Caiculate the net proceeds below. (Riound to the nearest cant) Sunny Coast Enterprises (B). Sunny Coast Enterprises has sold a combination of films and DVDs to Hong Kong Medla incorporated for USS101,000, with Cosst Enterprises has the lollowing atematives for financing this receivable: 1) Use its bank credit line. Interest would be at the prime rate of 4.9% plus 150L credit line but purchase export credit insurance for a 1\% fee. Because of the reduced risk, the bank interest rate would be reduced to 4.9% per annum withou would need to maintain a compensating balance of 20% of the loar's face amount, and no interest will be paid on the compensating balance by the bank. 3): approached by a factor that offers to purchase the Hong Kong Media imports recoivable at a 15.8% per annum discount plus a 2.2% charge for a non-recours a. What are the annualized percentage all-in costs of each alternative? b. What are the advantages and disadvantages of the factoring alternative compared to the alternatives 1 and 2. (NOTE: Assume a 360-day year.) The annualized percontage allin cost (A)C) is: AIC=Netproceedsinterestexpense+insurancefee(360/days) The annualized percontege al-in cost (AiC) is %. (Round to three decimal places.) Altomative 3: Factor Receivables. The cost of factoring is? (Round to the nearest cent.) Calculate the net proceeds below: (Round to the nearest cent.) Sunny Coast Enterprises (B). Sunny Coast Enlerprises has sold a combination of films and DVDs to Hong Kong Modia incorporated for Us5101,000, with payment due in five moreths. Sunny Coast Enterprisos has the following altematives for financing this receivible; 1) Use its bank credit lne. Interest would be at the prime rate of 4.6% plus 150 basis peints per achum. 2) Use its benk credit line but purchase export credt insurance for a 1% foes, Because of the reduced risk, the bank interest rate would be reduced to 4.9% por annum without any points. In both cases Sunny Coas would need to maintain a compensating balance of 20 hh of the loar's face amount, and no interest will be paid on the compensating balance by the bank: 3 Sunny Coast Enterprises has been approached by a factor that offers to purchase the Hong Kong Modia imports recelvable at a 15.8% por annum discount plus a 22% charge for a non-recounse clause. a. What are the annualized percentage allin costs of each alternative? b. What are the advantages and diadvantages of the tactoring attemasve compared to the aternatives 1 and? (NOTE: Assume a 360-day year.) Aternative 3: Factor Receivables The cost of factoring is ? (Round to the nearest cent.) Calculate the net proceeds below. (Round to the nearest cent.) The annualzed percentage altin cost (NC) in is (Round to three decimal places.) b. What are the advantages and disadvantages of the tacionng alernstive coenpared to the abernatives 1 and 2 . (Select at the choices that apply A. Athough the costs of factoring are clearly lower than using bark creda ines, factoring reduces the conpary's bank cedit ine and puniahes the compary's bothom ine uncecessave. 8. Although tho costs of factoring are clearty higher than using bank credil Ines, factoring mencoves the receivable from the balance aheet, both as an anset and the associaled debt to finance it using the bank aredit line. C. Factoring requires oxpending the cash at the start of the Sme period compared instead of walting five months laser unser the bark credt line. D. Factoring also provides the cash at the start of the time peciod compared to waiting fire months lawer under the bark crest ine