Answered step by step

Verified Expert Solution

Question

1 Approved Answer

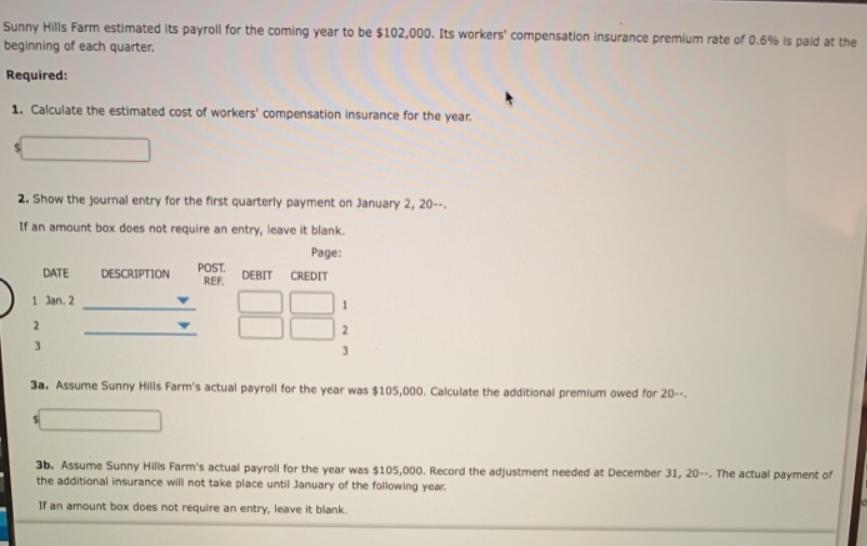

Sunny Hills Farm estimated its payroll for the coming year to be $102,000. Its workers' compensation insurance premium rate of 0.6% is paid at

Sunny Hills Farm estimated its payroll for the coming year to be $102,000. Its workers' compensation insurance premium rate of 0.6% is paid at the beginning of each quarter. Required: 1. Calculate the estimated cost of workers' compensation insurance for the year. 2. Show the journal entry for the first quarterly payment on January 2, 20--. If an amount box does not require an entry, leave it blank. Page: DESCRIPTION POST. REF. DEBIT CREDIT DATE 1 Jan. 2 3 3a. Assume Sunny Hills Farm's actual payroll for the year was $105,000. Calculate the additional premium owed for 20-- 3b. Assume Sunny Hills Farm's actual payroll for the year was $105,000. Record the adjustment needed at December 31, 20-, The actual payment of the additional insurance will not take place until January of the following year. If an amount box does not require an entry, leave it blank. DATE 1 Dec. 31 2 3 DESCRIPTION POST. REF DEBIT CREDIT 1 2 3

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 612 year 3 a Additional 18 1 payroll 102000year Insurance premium 061 Insuran...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started