| Sunny Vale's Debt ratio | | |

| | 2011 | |

| Total Debt (Liabilities) | 1,00,747 | |

| Total Assets | 1,54,815 | |

| Debt Ratio | 65.1% | |

| | | |

This provides creditors & investors with a general idea as to the amount of leverage being used by a company. The lower the percentage, the less leverage a company is using and the stronger its equity position. In general, Best Care HMO,the higher the ratio, the more risk that company is considered to have taken on.

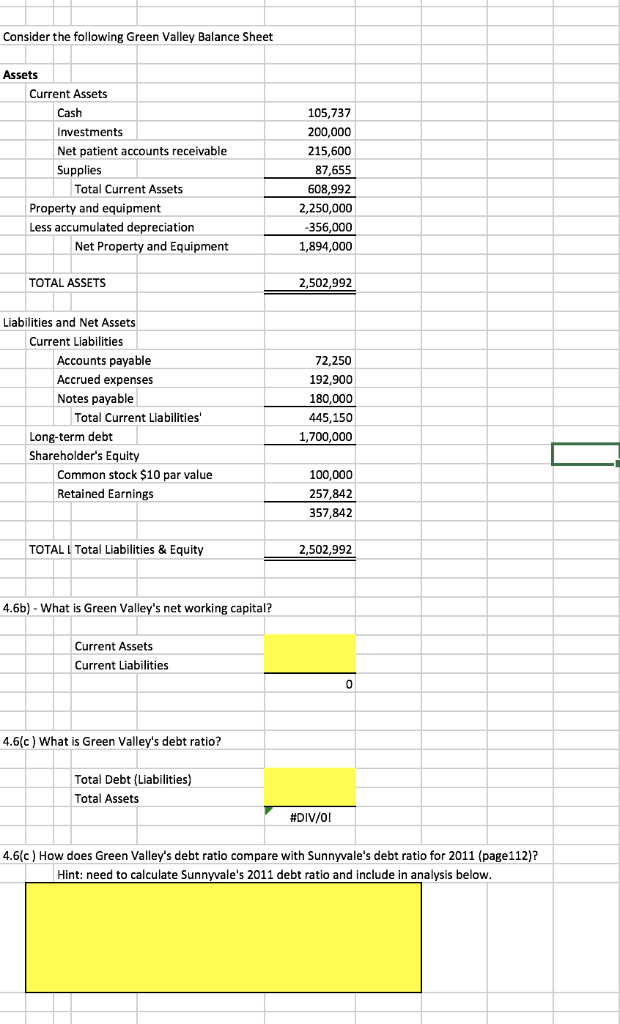

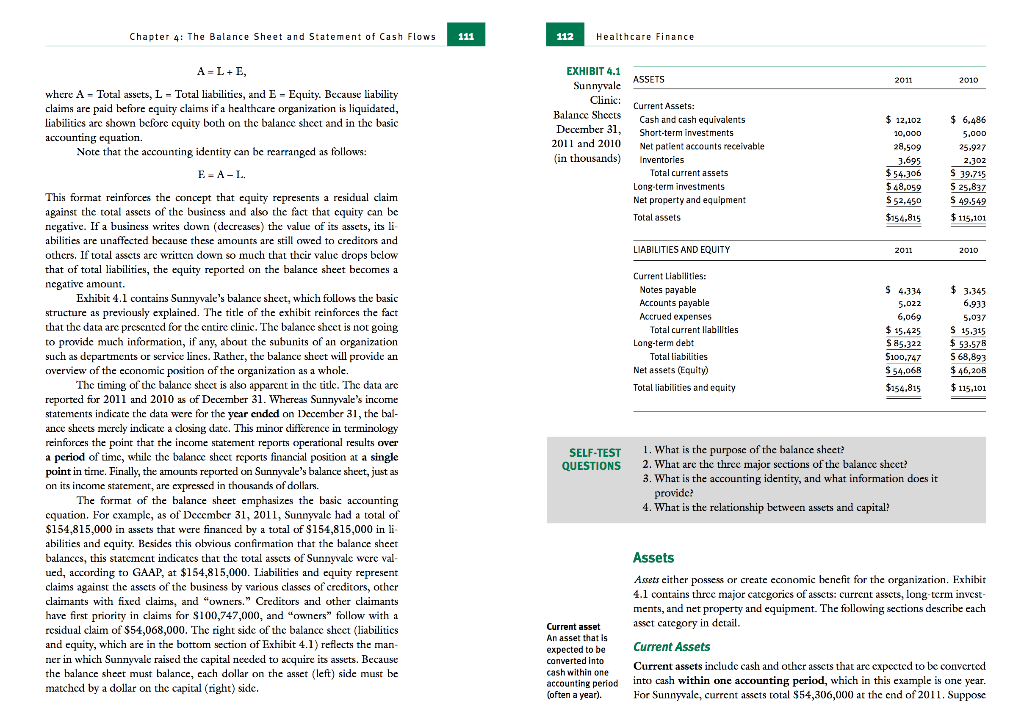

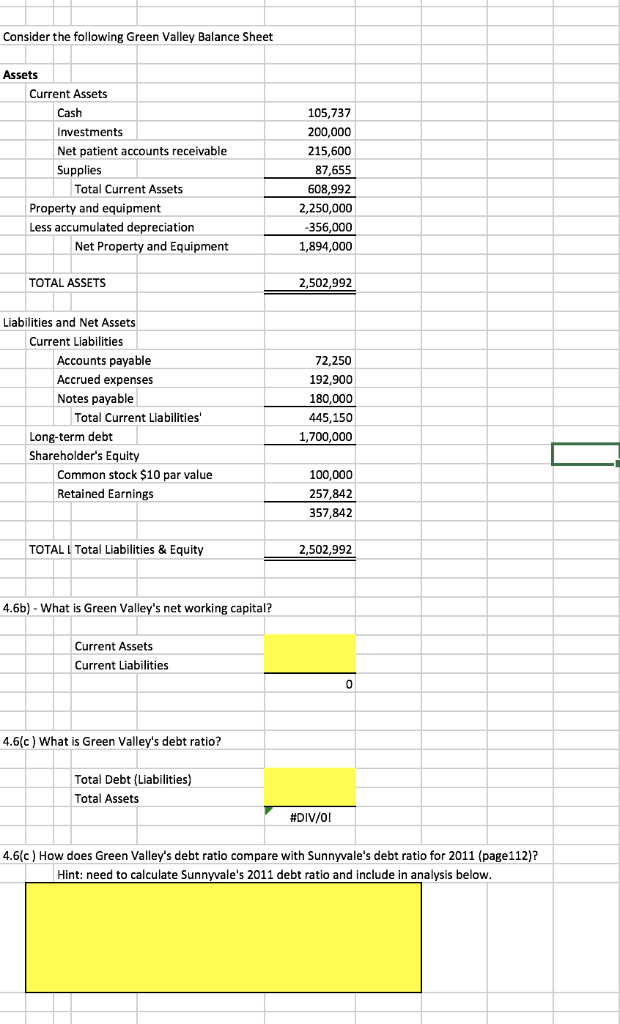

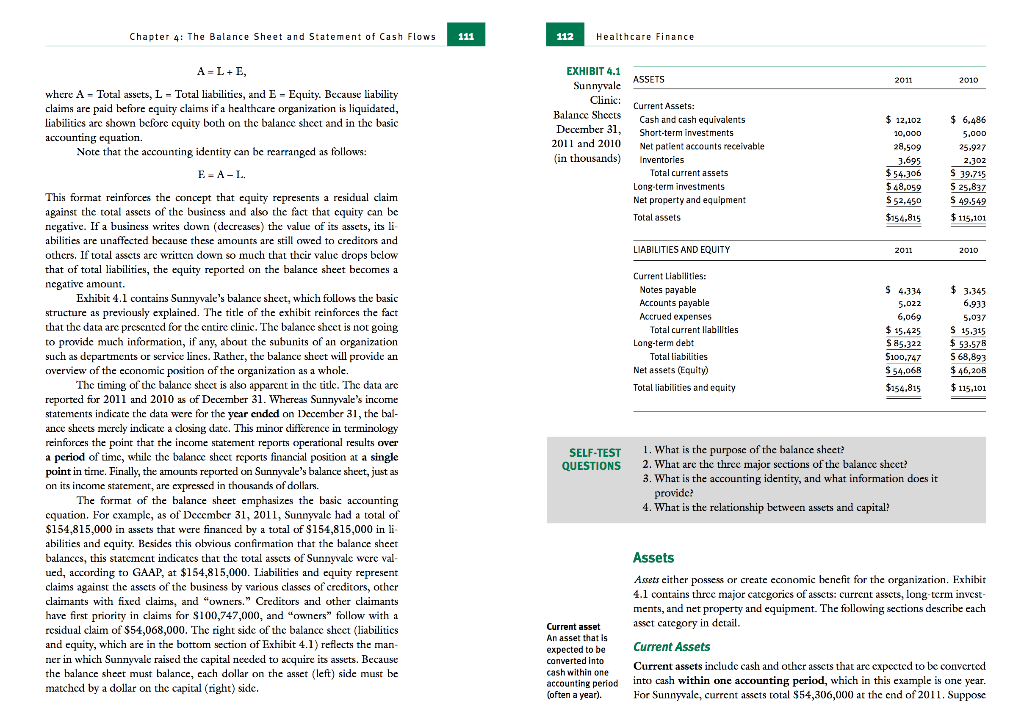

Consider the following Green Valley Balance Sheet Assets Current Assets 105,737 200,000 215,600 87,655 608,992 2,250,000 356,000 1,894,000 Cash Investments Net patient accounts receivable Supplies Total Current Assets Property and equipment Less accumulated depreciation Net Property and Equipment TOTAL ASSETS 2,502,992 Liabilities and Net Assets Current Liabilities Accounts payable Accrued expenses Notes payable 72,250 192,900 180,000 445,150 1,700,000 Total Current Liabilities Long-term debt Shareholder's Equity Common stock $10 par value Retained Earnings 100,000 257,842 357,842 TOTAL L Total Liabilities & Equity 2,502,992 4.6b)- What is Green Valley's net working capital? Current Assets Current Liabilities 0 4.6(c) What is Green Valley's debt ratio? Total Debt (Liabilities) Total Assets #DIV/0! 4.6(c) How does Green Valley's debt ratio compare with Sunnyvale's debt ratio for 2011 (page112)? Hint: need to calculate Sunnyvale's 2011 debt ratio and include in analysis below Chapter 4: The Balance Shee and Statement of Cash Flows 112 Healthcare Finance EXHIBIT 4.1 2011 2010 Sunnyvale ASSETS where A Total assets, L Total liabilities, and E -Equity. Because liability claims are paid before equity claims if a healthcare organization is liquidated, liabilitics arc shown before cquity both on the balancc shcct and in the basic accounting equation Current Assets: Balancc Shccts December 31, 2011 and 2010 cash and cash equivalents Short-term investments Net patient accounts re 12,102 10,000 28,509 3,695 54.306 5.000 5,927 39.715 S 49.549 $115,101 Note that the accounting identity can he rearranged as follows: Total current assets Long-term investments Net property and equlpment Total assets This format reinforces the concept that equity represents a residual claim against the total assets of the business and also the fact that cquity can be negative. If a business writes down (decreases) the value of its assets, its li abilities are unaffected hecause these amounts are still owed to creditors and othcrs. I total asscts are writen down so much that thcir valuc drops below that of total liabilities, the equity reported on the balance sheet becomes a ncgatwe amount. $154,815 LIABILITIES AND EQUITY 2010 Crrent Liabilities: $3.345 6.933 5,037 S 15,315 $ 53.576 Notes payable Exhibit 4.1 contains Sunnyvalc's balance sheet, which follows the basic structure as previously explained. The title of the exhibit reinforces the fact that the data are prescnted for the cntire clinic. The balance shcct is not going to provide much information, if any, about the subunits of an organization such as departments or service lines. Rather, the balance sheet will provide overview of the economic position of the organization as a whole. Accrued expenses 6,069 $15.425 S85.322 Total current llabilitles Tota Net assets (Equity) Total liabilities and equity 54,06$46,20FB $115,101 The timing of the balancc shect is also apparcnt in the tilc. The data arc $154,815 reported for 2011 and 2010 as of December 31. Whereas Sunnyvale's income statements indicate the data were for the year ended on December 31,the bal- ance shects merely indicate a closing date. This minor diffcrence in terminology reinforces the point that the income statement reports operational results over a period of timc, while the balancc shect rcports financial position at a single point in time. Finally, the amounts repurted on Sunnyvale's balance sheet, just as on its income statement, are expressed in thousands of dollars. 1. What is th 2. What are the three major sections of the balance sheet? 3. What is the accounting identity, and what information does it e purpose of the balance sheet? SELF-TEST QUESTIONS The format of the balance sheet emphasizes the basic accounting 4. What is the relationship between assets and capital? cquation. For cxamplc, as of Dcccmber 31, 2011, Sunnyvale had a total of $154,815,000 in assets that were financed by a total of $154,815,000 in li abilities and equity Resides this obvious confirmation that the halance sheet balances, this statemcnt indicatcs that thc total asscts of Sunnyvale were val ued, according to GAAP, at $154,815,000. Liabilities and equity represent claims against the asscts of the business by various classes of creditors, other claimants with fixed claims, and "owners." Creditors and other claimants have first priority in claims for S100,747,000, and "owners" follow with a residual claim of $54,068,000. The right side of thc balance shect (liabilitics and equity, which are in the bottom section of Exhibit 4.1) reflects the man ner in which Sunnyvale raised the capital needed to acquire its assets. Because the balance sheet must balance, each dollar on the asset (left) side must be matched by a dollar on the capital (right) sidc. Assets Assets either possess or create economic henefit for the organization. Exhibit 4.1 contains three major catcgorics of asscts: current asscts, long-tcrm invest ments, and net property and equipment. The following sections describe each asset category in Current asset An asset that is expected to be Current Assets converted into cash within one accounting period into cash within one a (often a year).For Sunnyvale, current assets total S54,306,000 at the end of 2011. Suppose Current assets includc cash and othcr asscts that are cxpccted to be convcrted ccountin e is one year