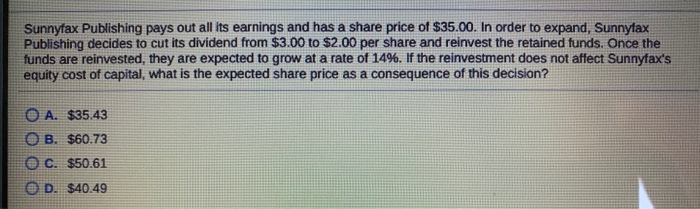

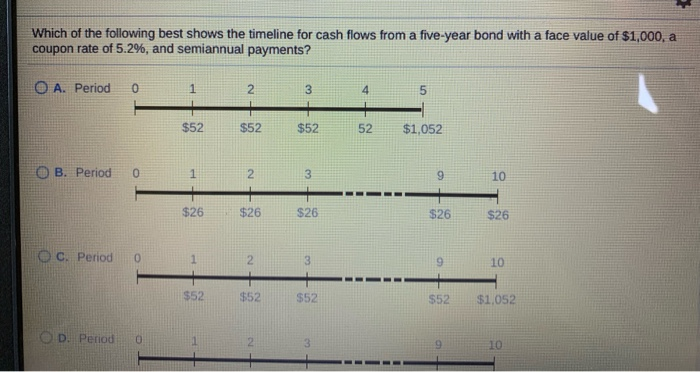

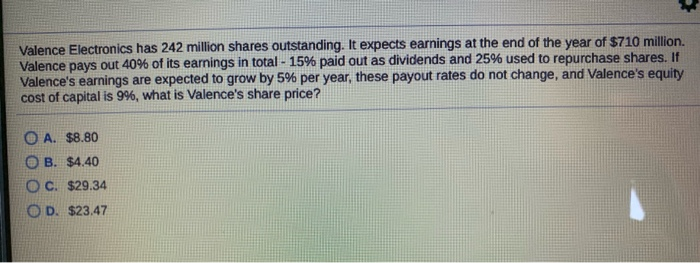

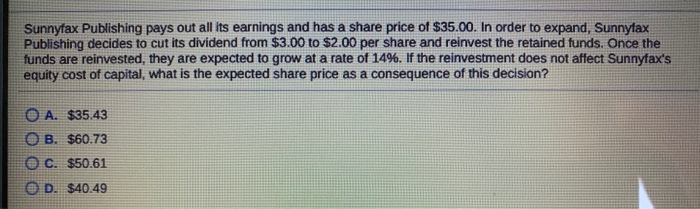

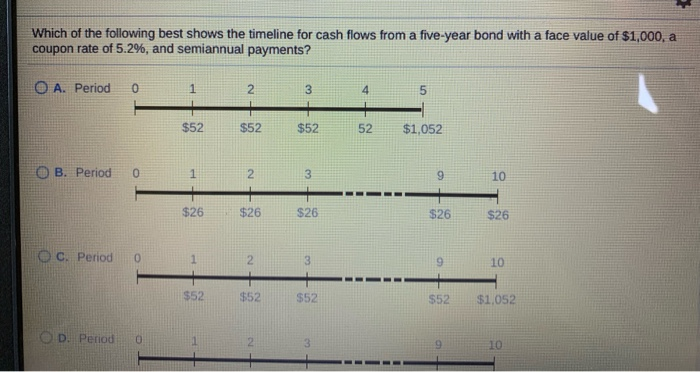

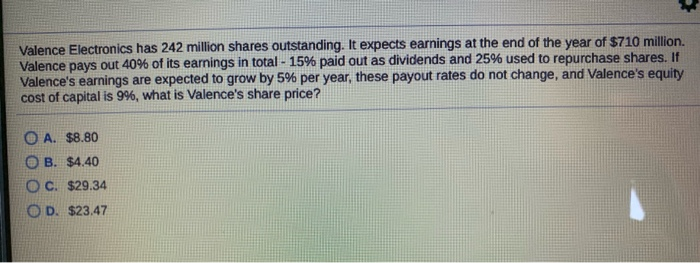

Sunnyfax Publishing pays out all its earnings and has a share price of $35.00. In order to expand, Sunnyfax Publishing decides to cut its dividend from $3.00 to $2.00 per share and reinvest the retained funds. Once the funds are reinvested, they are expected to grow at a rate of 14%. If the reinvestment does not affect Sunnyfax's equity cost of capital, what is the expected share price as a consequence of this decision? O A. $35.43 O B. $60.73 O C. $50.61 O D. $40.49 Which of the following best shows the timeline for cash flows from a five-year bond with a face value of $1,000, a coupon rate of 5.2%, and semiannual payments? O A. Period 0 2 3 5 $52 $52 $52 52 $1,052 B. Period 0 1 2 3 9 10 $26 $26 $26 $26 $26 OC. Period 0 3 10 $52 $52 $52 $52 $1,052 D. Period 10 Valence Electronics has 242 million shares outstanding. It expects earnings at the end of the year of $710 million. Valence pays out 40% of its earnings in total - 15% paid out as dividends and 25% used to repurchase shares. If Valence's earnings are expected to grow by 5% per year, these payout rates do not change, and Valence's equity cost of capital is 9%, what is Valence's share price? O A. $8.80 B. $4.40 OC. $29.34 OD. $23.47 Sunnyfax Publishing pays out all its earnings and has a share price of $35.00. In order to expand, Sunnyfax Publishing decides to cut its dividend from $3.00 to $2.00 per share and reinvest the retained funds. Once the funds are reinvested, they are expected to grow at a rate of 14%. If the reinvestment does not affect Sunnyfax's equity cost of capital, what is the expected share price as a consequence of this decision? O A. $35.43 O B. $60.73 O C. $50.61 O D. $40.49 Which of the following best shows the timeline for cash flows from a five-year bond with a face value of $1,000, a coupon rate of 5.2%, and semiannual payments? O A. Period 0 2 3 5 $52 $52 $52 52 $1,052 B. Period 0 1 2 3 9 10 $26 $26 $26 $26 $26 OC. Period 0 3 10 $52 $52 $52 $52 $1,052 D. Period 10 Valence Electronics has 242 million shares outstanding. It expects earnings at the end of the year of $710 million. Valence pays out 40% of its earnings in total - 15% paid out as dividends and 25% used to repurchase shares. If Valence's earnings are expected to grow by 5% per year, these payout rates do not change, and Valence's equity cost of capital is 9%, what is Valence's share price? O A. $8.80 B. $4.40 OC. $29.34 OD. $23.47