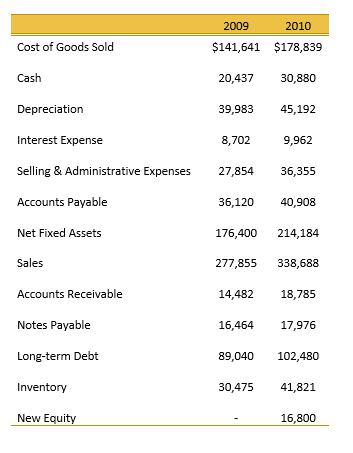

Sunset Boards current pays out 50 percent of net income as dividends to Tad and the other original investors. and has a 20 percent tax rate. You are Paula's assistant, and she has asked you to prepare the following: A. An income statement for 2009 & 2010 B. A Balance Sheet for 2009 & 2010 C. Operating cash flow for each year D. Cash Flow from Assets for 2010 E. Cash flow from creditors for 2010 F. Cash flow to stockholders for 2010 Question 1: How would you describe Sunset Boards' cash flow for 2010? Write a brief discussion. Question 2: In light of your discussion in the previous question, what do you think about Tad's expansion plans? 2009 2010 $141,641 $178,839 Cost of Goods Sold Cash 20,437 30,880 Depreciation 39,983 45,192 Interest Expense 8,702 9,962 Selling & Administrative Expenses 27,854 36,355 Accounts Payable 36,120 40,908 Net Fixed Assets 176,400 214,184 Sales 277,855 338,688 Accounts Receivable 14,482 18,785 Notes Payable 16,464 17,976 Long-term Debt 89,040 102,480 Inventory 30,475 41,821 New Equity 16,800 Sunset Boards current pays out 50 percent of net income as dividends to Tad and the other original investors. and has a 20 percent tax rate. You are Paula's assistant, and she has asked you to prepare the following: A. An income statement for 2009 & 2010 B. A Balance Sheet for 2009 & 2010 C. Operating cash flow for each year D. Cash Flow from Assets for 2010 E. Cash flow from creditors for 2010 F. Cash flow to stockholders for 2010 Question 1: How would you describe Sunset Boards' cash flow for 2010? Write a brief discussion. Question 2: In light of your discussion in the previous question, what do you think about Tad's expansion plans? 2009 2010 $141,641 $178,839 Cost of Goods Sold Cash 20,437 30,880 Depreciation 39,983 45,192 Interest Expense 8,702 9,962 Selling & Administrative Expenses 27,854 36,355 Accounts Payable 36,120 40,908 Net Fixed Assets 176,400 214,184 Sales 277,855 338,688 Accounts Receivable 14,482 18,785 Notes Payable 16,464 17,976 Long-term Debt 89,040 102,480 Inventory 30,475 41,821 New Equity 16,800