Answered step by step

Verified Expert Solution

Question

1 Approved Answer

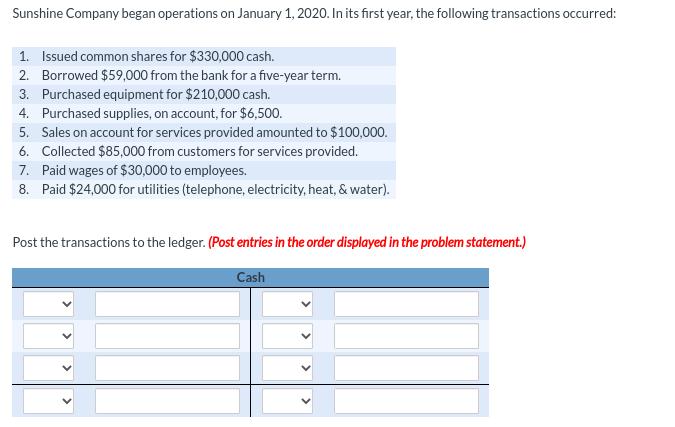

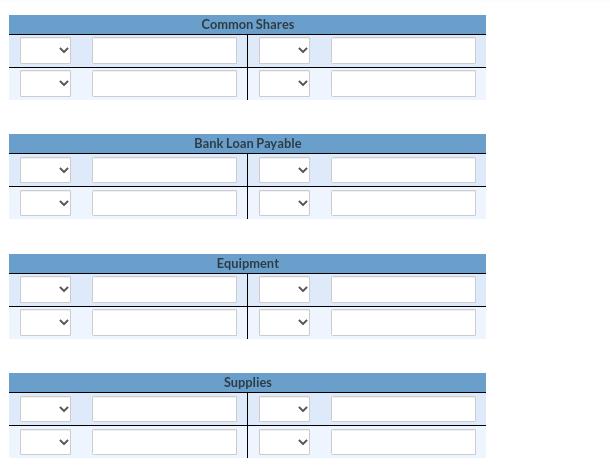

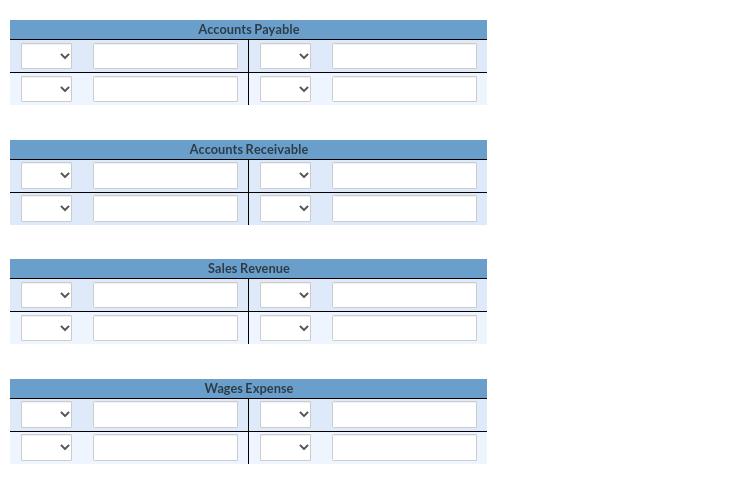

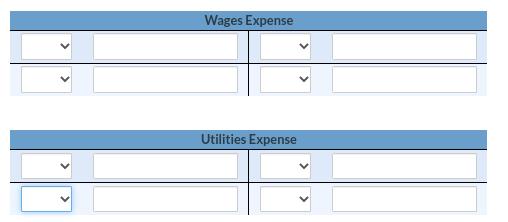

Sunshine Company began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $330,000 cash. 2.

Sunshine Company began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $330,000 cash. 2. Borrowed $59,000 from the bank for a five-year term. 3. Purchased equipment for $210,000 cash. 4. Purchased supplies, on account, for $6,500. 5. Sales on account for services provided amounted to $100,000. 6. Collected $85,000 from customers for services provided. 7. Paid wages of $30,000 to employees. 8. Paid $24,000 for utilities (telephone, electricity, heat, & water). Post the transactions to the ledger. (Post entries in the order displayed in the problem statement.) Cash > Common Shares Bank Loan Payable Equipment Supplies Accounts Payable Accounts Receivable Sales Revenue Wages Expense Wages Expense Utilities Expense Sunshine Company began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $330,000 cash. 2. Borrowed $59,000 from the bank for a five-year term. 3. Purchased equipment for $210,000 cash. 4. Purchased supplies, on account, for $6,500. 5. Sales on account for services provided amounted to $100,000. 6. Collected $85,000 from customers for services provided. 7. Paid wages of $30,000 to employees. 8. Paid $24,000 for utilities (telephone, electricity, heat, & water). Post the transactions to the ledger. (Post entries in the order displayed in the problem statement.) Cash > Common Shares Bank Loan Payable Equipment Supplies Accounts Payable Accounts Receivable Sales Revenue Wages Expense Wages Expense Utilities Expense Sunshine Company began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $330,000 cash. 2. Borrowed $59,000 from the bank for a five-year term. 3. Purchased equipment for $210,000 cash. 4. Purchased supplies, on account, for $6,500. 5. Sales on account for services provided amounted to $100,000. 6. Collected $85,000 from customers for services provided. 7. Paid wages of $30,000 to employees. 8. Paid $24,000 for utilities (telephone, electricity, heat, & water). Post the transactions to the ledger. (Post entries in the order displayed in the problem statement.) Cash > Common Shares Bank Loan Payable Equipment Supplies Accounts Payable Accounts Receivable Sales Revenue Wages Expense Wages Expense Utilities Expense Sunshine Company began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $330,000 cash. 2. Borrowed $59,000 from the bank for a five-year term. 3. Purchased equipment for $210,000 cash. 4. Purchased supplies, on account, for $6,500. 5. Sales on account for services provided amounted to $100,000. 6. Collected $85,000 from customers for services provided. 7. Paid wages of $30,000 to employees. 8. Paid $24,000 for utilities (telephone, electricity, heat, & water). Post the transactions to the ledger. (Post entries in the order displayed in the problem statement.) Cash > Common Shares Bank Loan Payable Equipment Supplies Accounts Payable Accounts Receivable Sales Revenue Wages Expense Wages Expense Utilities Expense

Step by Step Solution

★★★★★

3.27 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cash Amount Particulars Amount 1 330000 2 59000 6 85000 210000 Particulars ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started