Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunshine Hardware Ltd is a VAT registered business filing its VAT returns monthly. You are provided with the following information: 1. The purchases for

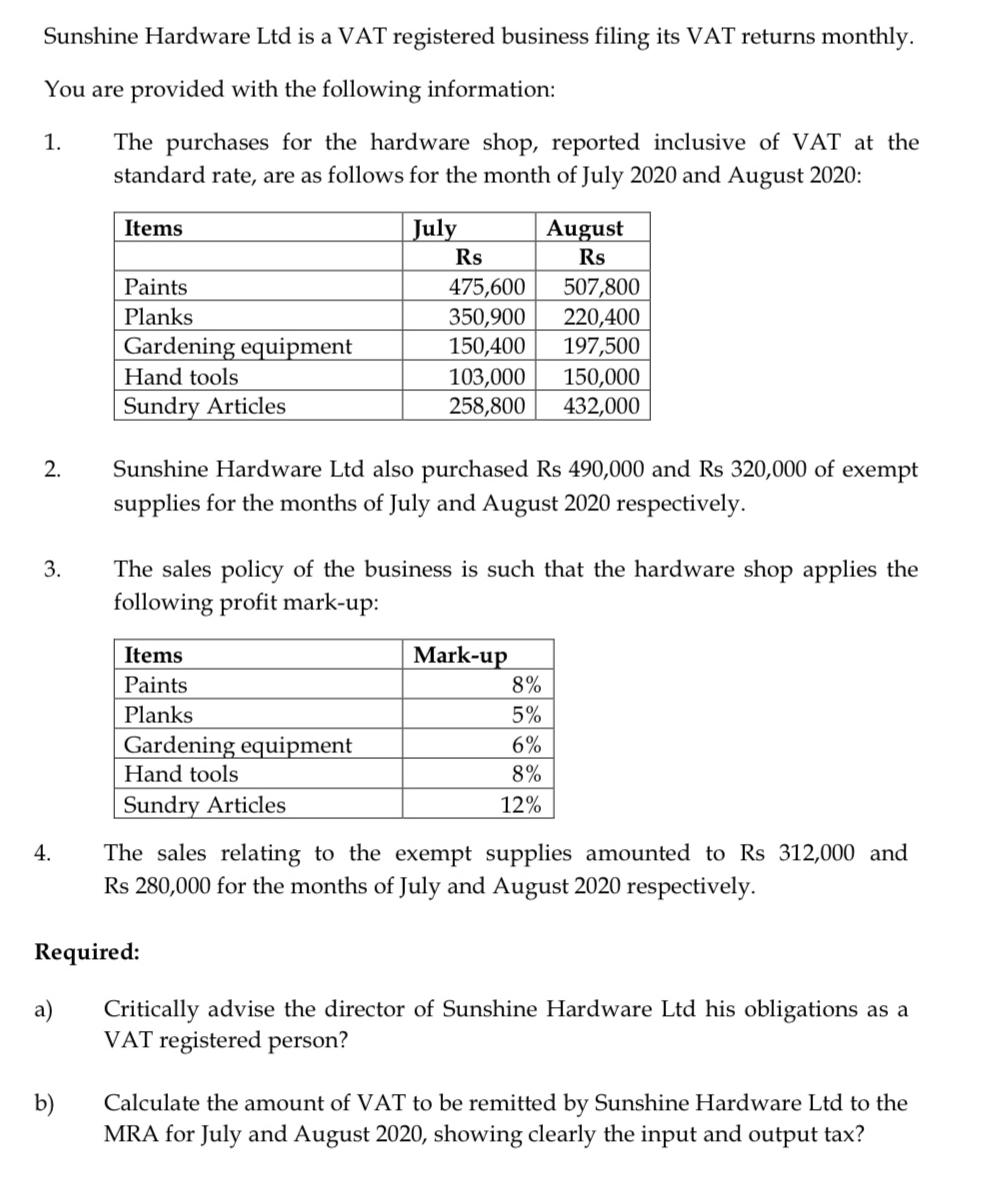

Sunshine Hardware Ltd is a VAT registered business filing its VAT returns monthly. You are provided with the following information: 1. The purchases for the hardware shop, reported inclusive of VAT at the standard rate, are as follows for the month of July 2020 and August 2020: Items 2. 3. 4. a) Paints Planks Gardening equipment b) Hand tools Sundry Articles July Items Paints Planks Gardening equipment Hand tools Sundry Articles Required: Rs 475,600 350,900 150,400 Sunshine Hardware Ltd also purchased Rs 490,000 and Rs 320,000 of exempt supplies for the months of July and August 2020 respectively. August Rs 103,000 150,000 258,800 432,000 The sales policy of the business is such that the hardware shop applies the following profit mark-up: Mark-up 507,800 220,400 197,500 8% 5% 6% 8% 12% The sales relating to the exempt supplies amounted to Rs 312,000 and Rs 280,000 for the months of July and August 2020 respectively. Critically advise the director of Sunshine Hardware Ltd his obligations as a VAT registered person? Calculate the amount of VAT to be remitted by Sunshine Hardware Ltd to the MRA for July and August 2020, showing clearly the input and output tax?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

We should work out the Tank to be transmitted for July and August 2020 July 2020 1 Output Expense on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started