Question

Sunsweet Bhd is a 60 years old company which principally engaged in the business of the food-based agriculture industry. It produces commodities such as rice,

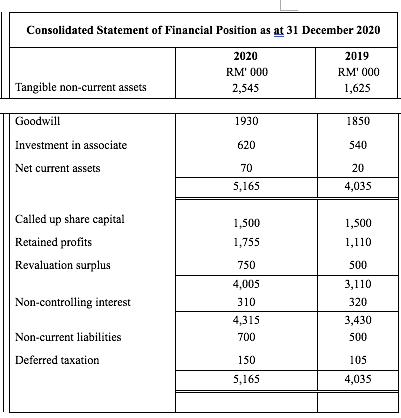

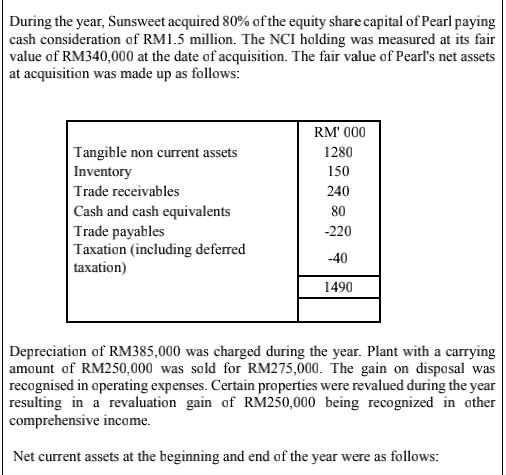

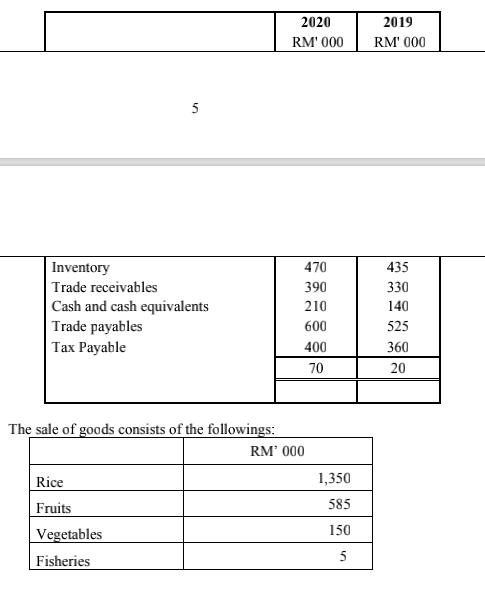

Sunsweet Bhd is a 60 years old company which principally engaged in the business of the food-based agriculture industry. It produces commodities such as rice, fruits, vegetables, and fisheries. The consolidated statement of financial position and the consolidated statement of profit or loss of Sunsweet Bhd for the year ended 31 December 2020 are as follows:

Critically construct and evaluate the consolidated statement of cash flows for Sunsweet Bhd for the year ended 31 December 2020 using the indirect method under IAS 7.

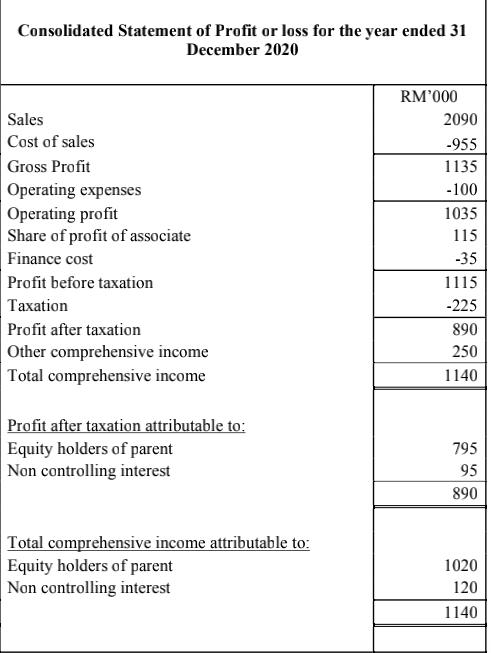

Consolidated Statement of Profit or loss for the year ended 31 December 2020 RM'000 Sales 2090 Cost of sales -955 Gross Profit 1135 Operating expenses Operating profit Share of profit of associate -100 1035 115 Finance cost -35 Profit before taxation 1115 Taxation -225 Profit after taxation | Other comprehensive income Total comprehensive income 890 250 1140 Profit after taxation attributable to: Equity holders of parent Non controlling interest 795 95 890 Total comprehensive income attributable to: Equity holders of parent Non controlling interest 1020 120 1140

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Cash Flow from Operating Activities Net Income 1140000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started