Question

Super-E Inc. (SI) manufactures component parts and sells them to major electronics companies. SI is a public company that reports under IFRS. Fiscal 2019 was

Super-E Inc. (SI) manufactures component parts and sells them to major electronics companies. SI is a public company that reports under IFRS.

Fiscal 2019 was a year of growth for SI. It launched several new product lines, and so far, these products have been a success. During the year, SI experienced revenue growth and an increase in market share. The CEO was very satisfied, as her main goal for 2019 was to improve profitability. She is very focused on share price and earnings per share, and she tends to reward decisions that she believes will improve these measures. She hopes that the increases in revenue and market share will soon trickle down to the bottom line.

The rapid growth has resulted in the internal audit department at SI being very busy. They have had to work overtime to implement appropriate internal controls as part of the processes for the new product lines and the changes in customer credit-granting policies. This challenge has been exacerbated by the fact that this department has been understaffed for much of the year.

You, CPA, are the external auditor for SI's December 31, 2019, financial statement audit. This is your firm's first year auditing SI; however, the predecessor's files suggest limited errors were identified in prior years.

Requirement 1:

Prepare a assessment of risk of material misstatement at the overall financial statement level for the 2019 audit.

requirement 2: Assess the appropriate accounting treatment for both financial instrument transactions

In 2019, SI undertook two transactions related to financial instruments.

Investment

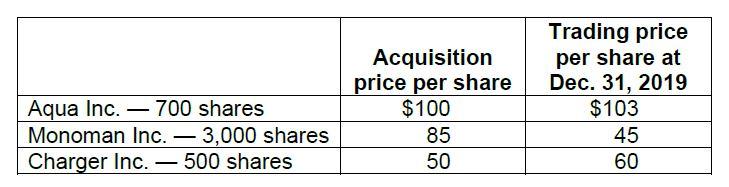

Management decided to invest in the stock market, selecting several public companies that have been receiving strong buy ratings from analysts. Management hopes to take advantage of the expected short-term increases in value so that the shares can be resold in the next fiscal year at a gain. Details of the investments are as follows:

The CFO has stated that he would like unrealized gains and losses on the share portfolio to not impact net income, and he wants to know whether this is an option.

The investments are currently reported at acquisition price.

Bonds

Due to favourable market conditions, SI decided to retire bonds in advance of their maturity date. Bonds with a face value of $5,000,000 were retired at 98% on October 31, 2019. The bonds paid 7% interest every December 31 and had been issued eight years earlier at par value.

The bookkeeper recorded the following journal entry on October 31 to retire the bonds and pay accrued interest:

DR Bond retirement expense 5,191,667

CR Cash 5,191,667

{($5,000,000 × 7% × 10/12 months) - [$5,000,000 - ($5,000,000 × 98%)]}

.Requirement 3: For each of the accounting issues discussed in Task #2, assess the risk of material misstatement at the assertion level.

Requirement 4: Consider and document the auditor's objectives and responsibilities related to the going-concern basis of accounting as they relate to SI's circumstances. Be sure to outline the CPA Canada Handbook - Assurance requirements and expand on the specifics with regard to SI.

As you perform the year-end audit work, some concerning information comes to light:

• After year end, a lawsuit was filed against SI by a competing firm. The competitor claims that the products SI launched in 2019 copied patented technology to which the competitor holds exclusive rights. SI's lawyer believes that SI will be found guilty and that damages will be material. This lawsuit has been in the news, and SI is not being portrayed favourably. SI's share price has declined.

• SI is struggling to manage its working capital. Cash is tied up in inventory that may not be saleable due to the lawsuit, and management has taken this inventory off the shelves until the lawsuit is resolved. In addition, accounts receivable collection continues to be slow. The bank has been reluctant to extend the operating line of credit due to recent circumstances.

• Management had performed an assessment of SI's ability to operate as a going concern and concluded that the going-concern basis of accounting was appropriate. However, the above information was not considered in this assessment.

Your firm considers these factors to be indicative of conditions that could cast significant doubt on the entity's ability to continue as a going concern.

Requirement 5:

Assume that you have performed the appropriate audit work regarding the going-concern assumption. In your opinion, the use of the going-concern assumption is not appropriate, based on evidence collected. However, management disagrees and has prepared the 2019 financial statements under the going-concern assumption.

Consider and document how this will impact the audit report that you will issue.

Aqua Inc. 700 shares - Monoman Inc. - 3,000 shares Charger Inc. 500 shares - Acquisition price per share $100 85 50 Trading price per share at Dec. 31, 2019 $103 45 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question is incomplete bec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started