Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Superfresh Co reported $10.981b revenue, $2.821b equity and $3.134b invested capital in the last annual report. The net profit margin has been stable in

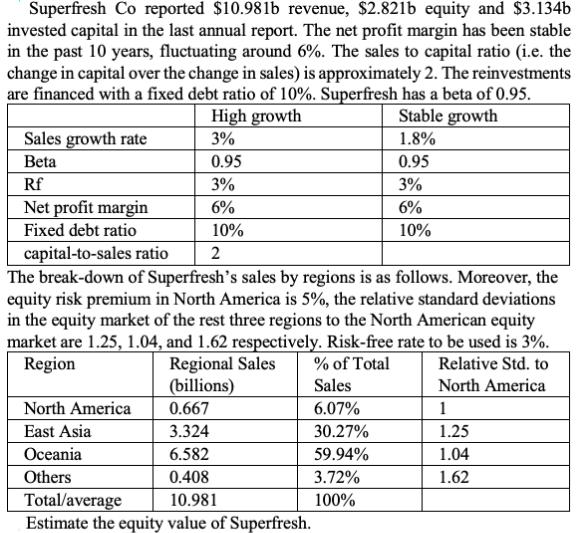

Superfresh Co reported $10.981b revenue, $2.821b equity and $3.134b invested capital in the last annual report. The net profit margin has been stable in the past 10 years, fluctuating around 6%. The sales to capital ratio (i.e. the change in capital over the change in sales) is approximately 2. The reinvestments are financed with a fixed debt ratio of 10%. Superfresh has a beta of 0.95. High growth Stable growth 3% 1.8% 0.95 0.95 3% 3% 6% 6% 10% 10% Sales growth rate Beta Rf Net profit margin Fixed debt ratio capital-to-sales ratio The break-down of Superfresh's sales by regions is as follows. Moreover, the equity risk premium in North America is 5%, the relative standard deviations in the equity market of the rest three regions to the North American equity market are 1.25, 1.04, and 1.62 respectively. Risk-free rate to be used is 3%. Region Regional Sales % of Total Relative Std. to North America (billions) 1 1.25 1.04 1.62 North America East Asia 2 0.667 3.324 6.582 0.408 Total/average 10.981 Estimate the equity value of Superfresh. Oceania Others Sales 6.07% 30.27% 59.94% 3.72% 100%

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the equity value of Superfresh Co we can use the Dividend Discount Model DDM with a stab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started