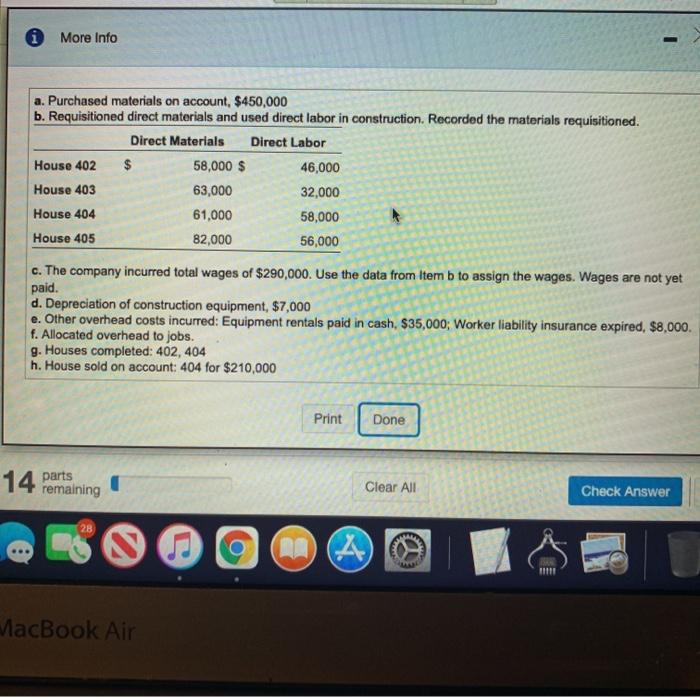

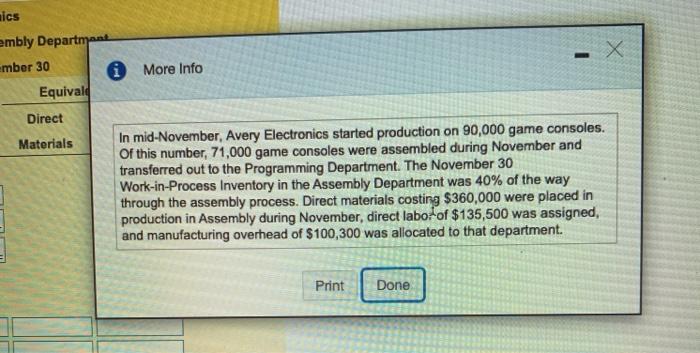

Superior Construction, Inc. is a home builder in Arizona, Superior uses a job order costing system in which each house is a job. Because it constructs houses, the company uses an account titled Construction Overhead. The company applies overhead based estimated direct labor costs. For the year, it estimated construction overhead of $1,050,000 and total direct labor cost of $5,250,000 The following events occurred during August: (Click the icon to view the events.) i More Info a. Purchased materials on account, $450,000 b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned. Direct Materials Direct Labor House 402 $ 58,000 $ 46,000 House 403 63,000 32,000 House 404 61,000 58,000 House 405 82,000 56,000 c. The company incurred total wages of $290,000. Use the data from Item b to assign the wages. Wages are not yet paid. d. Depreciation of construction equipment, $7,000 e. Other overhead costs incurred: Equipment rentals paid in cash, $35,000; Worker liability insurance expired, $8,000. f. Allocated overhead to jobs. g. Houses completed: 402, 404 h. House sold on account: 404 for $210,000 Print Done 14 parts remaining Clear All Check Answer 28 MacBook Air nics embly Department ember 30 1 More Info Equivald - X Direct Materials In mid-November, Avery Electronics started production on 90,000 game consoles. of this number, 71,000 game consoles were assembled during November and transferred out to the Programming Department. The November 30 Work-in-Process Inventory in the Assembly Department was 40% of the way through the assembly process. Direct materials costing $360,000 were placed in production in Assembly during November, direct labo of $135,500 was assigned, and manufacturing overhead of $100,300 was allocated to that department. Print Done Superior Construction, Inc. is a home builder in Arizona, Superior uses a job order costing system in which each house is a job. Because it constructs houses, the company uses an account titled Construction Overhead. The company applies overhead based estimated direct labor costs. For the year, it estimated construction overhead of $1,050,000 and total direct labor cost of $5,250,000 The following events occurred during August: (Click the icon to view the events.) i More Info a. Purchased materials on account, $450,000 b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned. Direct Materials Direct Labor House 402 $ 58,000 $ 46,000 House 403 63,000 32,000 House 404 61,000 58,000 House 405 82,000 56,000 c. The company incurred total wages of $290,000. Use the data from Item b to assign the wages. Wages are not yet paid. d. Depreciation of construction equipment, $7,000 e. Other overhead costs incurred: Equipment rentals paid in cash, $35,000; Worker liability insurance expired, $8,000. f. Allocated overhead to jobs. g. Houses completed: 402, 404 h. House sold on account: 404 for $210,000 Print Done 14 parts remaining Clear All Check Answer 28 MacBook Air nics embly Department ember 30 1 More Info Equivald - X Direct Materials In mid-November, Avery Electronics started production on 90,000 game consoles. of this number, 71,000 game consoles were assembled during November and transferred out to the Programming Department. The November 30 Work-in-Process Inventory in the Assembly Department was 40% of the way through the assembly process. Direct materials costing $360,000 were placed in production in Assembly during November, direct labo of $135,500 was assigned, and manufacturing overhead of $100,300 was allocated to that department. Print Done