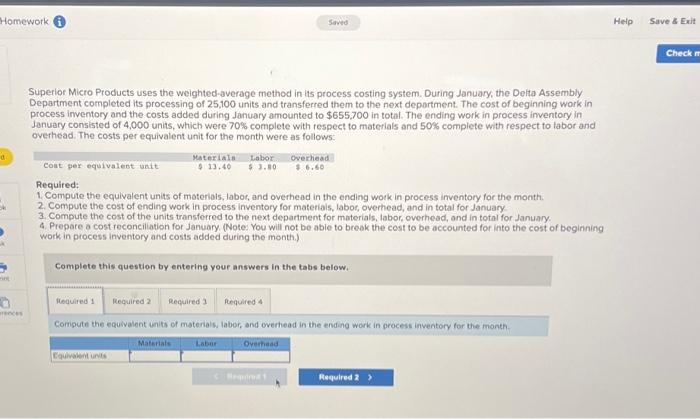

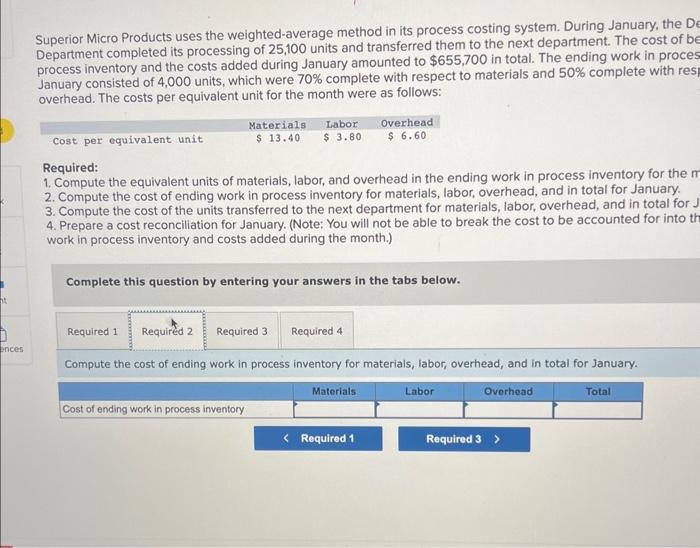

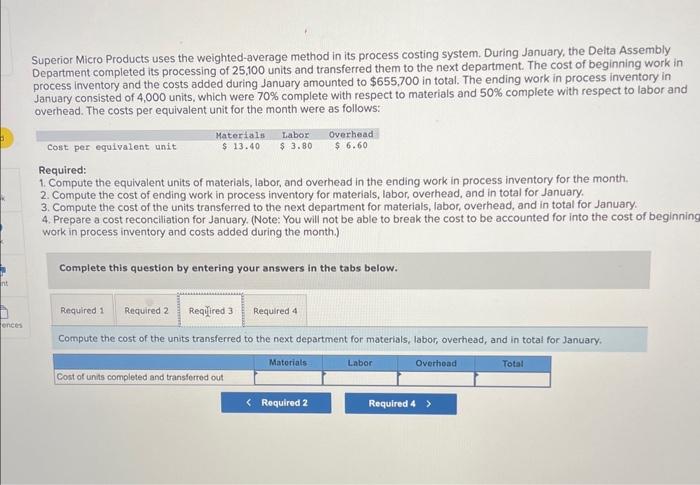

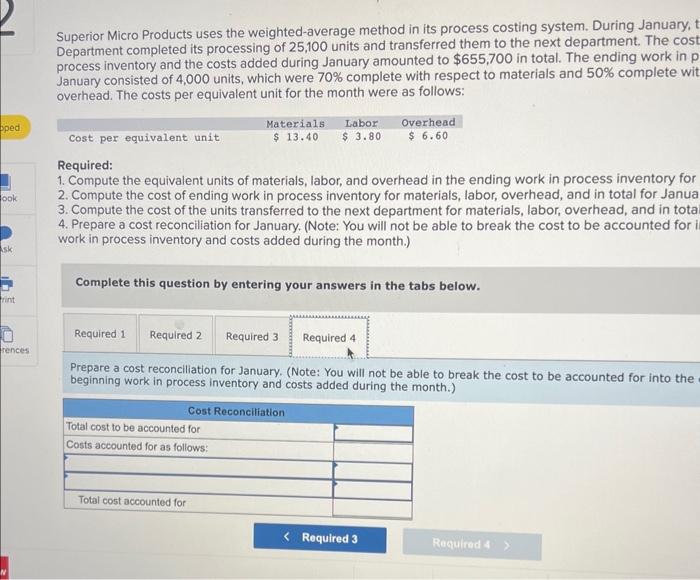

Superior Micro Products uses the weighted-average method in its process costing system. During January, the Delta Assembly Department completed its processing of 25,100 units and transferred them to the next deportment. The cost of beginning work in process inventory and the costs added during January amounted to $655,700 in total. The ending work in process inventory in January consisted of 4,000 units, which were 70% complete with respect to materials and 50% complete with respect to labor and overhead. The costs per equivalent unit for the month were as follows: Required: 1. Compute the equivalent units of materiais, labor, and overhead in the ending work in process inventory for the month. 2. Compute the cost of ending work in process inventory for materials, laboc, overhead, and in total for January 3. Compute the cost of the units transferred to the next department for materials, labor, overhead, and in total for January. 4. Prepare a cost reconciliation for January. (Note. You will not be abie to break the cost to be occounted for into the cost of beginning work in process inventory and costs added during the month.) Complete this question by entering your answers in the tabs below, Comipute the equivalent unitis of matenals, labor, and overhead in the ending work in process inventory for the manth. Superior Micro Products uses the weighted-average method in its process costing system. During January, the D Department completed its processing of 25,100 units and transferred them to the next department. The cost of be process inventory and the costs added during January amounted to $655,700 in total. The ending work in proce January consisted of 4,000 units, which were 70% complete with respect to materials and 50% complete with res overhead. The costs per equivalent unit for the month were as follows: Required: 1. Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for the 2. Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January. 3. Compute the cost of the units transferred to the next department for materials, labor, overhead, and in total for 4. Prepare a cost reconciliation for January. (Note: You will not be able to break the cost to be accounted for into work in process inventory and costs added during the month.) Complete this question by entering your answers in the tabs below. Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January. Superior Micro Products uses the weighted-average method in its process costing system. During January, the Deita Assembly Department completed its processing of 25,100 units and transferred them to the next department. The cost of beginning work in process inventory and the costs added during January amounted to $655,700 in total. The ending work in process inventory in January consisted of 4,000 units, which were 70% complete with respect to materials and 50% complete with respect to labor and overhead. The costs per equivalent unit for the month were as follows: Required: 1. Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for the month. 2. Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January. 3. Compute the cost of the units transferred to the next department for materials, labor, overhead, and in total for January. 4. Prepare a cost reconciliation for January. (Note: You will not be able to break the cost to be accounted for into the cost of beginnin work in process inventory and costs added during the month.) Complete this question by entering your answers in the tabs below. Compute the cost of the units transferred to the next department for materials, labor, overhead, and in total for January. Superior Micro Products uses the weighted-average method in its process costing system. During January, Department completed its processing of 25,100 units and transferred them to the next department. The cost process inventory and the costs added during January amounted to $655,700 in total. The ending work in p January consisted of 4,000 units, which were 70% complete with respect to materials and 50% complete wit overhead. The costs per equivalent unit for the month were as follows: Required: 1. Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for 2. Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for Janua 3. Compute the cost of the units transferred to the next department for materials, labor, overhead, and in tota 4. Prepare a cost reconciliation for January. (Note: You will not be able to break the cost to be accounted for work in process inventory and costs added during the month.) Complete this question by entering your answers in the tabs below. Prepare a cost reconciliation for January. (Note: You will not be able to break the cost to be accounted for into the beginning work in process inventory and costs added during the month.)