Answered step by step

Verified Expert Solution

Question

1 Approved Answer

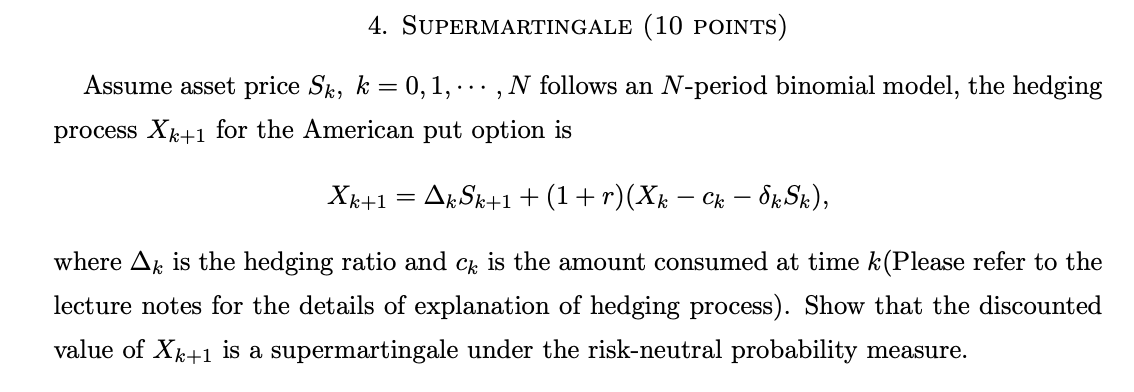

Supermartingale ( 1 0 points ) Assume asset price S k , k = 0 , 1 , cdots, N follows an N - period

Supermartingale points

Assume asset price cdots, follows an period binomial model, the hedging

process for the American put option is

where is the hedging ratio and is the amount consumed at time Please refer to the

lecture notes for the details of explanation of hedging process Show that the discounted

value of is a supermartingale under the riskneutral probability measure.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started