Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Supernet Co. has a bond outstanding with a coupon rate of 5 percent and semiannual payments. The yield to maturity is 4.5 percent and

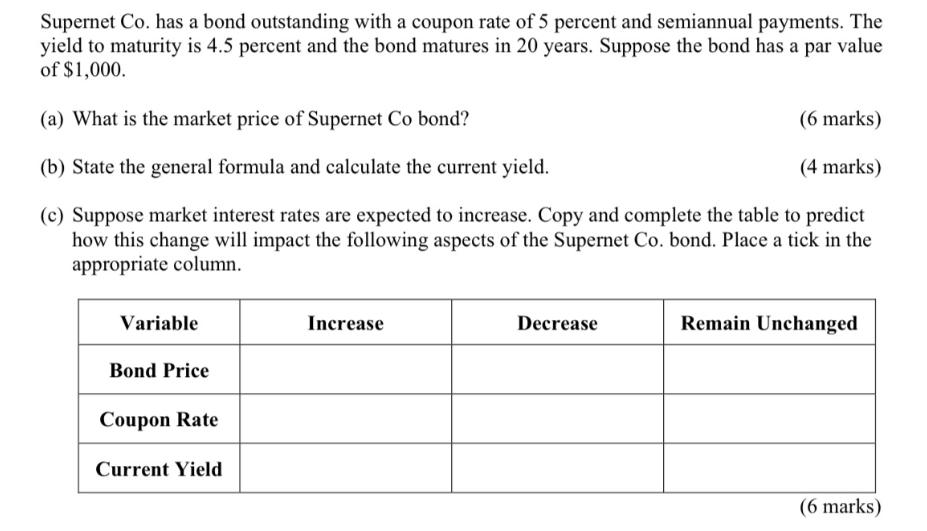

Supernet Co. has a bond outstanding with a coupon rate of 5 percent and semiannual payments. The yield to maturity is 4.5 percent and the bond matures in 20 years. Suppose the bond has a par value of $1,000. (a) What is the market price of Supernet Co bond? (b) State the general formula and calculate the current yield. (6 marks) (4 marks) (c) Suppose market interest rates are expected to increase. Copy and complete the table to predict how this change will impact the following aspects of the Supernet Co. bond. Place a tick in the appropriate column. Variable Increase Bond Price Coupon Rate Current Yield Decrease Remain Unchanged (6 marks) Part II (a) Suppose Kowloon Bank has suffered some financial loss in the past year. The rating of this bank has been recently lowered from BBB to BB. The bank wants to issue new bonds now. i. ii. Based on the above situation, identify the most relevant factor affecting the required return of the bond issued by Kowloon Bank. Briefly explain. [Word limit: 50 words] (4 marks) How would the coupon rate offered by Kowloon Bank differ from that of other banks with an AAA rating, considering only the bond ratings? Briefly explain. [Word limit: 50 words] (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started