Answered step by step

Verified Expert Solution

Question

1 Approved Answer

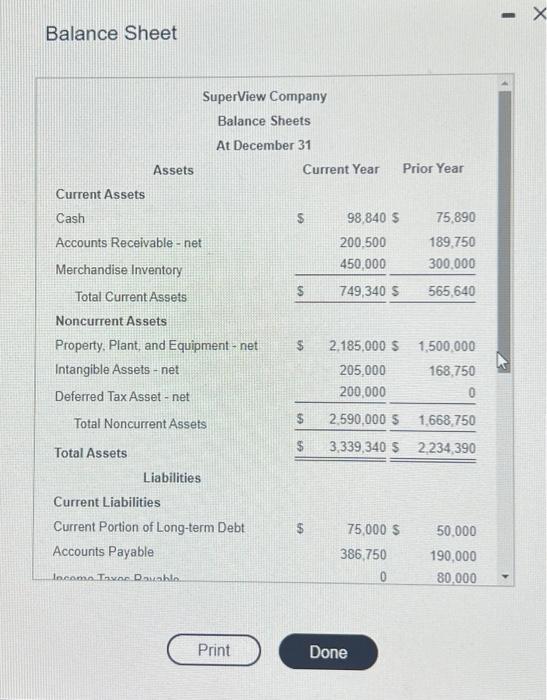

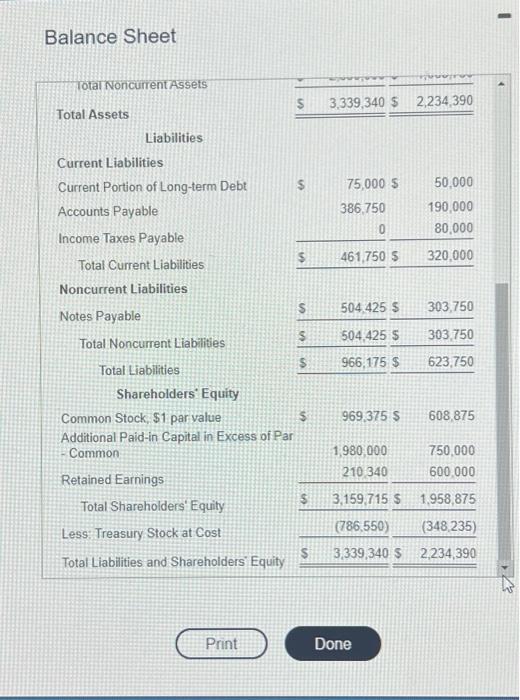

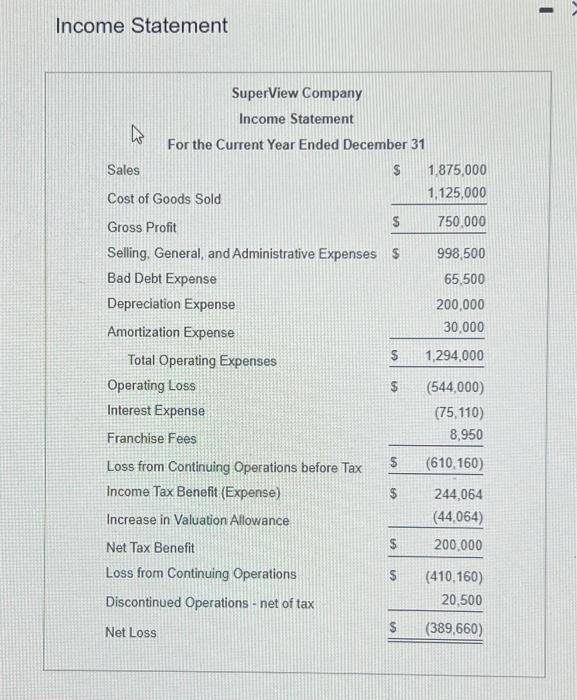

SuperView Company's comparative balance sheets and its current income statement follow. (Click the icon to view the balance sheets.) (Click the icon to view the

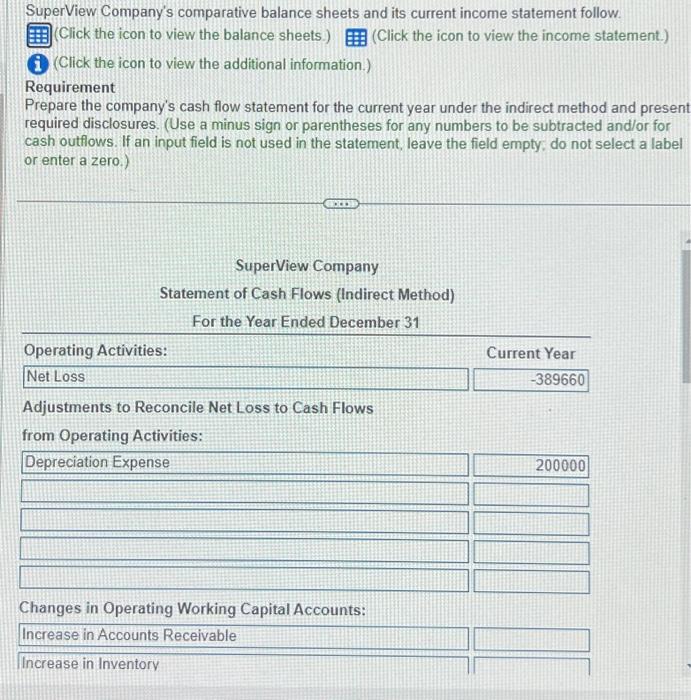

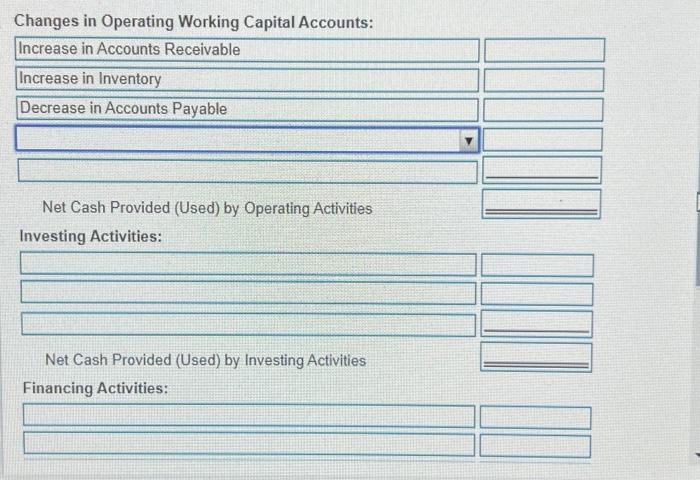

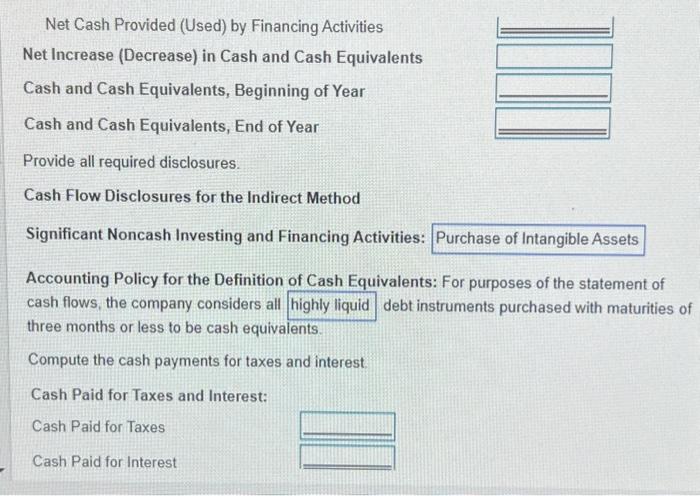

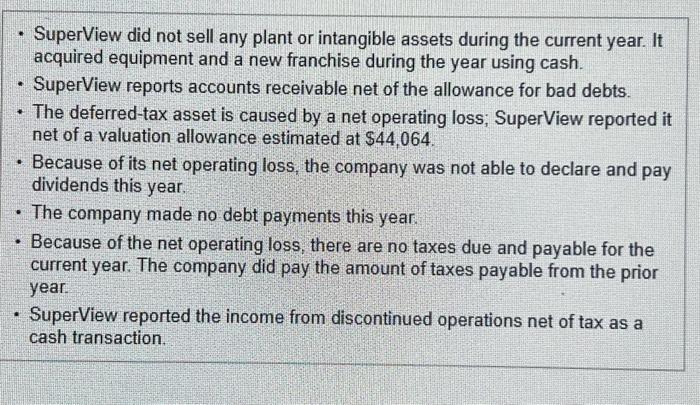

SuperView Company's comparative balance sheets and its current income statement follow. (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) i (Click the icon to view the additional information.) Requirement Prepare the company's cash flow statement for the current year under the indirect method and present required disclosures. (Use a minus sign or parentheses for any numbers to be subtracted and/or for cash outflows. If an input field is not used in the statement, leave the field empty; do not select a label or enter a zero.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started