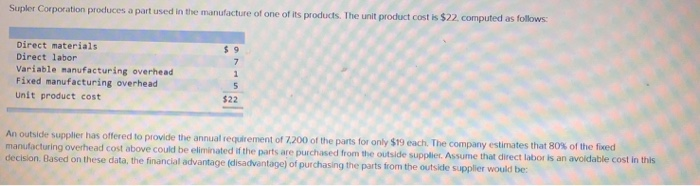

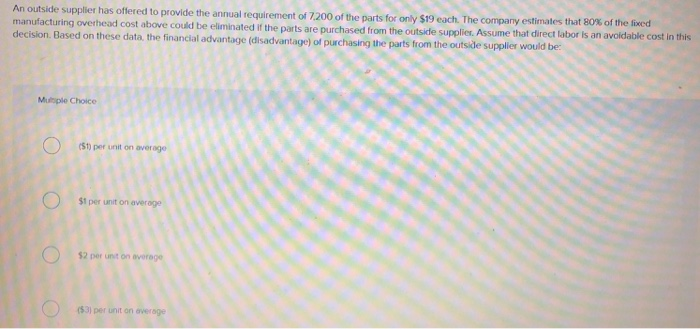

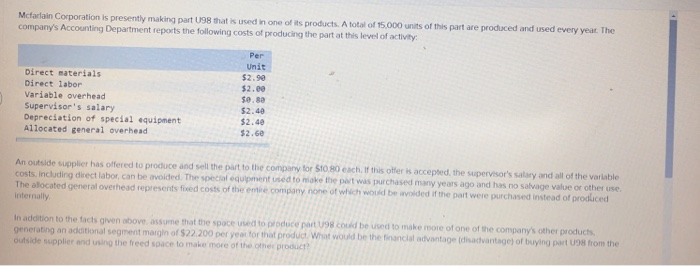

Supler Corporation produces a part used in the manufacture of one of its products. The unit product cost is $22, computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost $22 An outside supplier has offered to provide the annual requirement of 7,200 of the parts t decision. Based on these data, the financial advantage (disadventage) of purchasing the parts trom the outside supplier would each. The company estimates that 80% of the fixed be eliminated it the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this An outside supplier has offered to provide the annual requirement of 7 200 of the parts for only S19 each. The company estimates that 80% of th manufacturing overhead cost above could be eliminated if the parts are purchased from the outside s decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from ti upplies. Assume that direct labor is an a he outside supplier would be voidable cost in this Mulople Choice (51) per unit on averoge $1 per unit on averoge $2 per unt on average (53) per unit on average Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 15,000 units of this part are produced and used every yeat The company's Accounting Department reports the following costs of producing the part at this level of activity Direct materials Direct labor Variable overhead Supervisor's salary Depreciation of speial equipment Allocated general overhead Unit $2.90 $2.e0 $0.88 $2.48 $2.49 $2.60 An outside supplier has offered to produce and sell the part to the company tor St0.80 each. If this costs, including dkect labor,can be avoided. The special equipment used to moke t The alocated general overhead represents fived costs of the entire company none of internally offer s accepted, the supervisor's salary and all of the varlable years ago and has no salvage value or other use the pat was purchased many ed if the part were purchased instead of prodluced U98 could be used to make more of one of the company's other products In addition to the facts given above assume that the space used to produce par generating an additional segment magin of butside supplier and using the freed soace to make more of the oner product? $22.200 per yea tor that product What would be the inancial advantage (disadvantage) of buying part U98 trom the ($18.300) $7,800) $22.200 ($52.200)