Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Supplemental Instruction Acct 201B Use the following information for the following two problems Amanda Corporation makes a product with the following standard costs: Direct

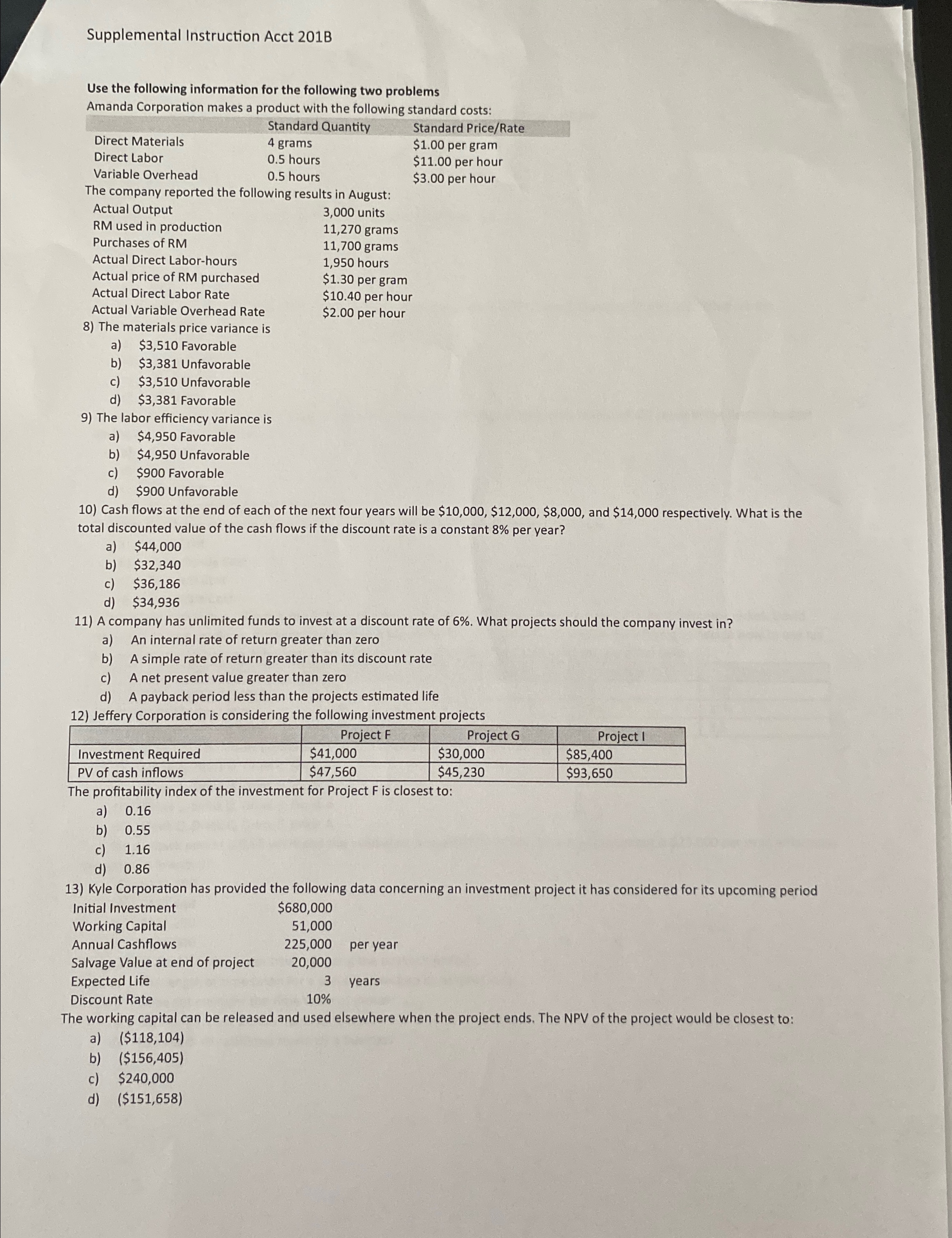

Supplemental Instruction Acct 201B Use the following information for the following two problems Amanda Corporation makes a product with the following standard costs: Direct Materials Direct Labor Variable Overhead Standard Quantity 4 grams 0.5 hours 0.5 hours The company reported the following results in August: Actual Output RM used in production Purchases of RM Actual Direct Labor-hours Actual price of RM purchased Actual Direct Labor Rate Actual Variable Overhead Rate 8) The materials price variance is $3,510 Favorable a) b) $3,381 Unfavorable c) $3,510 Unfavorable 3,000 units 11,270 grams 11,700 grams 1,950 hours $1.30 per gram $10.40 per hour $2.00 per hour Standard Price/Rate $1.00 per gram $11.00 per hour $3.00 per hour d) $3,381 Favorable 9) The labor efficiency variance is a) $4,950 Favorable b) $4,950 Unfavorable c) $900 Favorable d) $900 Unfavorable 10) Cash flows at the end of each of the next four years will be $10,000, $12,000, $8,000, and $14,000 respectively. What is the total discounted value of the cash flows if the discount rate is a constant 8% per year? a) $44,000 b) $32,340 c) $36,186 d) $34,936 11) A company has unlimited funds to invest at a discount rate of 6%. What projects should the company invest in? a) An internal rate of return greater than zero b) A simple rate of return greater than its discount rate c) A net present value greater than zero d) A payback period less than the projects estimated life 12) Jeffery Corporation is considering the following investment projects Investment Required PV of cash inflows Project F $41,000 $47,560 Project G Project I $30,000 $85,400 $45,230 $93,650 The profitability index of the investment for Project F is closest to: a) 0.16 b) 0.55 c) 1.16 d) 0.86 13) Kyle Corporation has provided the following data concerning an investment project it has considered for its upcoming period Initial Investment Working Capital $680,000 51,000 Annual Cashflows 225,000 per year Salvage Value at end of project 20,000 Expected Life Discount Rate 3 years 10% The working capital can be released and used elsewhere when the project ends. The NPV of the project would be closest to: a) ($118,104) b) ($156,405) c) $240,000 d) ($151,658)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started