Answered step by step

Verified Expert Solution

Question

1 Approved Answer

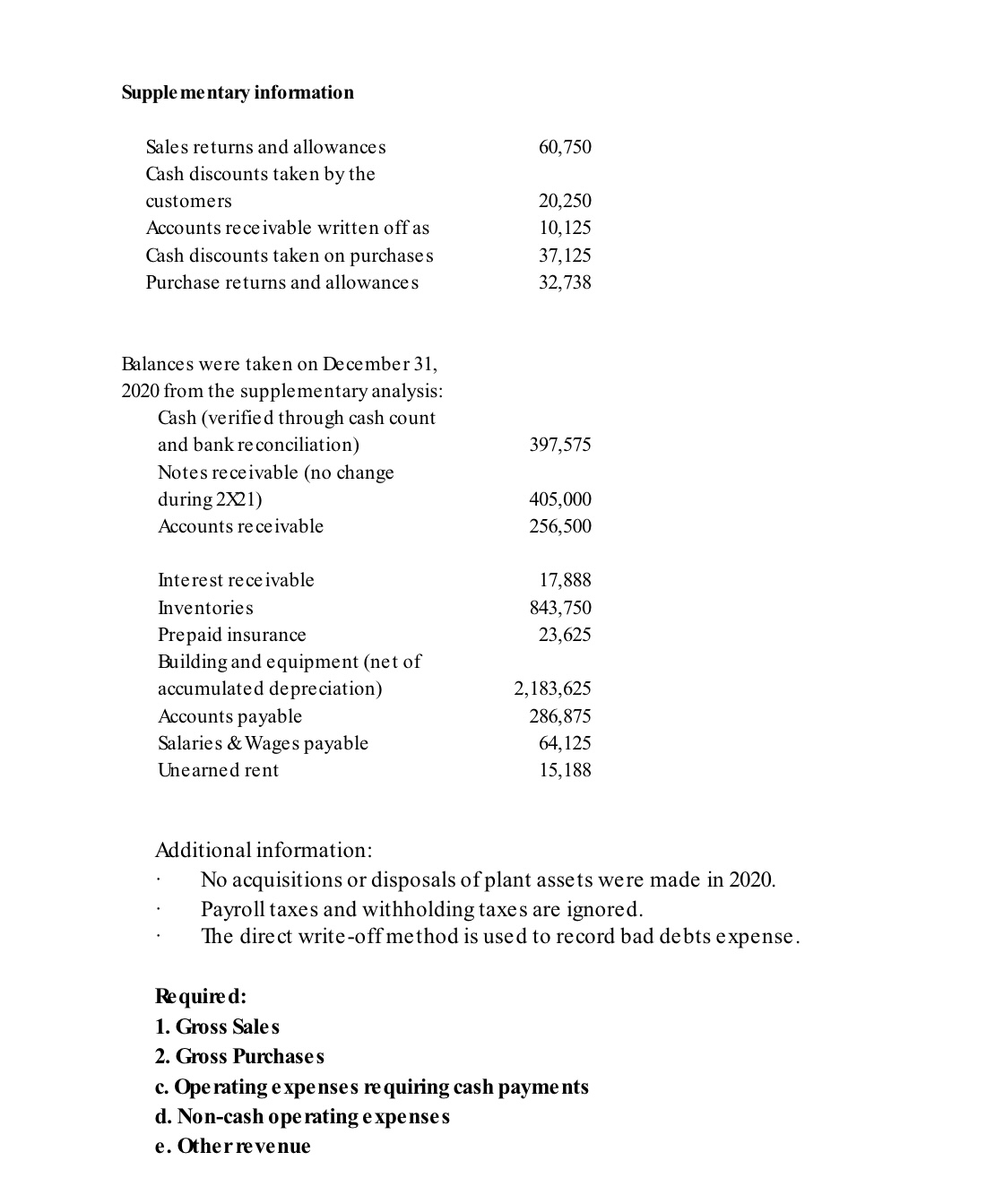

Supplementary information Sales returns and allowances 60,750 Cash discounts taken by the customers 20,250 Accounts receivable written off as 10,125 Cash discounts taken on

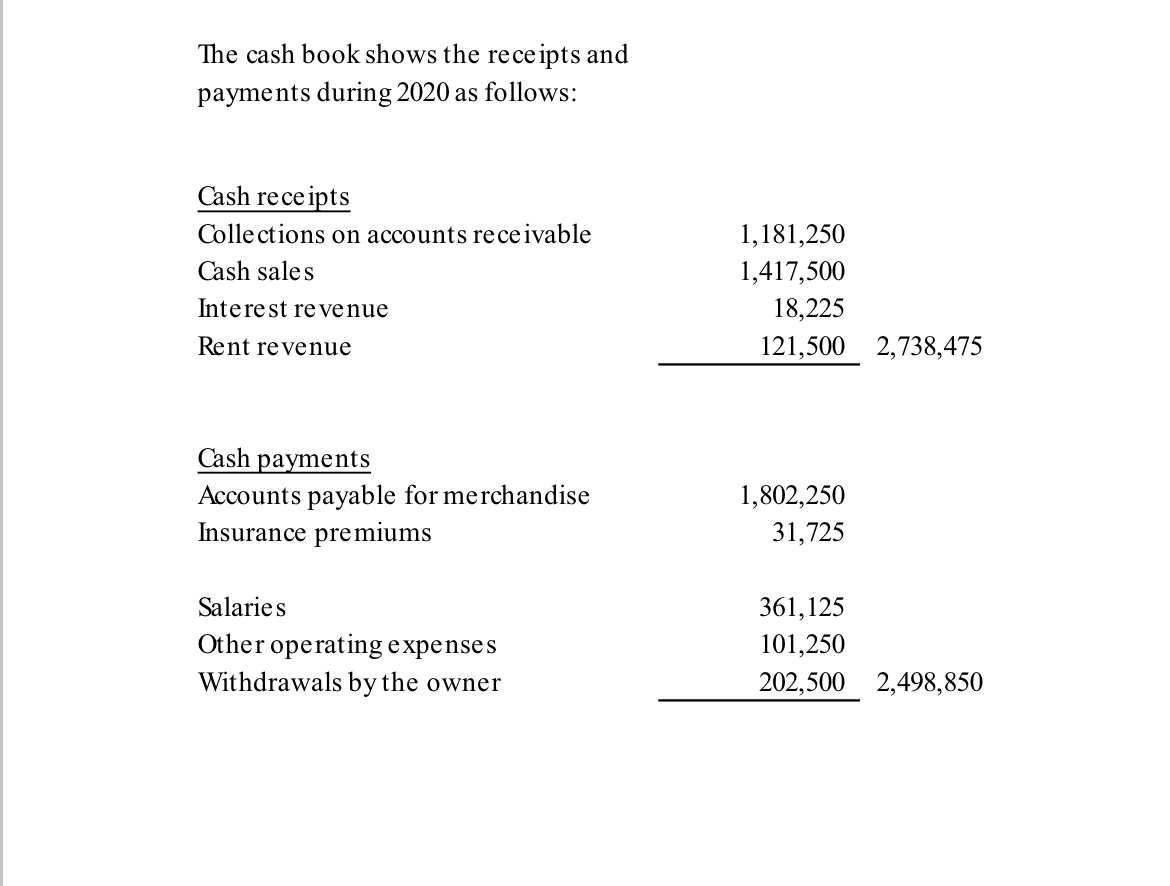

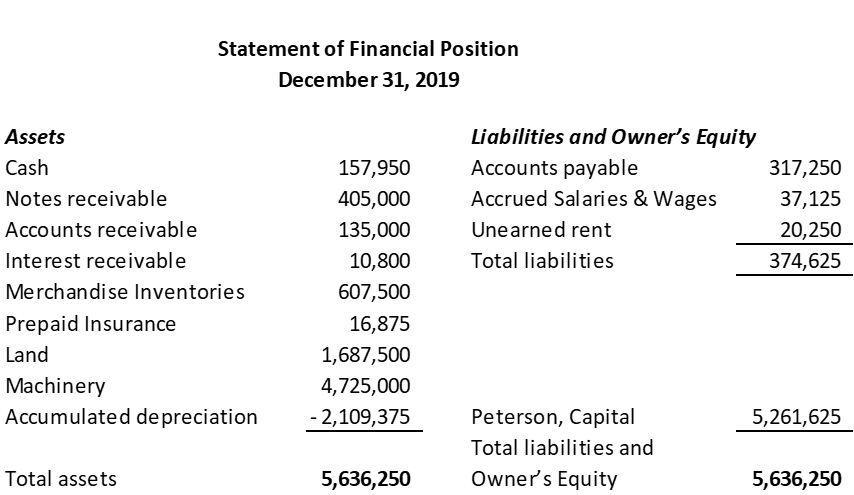

Supplementary information Sales returns and allowances 60,750 Cash discounts taken by the customers 20,250 Accounts receivable written off as 10,125 Cash discounts taken on purchases 37,125 Purchase returns and allowances 32,738 Balances were taken on December 31, 2020 from the supplementary analysis: Cash (verified through cash count and bank reconciliation) 397,575 Notes receivable (no change during 2X21) 405,000 Accounts receivable 256,500 Interest receivable 17,888 Inventories 843,750 Prepaid insurance 23,625 Building and equipment (net of accumulated depreciation) 2,183,625 Accounts payable 286,875 Salaries & Wages payable 64,125 Unearned rent 15,188 Additional information: No acquisitions or disposals of plant assets were made in 2020. Payroll taxes and withholding taxes are ignored. The direct write-off method is used to record bad debts expense. Required: 1. Gross Sales 2. Gross Purchases c. Operating expenses requiring cash payments d. Non-cash operating expenses e. Other revenue The cash book shows the receipts and payments during 2020 as follows: Cash receipts Collections on accounts receivable 1,181,250 Cash sales 1,417,500 Interest revenue Rent revenue 18,225 121,500 2,738,475 Cash payments Accounts payable for merchandise Insurance premiums 1,802,250 31,725 Salaries Other operating expenses Withdrawals by the owner 202,500 2,498,850 361,125 101,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started