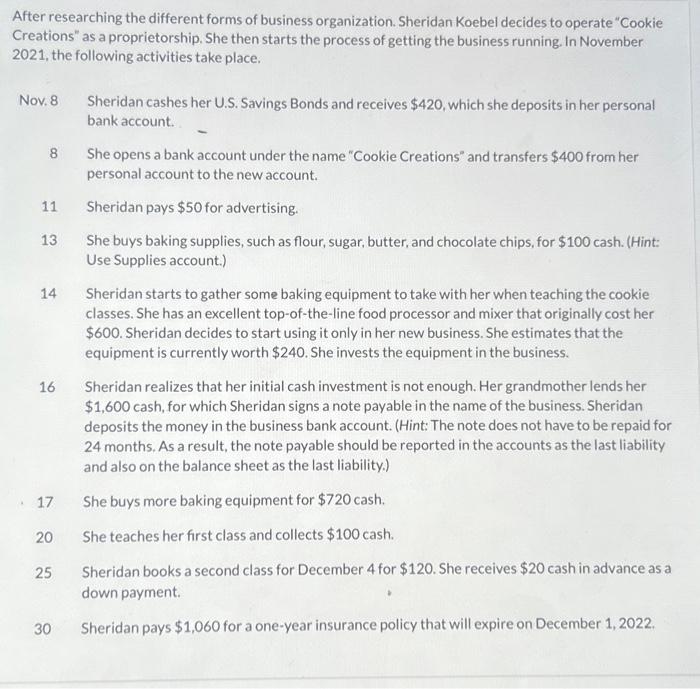

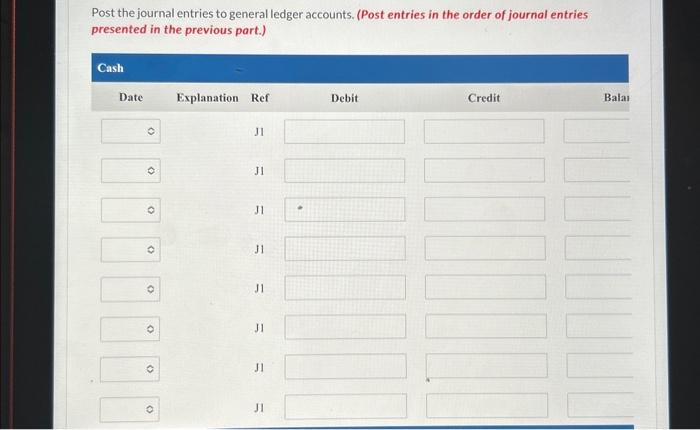

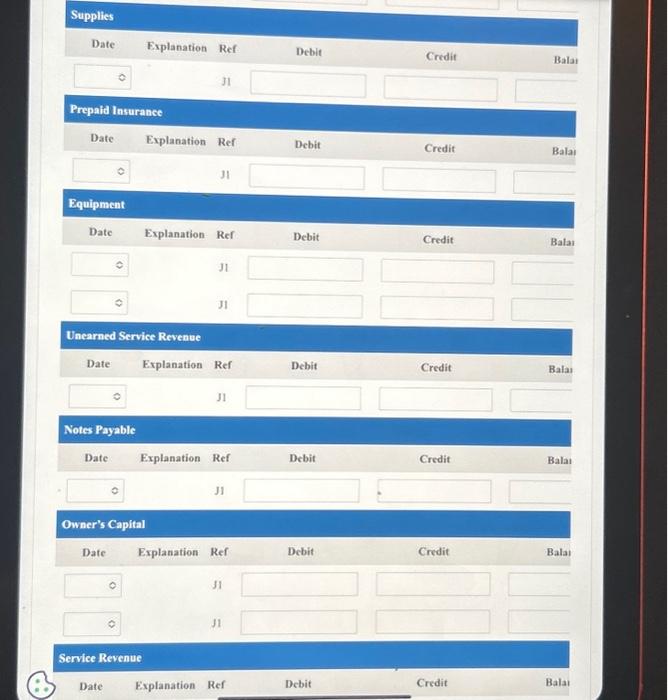

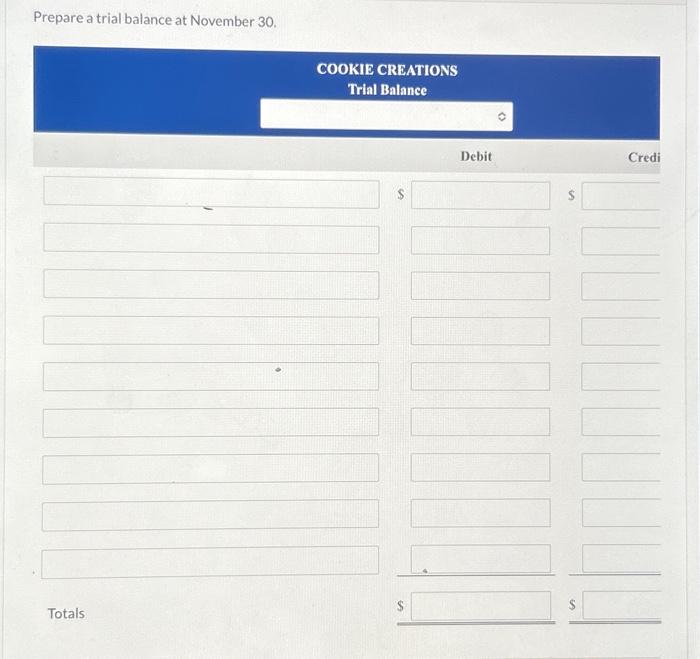

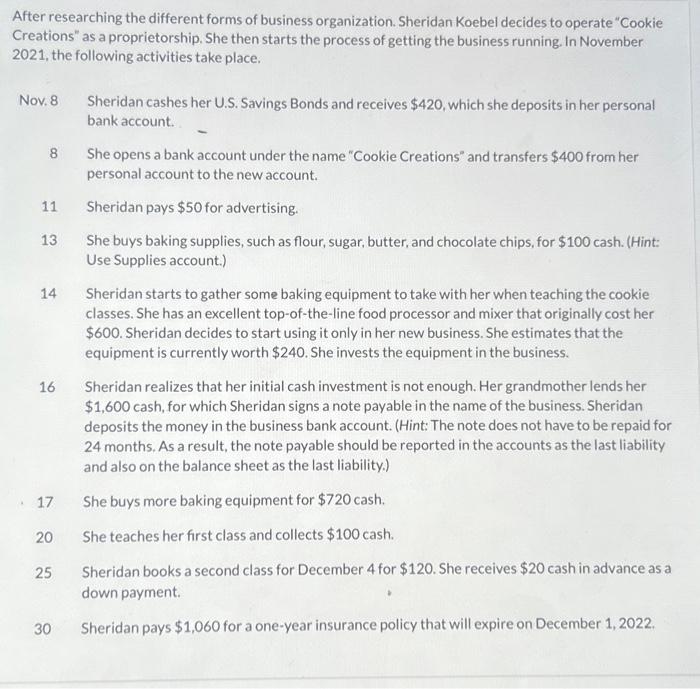

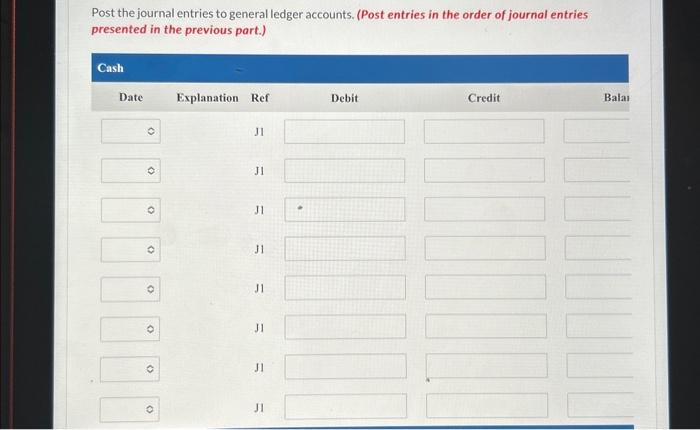

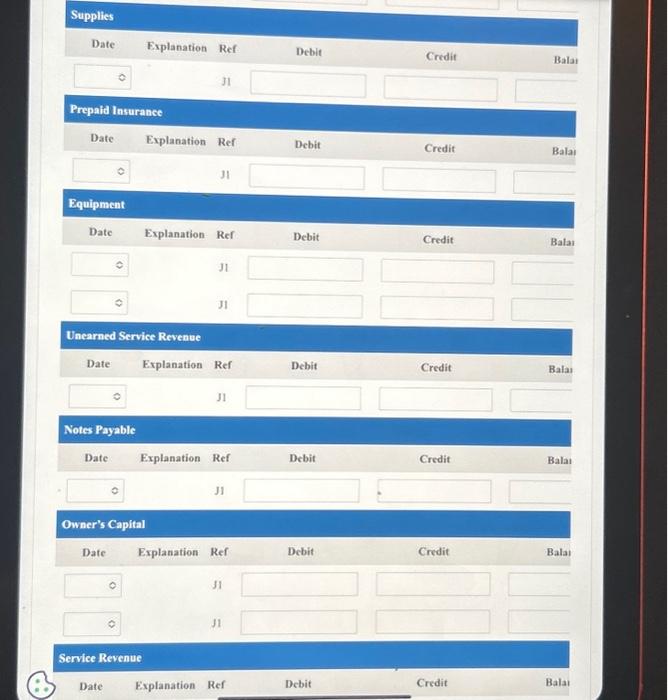

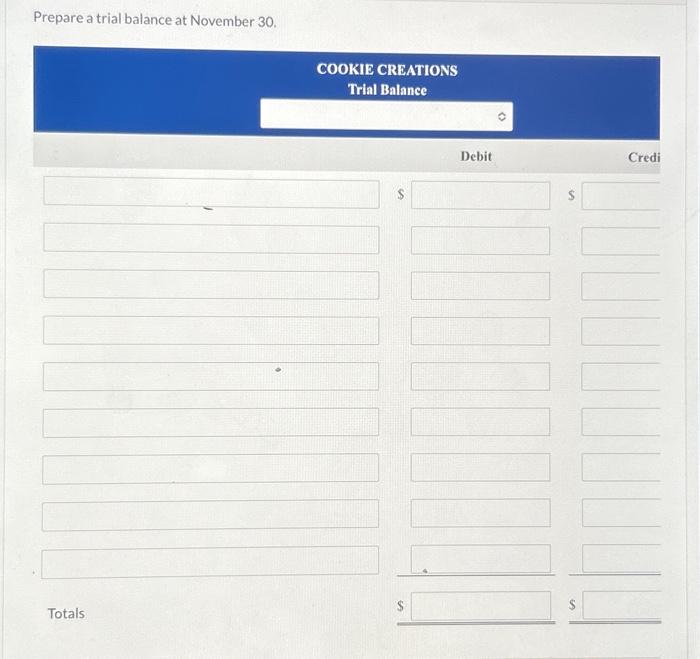

Supplies Date Explanation Ref Debit Credit Bala J1 Prepaid Insurance Date Explanation Ref Debit Credit Bala 31 Equipment Date Explanation Ref Debit Credit Bala J1 Unearned Service Revenue Date Explanation Ref Debit Credit Bala! J1 Notes Payable Date Explanation Ref Debit Credit Bala J) Owner's Capital Date Explanation Ref Debit Credit Bala! J1 J1 Service Revenue Date Explanation Ref Debit Credit Bala After researching the different forms of business organization. Sheridan Koebel decides to operate "Cookie Creations" as a proprietorship. She then starts the process of getting the business running. In November 2021, the following activities take place. Nov. 8 Sheridan cashes her U.S. Savings Bonds and receives $420, which she deposits in her personal bank account. 8 She opens a bank account under the name "Cookie Creations" and transfers $400 from her personal account to the new account. 11 Sheridan pays $50 for advertising. 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $100 cash. (Hint: Use Supplies account.) 14 Sheridan starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer that originally cost her $600. Sheridan decides to start using it only in her new business. She estimates that the equipment is currently worth $240. She invests the equipment in the business. 16 Sheridan realizes that her initial cash investment is not enough. Her grandmother lends her $1,600 cash, for which Sheridan signs a note payable in the name of the business. Sheridan deposits the money in the business bank account. (Hint: The note does not have to be repaid for 24 months. As a result, the note payable should be reported in the accounts as the last liability and also on the balance sheet as the last liability.) 17 She buys more baking equipment for $720 cash. 20 She teaches her first class and collects $100 cash. 25 Sheridan books a second class for December 4 for $120. She receives $20 cash in advance as a down payment. 30 Sheridan pays $1,060 for a one-year insurance policy that will expire on December 1,2022. Drmon-n-1-1-11-1 Post the journal entries to general ledger accounts. (Post entries in the order of journal entries presented in the previous part.)