Answered step by step

Verified Expert Solution

Question

1 Approved Answer

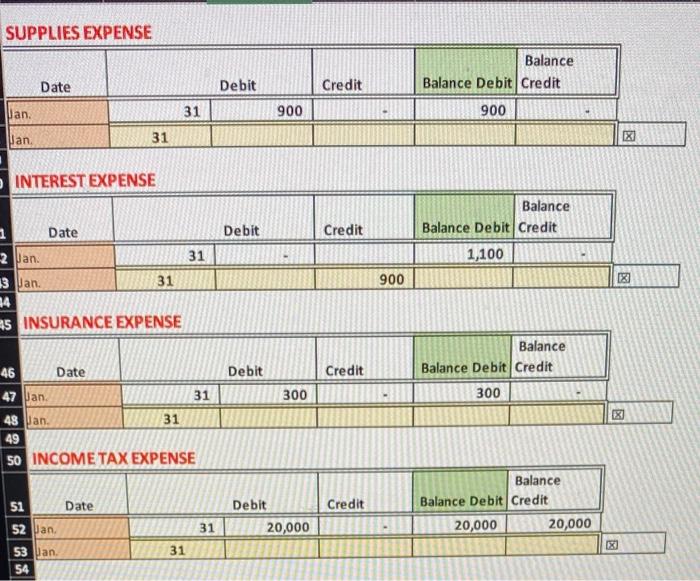

SUPPLIES EXPENSE Balance Date Debit Credit Balance Debit Credit Jan. 31 900 900 Jan. 31 -INTEREST EXPENSE Balance Date Debit Credit Balance Debit Credit

SUPPLIES EXPENSE Balance Date Debit Credit Balance Debit Credit Jan. 31 900 900 Jan. 31 -INTEREST EXPENSE Balance Date Debit Credit Balance Debit Credit 2 Jan. 31 1,100 900 3 Jan. 14 as INSURANCE EXPENSE 31 Balance Date Debit Credit Balance Debit Credit 46 47 Jan. 31 300 300 48 Jan. 31 49 s0 INCOME TAX EXPENSE Balance Debit Credit Balance Debit Credit 51 Date 52 Jan. 20,000 20,000 20,000 31 53 an. 31 54 enter the closing entry for dividends first (the balance will be a debit) enter the closing entry for the income summary- the balance wil be a credit Check: Does RE equal what you prepared in the financial statements enter the closing entry for sales revenue enter the closing entry for service revenue enter the closingg entry for cost of goods sold enter the closing entry for salariesand wage expense enter the closing entry for depreciation expense enter the closing entry for supplies expense enter the closing entry for interest expense enter the closing entry for insurance expense enter the closing entry for incame tax expense and then check-does you balance a the net income cakulated on the financialstatements? the income summary isa temporary account and should close to zero

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

my Working is as follows Cash Accounts Receivable Month Day Debit Credit Balance Debit Balance Credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started