Answered step by step

Verified Expert Solution

Question

1 Approved Answer

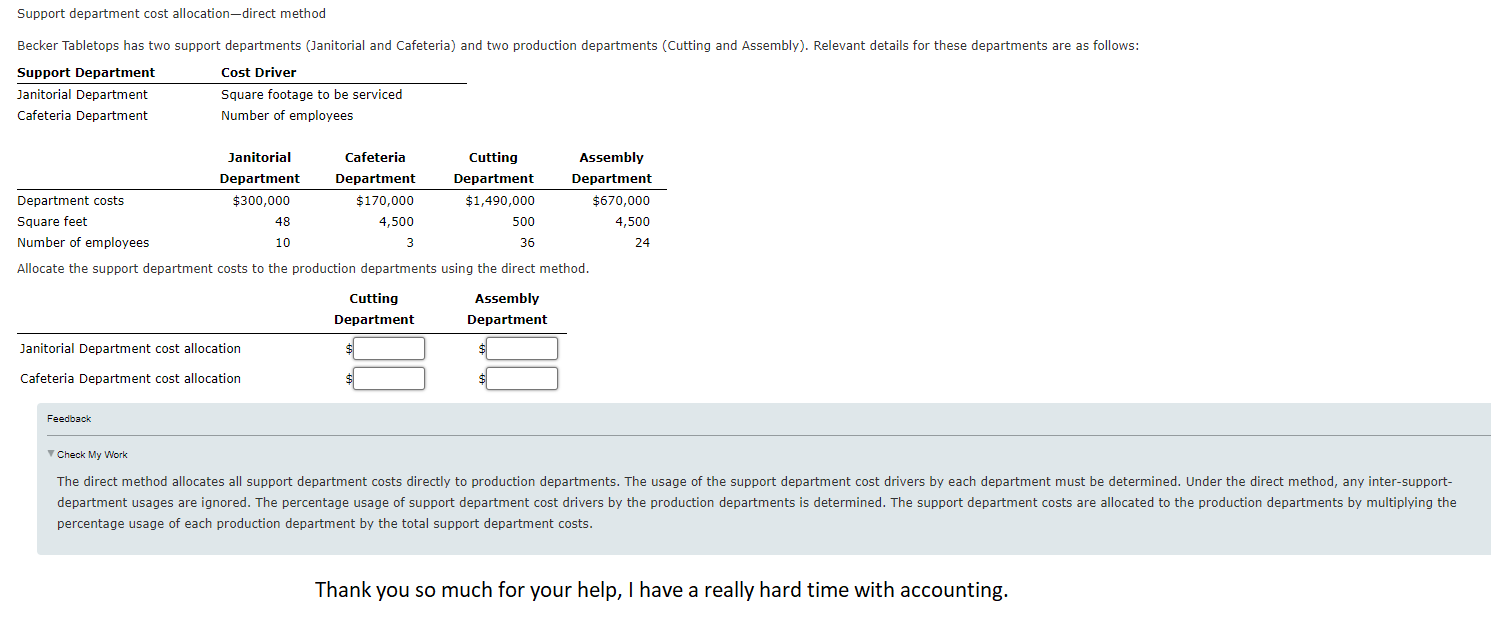

Support department cost allocation-direct method Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for

Support department cost allocation-direct method Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows: Support Department Cost Driver Square footage to be serviced Janitorial Department Cafeteria Department Number of employees Janitorial Department Cafeteria Department Department costs $300,000 Square feet Number of employees 48 10 Allocate the support department costs to the production departments using the direct method. 4,500 24 $170,000 4,500 3 Cutting Department $1,490,000 Assembly Department $670,000 500 36 Janitorial Department cost allocation Cafeteria Department cost allocation Feedback Cutting Department Assembly Department Check My Work The direct method allocates all support department costs directly to production departments. The usage of the support department cost drivers by each department must be determined. Under the direct method, any inter-support- department usages are ignored. The percentage usage of support department cost drivers by the production departments is determined. The support department costs are allocated to the production departments by multiplying the percentage usage of each production department by the total support department costs. Thank you so much for your help, I have a really hard time with accounting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started