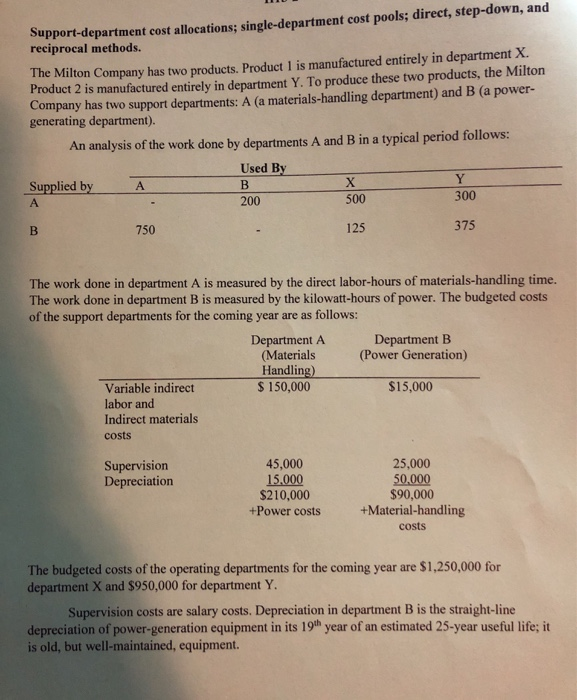

Support-department cost allocations; single-department cost pools; direct, step-down, and reciprocal methods. The Milton Company has two products. Product 1 is manufactured entirely in department X. Product 2 is manufactured entirely in department Y. To produce these two products, the Milton Company has two support departments: A (a materials-handling department) and B (a power- generating department). An analysis of the work done by departments A and B in a typical period follows: Used By Supplied by 200 500 750 375 B Y 300 The work done in department A is measured by the direct labor-hours of materials-handling time. The work done in department B is measured by the kilowatt-hours of power. The budgeted costs of the support departments for the coming year are as follows: Department A Department B (Power Generation) Handling) $ 150,000 $15,000 Variable indirect labor and Indirect materials costs Supervision Depreciation 45,000 15.000 $210,000 +Power costs 25,000 50,000 $90,000 +Material handling costs The budgeted costs of the operating departments for the coming year are $1,250,000 for department X and $950,000 for department Y. Supervision costs are salary costs. Depreciation in department B is the straight-line depreciation of power-generation equipment in its 19th year of an estimated 25-year useful life: it is old, but well-maintained, equipment. Support-department cost allocations; single-department cost pools; direct, step-down, and reciprocal methods. The Milton Company has two products. Product 1 is manufactured entirely in department X. Product 2 is manufactured entirely in department Y. To produce these two products, the Milton Company has two support departments: A (a materials-handling department) and B (a power- generating department). An analysis of the work done by departments A and B in a typical period follows: Used By Supplied by 200 500 750 375 B Y 300 The work done in department A is measured by the direct labor-hours of materials-handling time. The work done in department B is measured by the kilowatt-hours of power. The budgeted costs of the support departments for the coming year are as follows: Department A Department B (Power Generation) Handling) $ 150,000 $15,000 Variable indirect labor and Indirect materials costs Supervision Depreciation 45,000 15.000 $210,000 +Power costs 25,000 50,000 $90,000 +Material handling costs The budgeted costs of the operating departments for the coming year are $1,250,000 for department X and $950,000 for department Y. Supervision costs are salary costs. Depreciation in department B is the straight-line depreciation of power-generation equipment in its 19th year of an estimated 25-year useful life: it is old, but well-maintained, equipment