Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Supporting questions 19-25 BACKFLUSH COSTING, TWO TRIGGER POINTS, COMPLETION OF PRODUCTION AND SALE (continuation of Exercise 19-240). Assume the same facts as in Exercise 19-240,

Supporting questions

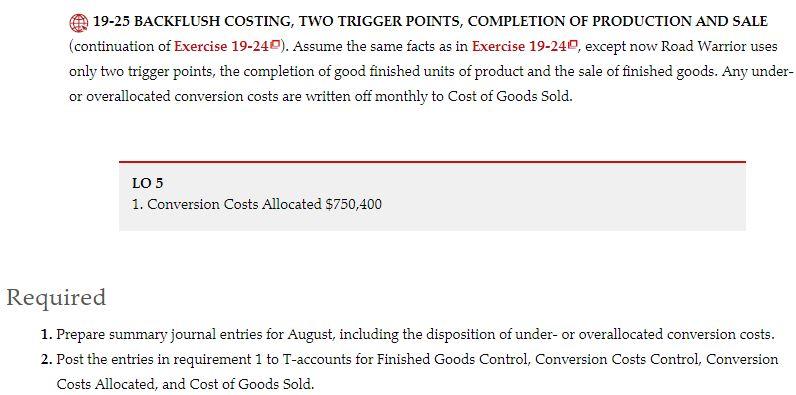

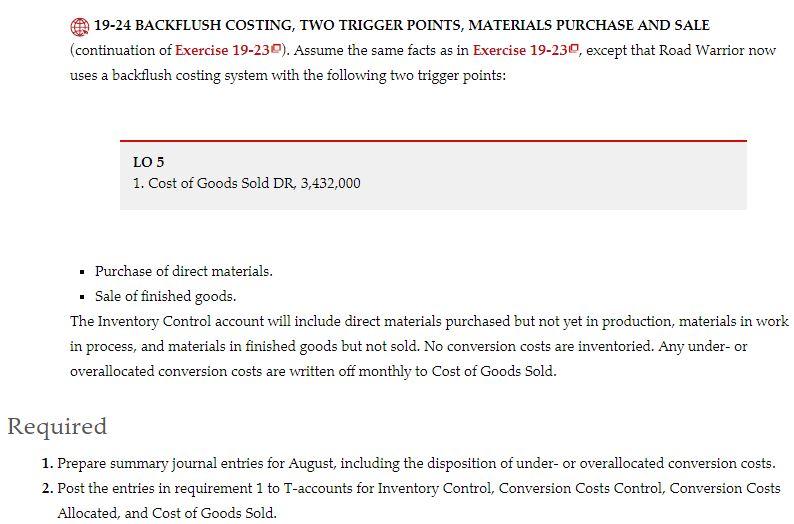

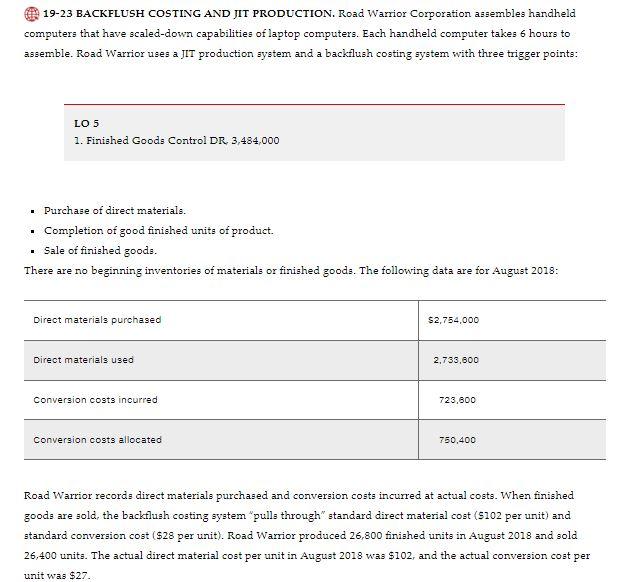

19-25 BACKFLUSH COSTING, TWO TRIGGER POINTS, COMPLETION OF PRODUCTION AND SALE (continuation of Exercise 19-240). Assume the same facts as in Exercise 19-240, except now Road Warrior uses only two trigger points, the completion of good finished units of product and the sale of finished goods. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold. LO 5 1. Conversion Costs Allocated $750,400 Required 1. Prepare summary journal entries for August, including the disposition of under-or overallocated conversion costs. 2. Post the entries in requirement 1 to T-accounts for Finished Goods Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold. 19-24 BACKFLUSH COSTING, TWO TRIGGER POINTS, MATERIALS PURCHASE AND SALE (continuation of Exercise 19-230). Assume the same facts as in Exercise 19-230, except that Road Warrior now uses a backflush costing system with the following two trigger points: LO 5 1. Cost of Goods Sold DR, 3,432,000 Purchase of direct materials. Sale of finished goods. The Inventory Control account will include direct materials purchased but not yet in production, materials in work in process, and materials in finished goods but not sold. No conversion costs are inventoried. Any under-or overallocated conversion costs are written off monthly to cost of Goods Sold. Required 1. Prepare summary journal entries for August, including the disposition of under- or overallocated conversion costs. 2. Post the entries in requirement 1 to T-accounts for Inventory Control, Conversion Costs Control, Conversion Costs Allocated, and Cost of Goods Sold. 19-23 BACKFLUSH COSTING AND JIT PRODUCTION. Road Warrior Corporation assembles handheld computers that have scaled-down capabilities of laptop computers. Each handheld computer takes 5 hours to assemble. Road Warrior uses a JIT production system and a backflush costing system with three trigger points: LO 5 1. Finished Goods Control DR 3,484.000 Purchase of direct materials. Completion of good finished units of product. Sale of finished goods. There are no beginning inventories of materials or finished goods. The following data are for August 2018: Direct materials purchased $2,754,000 Direct materials used 2,733,800 Conversion costs incurred 723,800 Conversion costs allocated 750,400 Road Warrior records direct materials purchased and conversion costs incurred at actual costs. When finished goods are sold, the backflush costing system "pulls through" standard direct material cost (5102 per unit) and standard conversion cost ($28 per unit). Road Warrior produced 26,800 finished units in August 2013 and sold 26,400 units. The actual direct material cost per unit in August 2018 was $102, and the actual conversion cost per unit was $27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started