Answered step by step

Verified Expert Solution

Question

1 Approved Answer

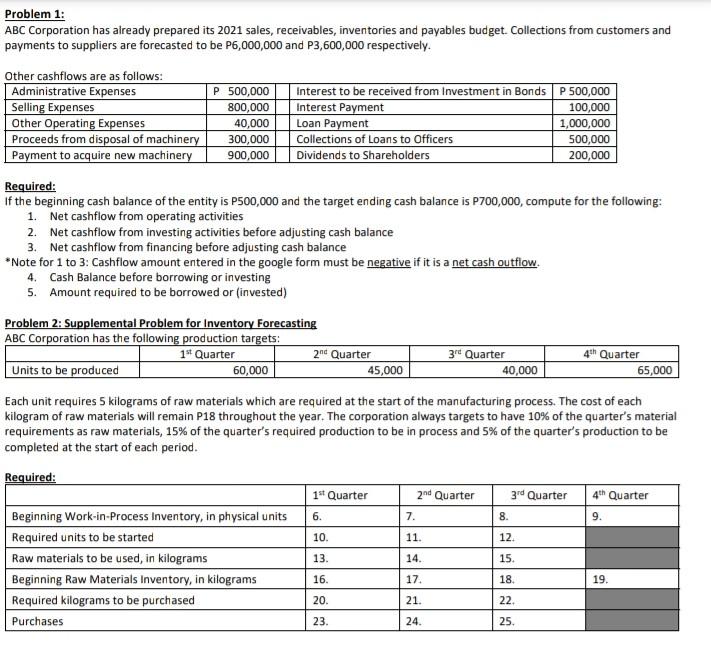

supporting tables Problem 1: ABC Corporation has already prepared its 2021 sales, receivables, inventories and payables budget. Collections from customers and payments to suppliers are

supporting tables

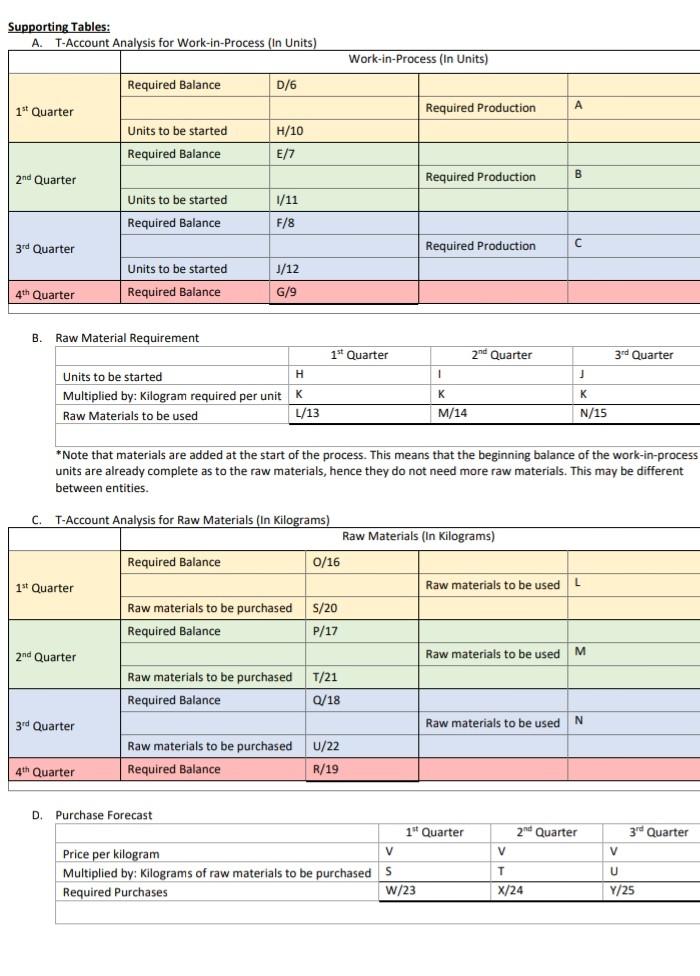

Problem 1: ABC Corporation has already prepared its 2021 sales, receivables, inventories and payables budget. Collections from customers and payments to suppliers are forecasted to be P6,000,000 and P3,600,000 respectively. Other cashflows are as follows: Administrative Expenses P 500,000 Interest to be received from Investment in Bonds P 500,000 Selling Expenses 800,000 Interest Payment 100,000 Other Operating Expenses 40,000 Loan Payment 1,000,000 Proceeds from disposal of machinery 300,000 Collections of Loans to Officers 500,000 Payment to acquire new machinery 900,000 Dividends to Shareholders 200,000 Required: If the beginning cash balance of the entity is P500,000 and the target ending cash balance is P700,000, compute for the following: 1. Net cashflow from operating activities 2. Net cashflow from investing activities before adjusting cash balance 3. Net cashflow from financing before adjusting cash balance *Note for 1 to 3: Cashflow amount entered in the google form must be negative if it is a net cash outflow. 4. Cash Balance before borrowing or investing 5. Amount required to be borrowed or (invested) Problem 2: Supplemental Problem for Inventory Forecasting ABC Corporation has the following production targets: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 60,000 45,000 40,000 65,000 Each unit requires 5 kilograms of raw materials which are required at the start of the manufacturing process. The cost of each kilogram of raw materials will remain P18 throughout the year. The corporation always targets to have 10% of the quarter's material requirements as raw materials, 15% of the quarter's required production to be in process and 5% of the quarter's production to be completed at the start of each period. Required: 2nd Quarter 1st Quarter 6. 3rd Quarter 8. 4th Quarter 9. 7. 10. 11. 12 13 14. 15. Beginning Work-in-Process Inventory, in physical units Required units to be started Raw materials to be used, in kilograms Beginning Raw Materials Inventory, in kilograms Required kilograms to be purchased Purchases 16. 17 18 19. 20. 21. 22. 23. 24. 25. Supporting Tables: A.T-Account Analysis for Work-in-Process (In Units) Work-in-Process (In Units) Required Balance D/6 1st Quarter Required Production Units to be started H/10 Required Balance E/7 2nd Quarter Required Production B 1/11 Units to be started Required Balance F/8 3rd Quarter Required Production J/12 Units to be started Required Balance 4th Quarter G/9 B. Raw Material Requirement 1st Quarter 2nd Quarter 3rd Quarter H 1 J Units to be started Multiplied by: Kilogram required per unit Raw Materials to be used K K K L/13 M/14 N/15 *Note that materials are added at the start of the process. This means that the beginning balance of the work-in-process units are already complete as to the raw materials, hence they do not need more raw materials. This may be different between entities. C. T-Account Analysis for Raw Materials (In Kilograms) Raw Materials (In Kilograms) Required Balance 0/16 1st Quarter Raw materials to be used Raw materials to be purchased s/20 Required Balance P/17 2nd Quarter Raw materials to be used M Raw materials to be purchased T/21 Required Balance Q/18 3rd Quarter Raw materials to be used N Raw materials to be purchased U/22 Required Balance R/19 4th Quarter D. Purchase Forecast 1 Quarter 2nd Quarter 3rd Quarter V V V Price per kilogram Multiplied by: Kilograms of raw materials to be purchased S Required Purchases W/23 T U Y/25 X/24Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started