Answered step by step

Verified Expert Solution

Question

1 Approved Answer

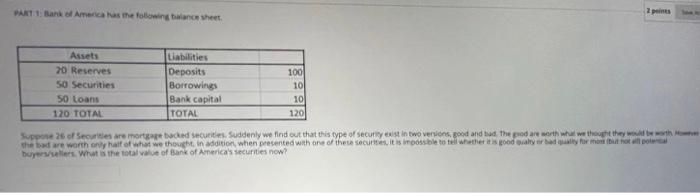

Suppose 26 of the securities are mortgage-backed securities. Suddenly we find out that this type of security exists in two versions, good and bad. The

- Suppose 26 of the securities are mortgage-backed securities. Suddenly we find out that this type of security exists in two versions, good and bad. The good are worth what we thought they would be worth. However, the bad is worth only half of what we thought. In addition, when presented with one of these securities, it is impossible to tell good or bad. What is the total value of BOAs securities now?

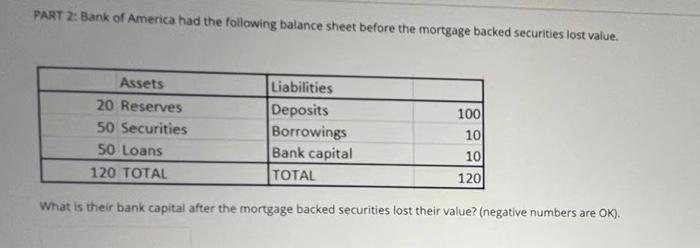

- What is their bank capital after the mortgage-backed securities lost their value? can be a negative number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started