Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose 3M is currently trading for $149.79 per share. The company is expected to pay the following annual dividends on its common stock over the

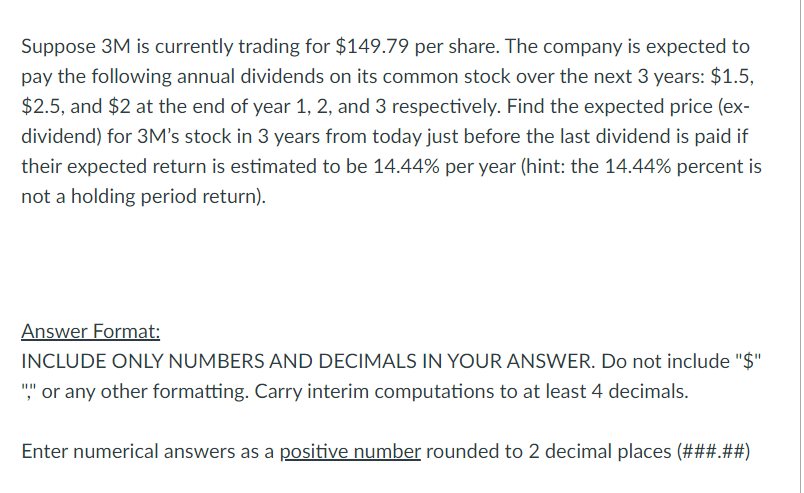

Suppose 3M is currently trading for $149.79 per share. The company is expected to pay the following annual dividends on its common stock over the next 3 years: $1.5, $2.5, and $2 at the end of year 1,2 , and 3 respectively. Find the expected price (exdividend) for 3M 's stock in 3 years from today just before the last dividend is paid if their expected return is estimated to be 14.44% per year (hint: the 14.44% percent is not a holding period return). Answer Format: INCLUDE ONLY NUMBERS AND DECIMALS IN YOUR ANSWER. Do not include "\$" "," or any other formatting. Carry interim computations to at least 4 decimals. Enter numerical answers as a positive number rounded to 2 decimal places (\#\#\#.\#\#)

Suppose 3M is currently trading for $149.79 per share. The company is expected to pay the following annual dividends on its common stock over the next 3 years: $1.5, $2.5, and $2 at the end of year 1,2 , and 3 respectively. Find the expected price (exdividend) for 3M 's stock in 3 years from today just before the last dividend is paid if their expected return is estimated to be 14.44% per year (hint: the 14.44% percent is not a holding period return). Answer Format: INCLUDE ONLY NUMBERS AND DECIMALS IN YOUR ANSWER. Do not include "\$" "," or any other formatting. Carry interim computations to at least 4 decimals. Enter numerical answers as a positive number rounded to 2 decimal places (\#\#\#.\#\#)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started