Answered step by step

Verified Expert Solution

Question

1 Approved Answer

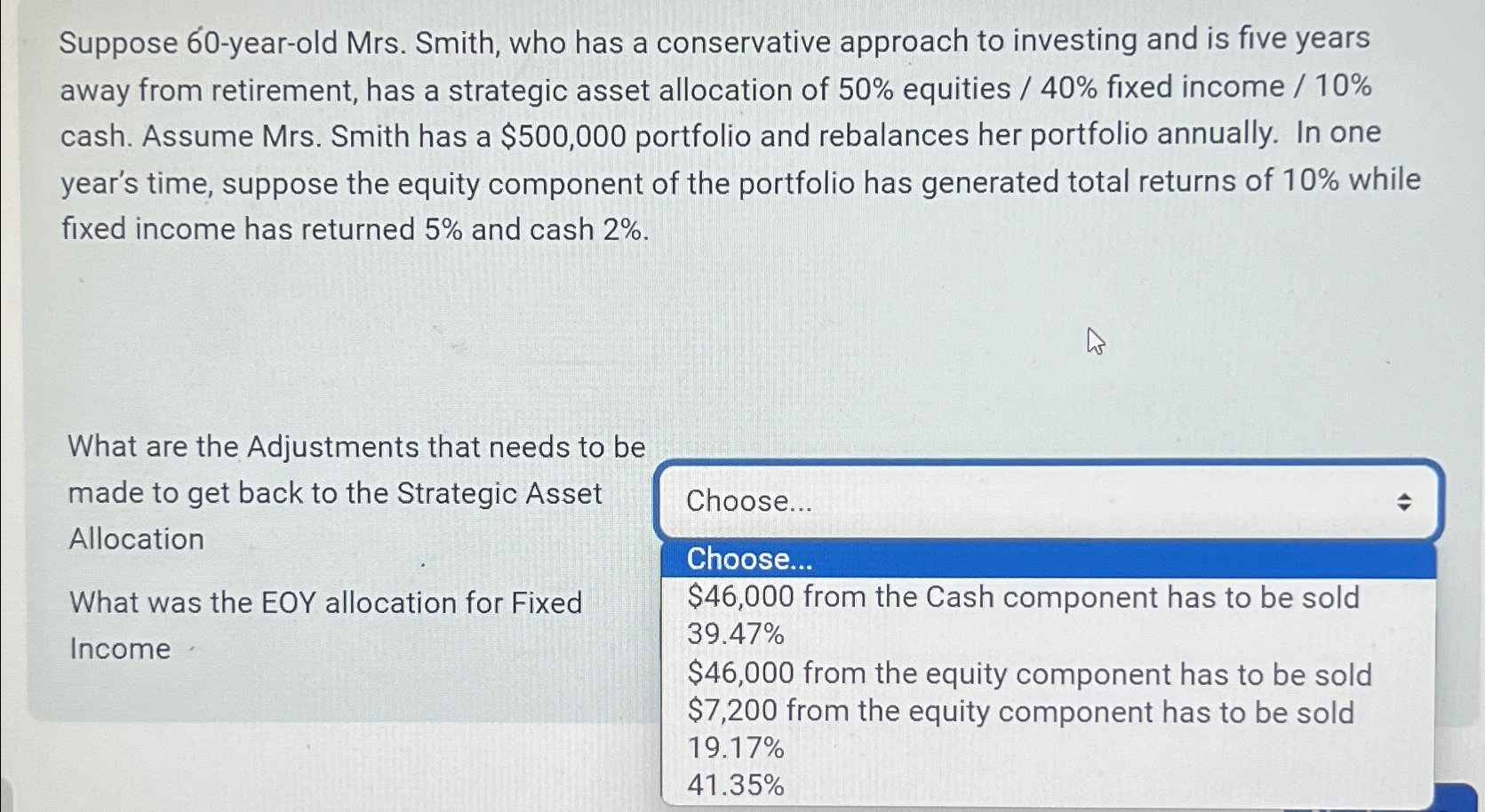

Suppose 6 0 - year - old Mrs . Smith, who has a conservative approach to investing and is five years away from retirement, has

Suppose yearold Mrs Smith, who has a conservative approach to investing and is five years away from retirement, has a strategic asset allocation of equities fixed income cash. Assume Mrs Smith has a $ portfolio and rebalances her portfolio annually. In one year's time, suppose the equity component of the portfolio has generated total returns of while fixed income has returned and cash

What are the Adjustments that needs to be made to get back to the Strategic Asset Allocation

What was the EOY allocation for Fixed Income

Choose...

Choose...

$ from the Cash component has to be sold

$ from the equity component has to be sold $ from the equity component has to be sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started