Question

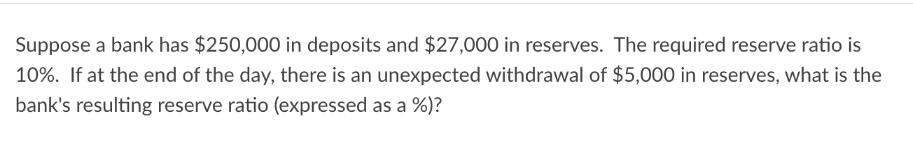

Suppose a bank has $250,000 in deposits and $27,000 in reserves. The required reserve ratio is 10%. If at the end of the day,

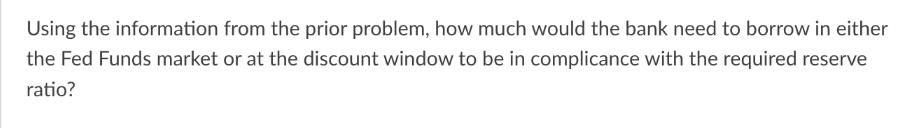

Suppose a bank has $250,000 in deposits and $27,000 in reserves. The required reserve ratio is 10%. If at the end of the day, there is an unexpected withdrawal of $5,000 in reserves, what is the bank's resulting reserve ratio (expressed as a %)? Using the information from the prior problem, how much would the bank need to borrow in either the Fed Funds market or at the discount window to be in complicance with the required reserve ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the banks resulting reserve ratio after an unexpected withdrawal of 5000 in reserves yo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Principles of Economics

Authors: Tyler Cowen, Alex Tabarrok

3rd edition

1429278390, 978-1429278416, 1429278412, 978-1429278393

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App