Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a bank in the island republic of Banana Land, known as Banana Bank has $20 million in reserves, $80 million in loans, $10

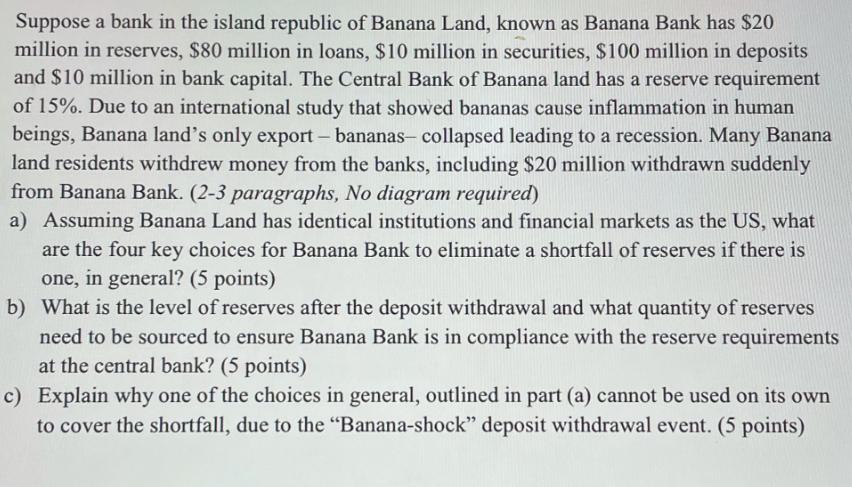

Suppose a bank in the island republic of Banana Land, known as Banana Bank has $20 million in reserves, $80 million in loans, $10 million in securities, $100 million in deposits and $10 million in bank capital. The Central Bank of Banana land has a reserve requirement of 15%. Due to an international study that showed bananas cause inflammation in human beings, Banana land's only export- bananas- collapsed leading to a recession. Many Banana land residents withdrew money from the banks, including $20 million withdrawn suddenly from Banana Bank. (2-3 paragraphs, No diagram required) a) Assuming Banana Land has identical institutions and financial markets as the US, what are the four key choices for Banana Bank to eliminate a shortfall of reserves if there is one, in general? (5 points) b) What is the level of reserves after the deposit withdrawal and what quantity of reserves need to be sourced to ensure Banana Bank is in compliance with the reserve requirements at the central bank? (5 points) c) Explain why one of the choices in general, outlined in part (a) cannot be used on its own to cover the shortfall, due to the "Banana-shock" deposit withdrawal event. (5 points)

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a The four key choices for Banana Bank to eliminate a shortfall of reserves if there is one in general assuming Banana Land has identical institutions ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started