Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a bank raised $24B in deposits and $3B in equity. The bank invests these funds in mortgages and cash. Each $1.0 invested in

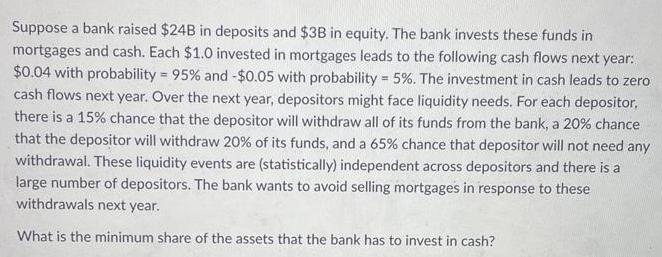

Suppose a bank raised $24B in deposits and $3B in equity. The bank invests these funds in mortgages and cash. Each $1.0 invested in mortgages leads to the following cash flows next year: $0.04 with probability = 95% and - $0.05 with probability = 5%. The investment in cash leads to zero cash flows next year. Over the next year, depositors might face liquidity needs. For each depositor, there is a 15% chance that the depositor will withdraw all of its funds from the bank, a 20% chance that the depositor will withdraw 20% of its funds, and a 65% chance that depositor will not need any withdrawal. These liquidity events are (statistically) independent across depositors and there is a large number of depositors. The bank wants to avoid selling mortgages in response to these withdrawals next year. What is the minimum share of the assets that the bank has to invest in cash?

Step by Step Solution

★★★★★

3.25 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine the minimum share of assets that the bank has to invest in cash in order to avoid selling mortgages in response to withdrawals next year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started