Question

Suppose a binomial tree model for a stock where price can go up (u = 1.2) or down (d = 0.7). The riskless interest

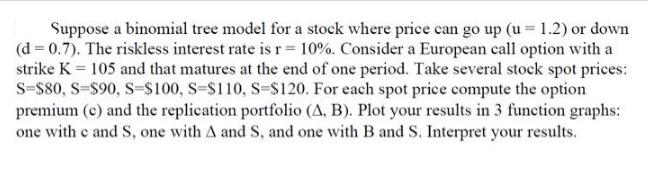

Suppose a binomial tree model for a stock where price can go up (u = 1.2) or down (d = 0.7). The riskless interest rate is r = 10%. Consider a European call option with a strike K = 105 and that matures at the end of one period. Take several stock spot prices: S=$80, S-$90, S-$100, S-$110, S-$120. For each spot price compute the option premium (c) and the replication portfolio (A, B). Plot your results in 3 function graphs: one with c and S, one with A and S, and one with B and S. Interpret your results.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To compute the option premium c and the replication portfolio A B for a European call option using the binomial tree model we need to follow these ste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

6th edition

1305637100, 978-1305637108

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App