Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a consumer has a utility function u(x1,x2) = log(x1)+log(x2) and an income of y = 100 and the prices of the two goods

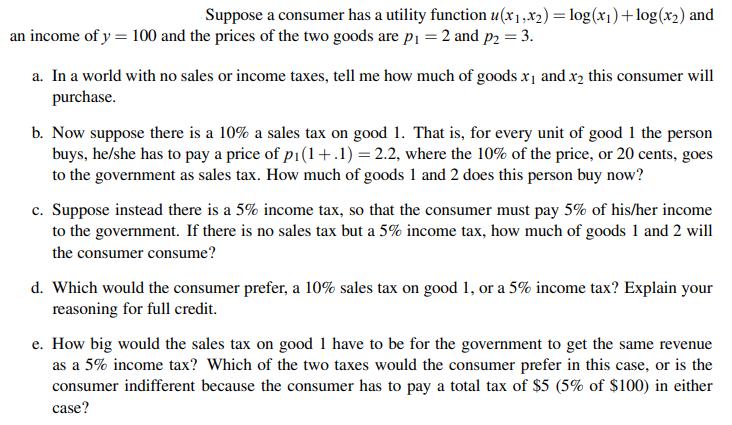

Suppose a consumer has a utility function u(x1,x2) = log(x1)+log(x2) and an income of y = 100 and the prices of the two goods are p = 2 and p2 = 3. a. In a world with no sales or income taxes, tell me how much of goods x1 and x2 this consumer will purchase. b. Now suppose there is a 10% a sales tax on good 1. That is, for every unit of good 1 the person buys, he/she has to pay a price of pi(1+.1) = 2.2, where the 10% of the price, or 20 cents, goes to the government as sales tax. How much of goods 1 and 2 does this person buy now? c. Suppose instead there is a 5% income tax, so that the consumer must pay 5% of his/her income to the government. If there is no sales tax but a 5% income tax, how much of goods 1 and 2 will the consumer consume? d. Which would the consumer prefer, a 10% sales tax on good 1, or a 5% income tax? Explain your reasoning for full credit. e. How big would the sales tax on good 1 have to be for the government to get the same revenue as a 5% income tax? Which of the two taxes would the consumer prefer in this case, or is the consumer indifferent because the consumer has to pay a total tax of $5 (5% of $100) in either case?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started