Suppose a Dover store in Madison, Missouri, ended September 2021 with 600,000 units of merchandise that cost $8 each. Suppose the store then sold

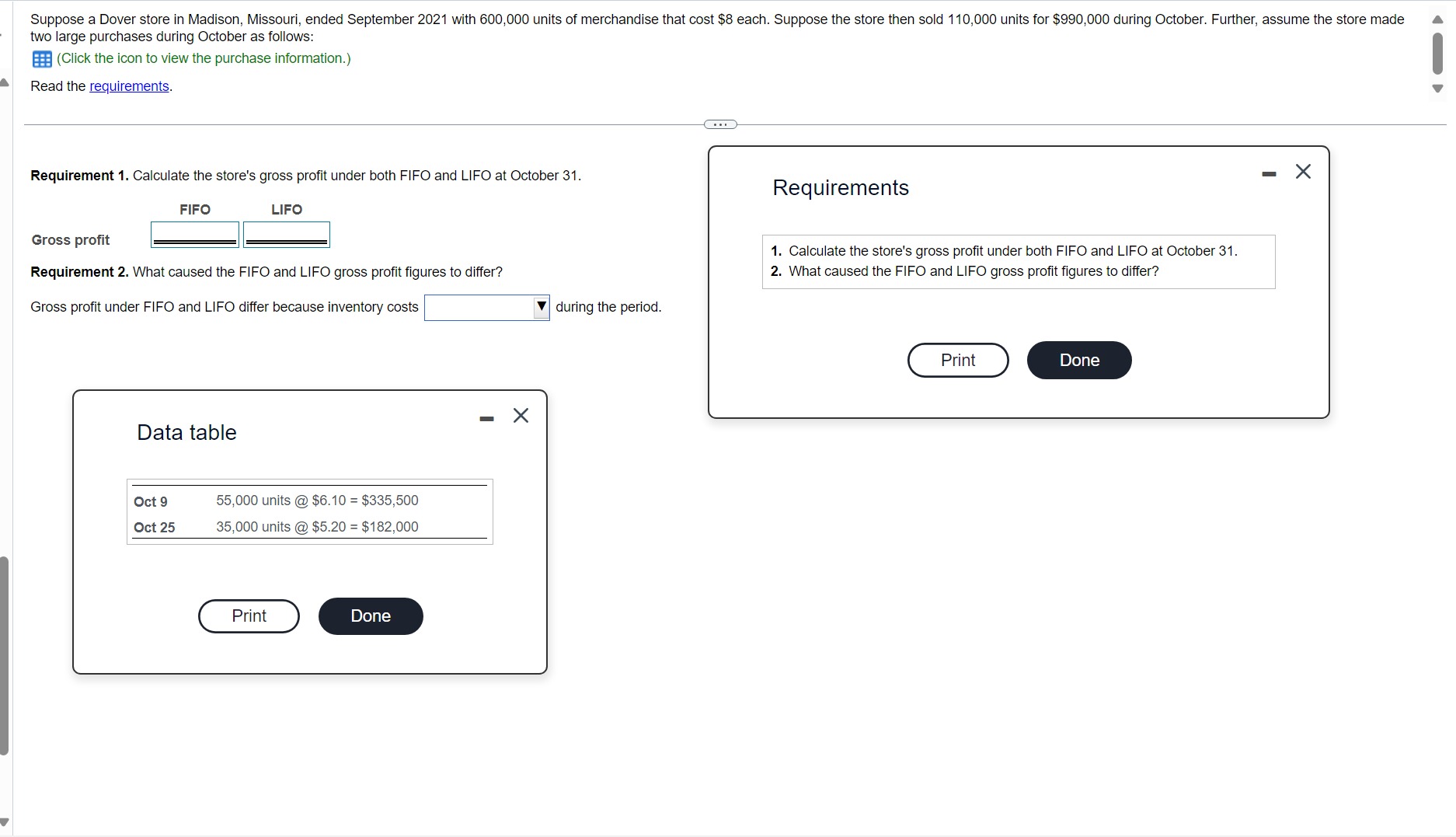

Suppose a Dover store in Madison, Missouri, ended September 2021 with 600,000 units of merchandise that cost $8 each. Suppose the store then sold 110,000 units for $990,000 during October. Further, assume the store made two large purchases during October as follows: (Click the icon to view the purchase information.) Read the requirements. Requirement 1. Calculate the store's gross profit under both FIFO and LIFO at October 31. Gross profit FIFO LIFO Requirement 2. What caused the FIFO and LIFO gross profit figures to differ? Gross profit under FIFO and LIFO differ because inventory costs Data table Oct 9 Oct 25 55,000 units @ $6.10 = $335,500 35,000 units @ $5.20 = $182,000 Print Done Requirements 1. Calculate the store's gross profit under both FIFO and LIFO at October 31. 2. What caused the FIFO and LIFO gross profit figures to differ? during the period. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understanding the Problem Problem Calculate the gross profit for a store under both FIFO and LIFO methods and explain the difference between the two Given Information Beginning inventory600000 units a... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards